Talking Points:

- GBP/USD Technical Strategy: Flat

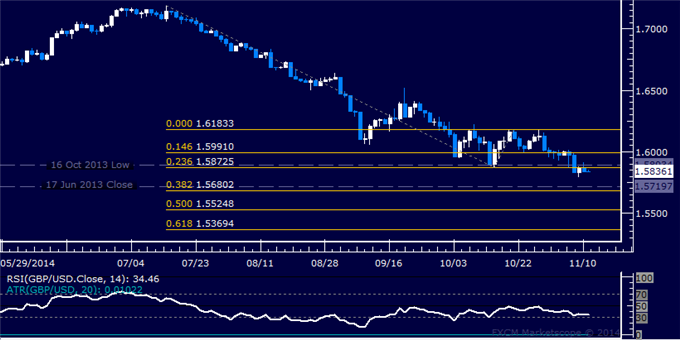

- Support: 1.5680, 1.5525, 1.5369

- Resistance: 1.5893, 1.5991, 1.6183

The British Pound paused to consolidate losses after plunging to a 14-month low beneath the 1.58 figure against the US Dollar. A daily close below the 1.5680-5720 area (38.2% Fibonacci expansion, June 2013 bottom) exposes the 50% level at 1.5525. Alternatively, a reversal above the 1.5873-93 zone (October 2013 low, 23.6% Fib) clears the way for a test of the 14.6% expansion at 1.5991

Entering short seems attractive from a technical perspective but we will tactically opt against taking on the trade. The upcoming publication of the Bank of England Quarterly Inflation Report may mark a pivotal moment for monetary policy bets, throwing off chart-based direction cues. With that in mind, we will stand aside for now.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI