Stock market today: S&P 500 closes lower, but posts second weekly win

GBP/USD for Tuesday, August 27, 2013

To finish out last week the GBP/USD fell strongly back through the key 1.56 level back to a short term support level around 1.5550 before settling around 1.5580. To start this week it has done very little and is just trading between 1.5570 and 1.5580. It did well throughout most of last week to maintain its level above the key 1.56 level and in the process moving to a new two month high above 1.57. It immediately retreated strongly but continued to receive solid support from the 1.56 level before closing below at the end of the week. A couple of weeks ago it surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level.

Last month the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

The Bank of England governor, Mark Carney, will reiterate his pledge to keep Britain’s borrowing costs at record lows until the recovery is secured, in the face of growing scepticism, when he gives his maiden public speech in the UK this week. Carney is expected to use an appearance at Nottingham University on Wednesday to challenge hawks in the City who doubt whether he can maintain interest rates at record lows until 2016. Economists predict that Mervyn King’s successor will repeat his July warning that market expectations of an earlier rate rise are “unwarranted”. Under the Bank’s new forward guidance, it will not raise rates until another 750,000 jobs have been created in the UK economy.

GBP/USD August 27 at 01:00 GMT 1.5582 H: 1.5612 L: 1.5556

During the early hours of the Asian trading session on Tuesday, the GBP/USD is trying to rally back up towards 1.56. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid recovery over the last month or so. Current range: Right around 1.5580.

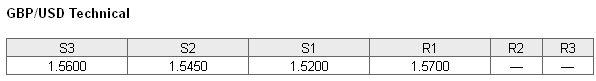

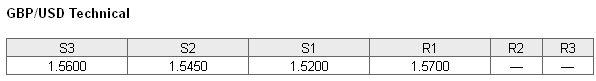

Further levels in both directions:

• Below: 1.5600, 1.5450 and 1.5200.

• Above: 1.5700.

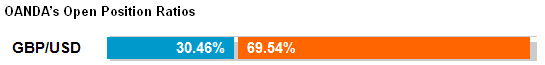

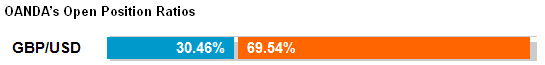

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved crept back up above 30% as the GBP/USD has settled underneath 1.56. Trader sentiment remains in favour of short positions.

Economic Releases

To finish out last week the GBP/USD fell strongly back through the key 1.56 level back to a short term support level around 1.5550 before settling around 1.5580. To start this week it has done very little and is just trading between 1.5570 and 1.5580. It did well throughout most of last week to maintain its level above the key 1.56 level and in the process moving to a new two month high above 1.57. It immediately retreated strongly but continued to receive solid support from the 1.56 level before closing below at the end of the week. A couple of weeks ago it surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level.

Last month the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

The Bank of England governor, Mark Carney, will reiterate his pledge to keep Britain’s borrowing costs at record lows until the recovery is secured, in the face of growing scepticism, when he gives his maiden public speech in the UK this week. Carney is expected to use an appearance at Nottingham University on Wednesday to challenge hawks in the City who doubt whether he can maintain interest rates at record lows until 2016. Economists predict that Mervyn King’s successor will repeat his July warning that market expectations of an earlier rate rise are “unwarranted”. Under the Bank’s new forward guidance, it will not raise rates until another 750,000 jobs have been created in the UK economy.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

GBP/USD August 27 at 01:00 GMT 1.5582 H: 1.5612 L: 1.5556

During the early hours of the Asian trading session on Tuesday, the GBP/USD is trying to rally back up towards 1.56. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid recovery over the last month or so. Current range: Right around 1.5580.

Further levels in both directions:

• Below: 1.5600, 1.5450 and 1.5200.

• Above: 1.5700.

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved crept back up above 30% as the GBP/USD has settled underneath 1.56. Trader sentiment remains in favour of short positions.

Economic Releases

- 13:00 US S&P Case-Shiller Home Price (Jun)

- 14:00 US Consumer Confidence (Aug)

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI