Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

Talking Points:

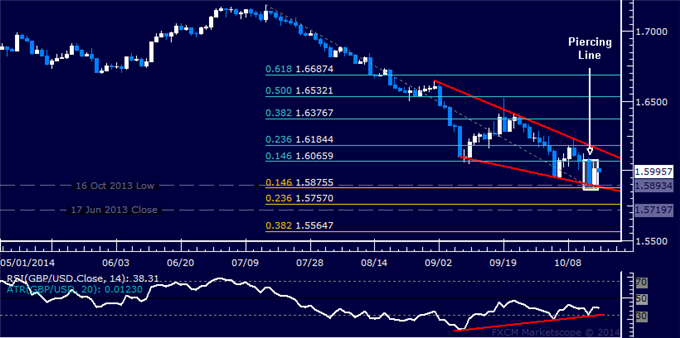

- GBP/USD Technical Strategy: Short at 1.6233

- Support: 1.5876, 1.5720, 1.5565

- Resistance: 1.6066, 1.6184, 1.6377

The British Pound may be setting up for a move higher against the US Dollar after producing a bullish Piercing Line candlestick pattern. The outlines of a falling wedge chart formation reinforce the case for an upside scenario. A daily close above the 14.6% Fibonacci retracement at 1.6066 exposes the 1.6155-84 area marked by the wedge top and the 23.6% level. Alternatively, a turn below the 1.5876 – the intersection of the 14.6% Fib expansion and the wedge floor – opens the door for a test of the 1.5720-57 zone (June 2013 floor, 23.6% Fib expansion).

We entered short GBP/USD at 1.6233and have since taken profit on half of our exposure. The rest remains open to capture any further downside momentum in the event the wedge setup fizzles, with a stop-loss at the breakeven level (1.6233).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.