Bitcoin price today: muted at $118k but altcoins soar as House passes new bills

GBP/USD

The GBP/USD has done well to break through the resistance level around 1.6150 in pushing through to a new three week high just above 1.62. The 1.6150 level had been causing some problems over the last few days. Over the last few weeks or so the pound has bounced strongly off the support level at 1.59 to return back to its present levels. Towards the end of October the GBP/USD slowly drifted lower from the strong resistance level at 1.6250, and down to a three week low just around 1.5900 which was recently passed as the pound moved down towards 1.5850only a week ago. For the week or so before that the pound moved well from the key level at 1.60 back up to the significant level at 1.6250, only again for this level to stand tall and fend off buyers for several days. Throughout September the pound rallied well and surged higher to move back up strongly through numerous levels which was punctuated by a push through to its highest level for the year just above 1.6250 several weeks ago. In the first week of October the pound was easing back towards 1.60 and 1.59 where it established a narrow trading range between before surging back to 1.6250 again.

Back in the middle of August the pound surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level. A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

The news was much better over in the UK, as another important indicator hit a multi-year high. CBI Industrial Order Expectations jumped to 11 points in October, bouncing back from a weak reading of -4 points the month before. This was the manufacturing indicator's best showing since 1995, and is another indication of a growing British economy. GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="551" height="231">

GBP/USD Daily Chart" title="GBP/USD Daily Chart" width="551" height="231"> GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" width="551" height="231">

GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" width="551" height="231">

GBP/USD November 21 at 23:55 GMT 1.6178 H: 1.6202 L: 1.6075 GBP/USD Technical Chart" title="GBP/USD Technical Chart" width="551" height="231">

GBP/USD Technical Chart" title="GBP/USD Technical Chart" width="551" height="231">

During the early hours of the Asian trading session on Friday, the GBP/USD is just easing back a little after its strong surge higher over the last 24 hours or so moving up to just above 1.62. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid resurgence over the last couple of months moving back to above 1.62 and its highest point for the year. Current range: Just below 1.6200 around 1.6190.

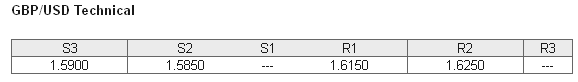

Further levels in both directions:

• Below: 1.5900 and 1.5850.

• Above: 1.6200 and 1.6250. GBP/USD Position Ratios Chart" title="GBP/USD Position Ratios Chart" width="551" height="231">

GBP/USD Position Ratios Chart" title="GBP/USD Position Ratios Chart" width="551" height="231">

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back below 30% as the GBP/USD runs into resistance at 1.6200. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 13:30 CA CPI (Oct)

- 13:30 CA CPI - BoC core rate (Oct)

- 13:30 CA Retail Sales (Sep)

- 13:30 CA Retail Sales (ex Auto) (Sep)

- 14:00 BE BNB Business Sentiment (Nov)

- JP BoJ Monthly Economic Report for November

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.