U.S. consumer prices rise by 2.7% in June

Talking Points

- GBP/USD Retail Crowd Flips Net-Long Following Dismal U.K. CPI Report.

- EUR/USD Fails to Retain Bullish Structure as ECB Reinforces Dovish Forward-Guidance.

- USDOLLAR Downside Targets Remain Favored on Bearish Formation, Dismal Data.

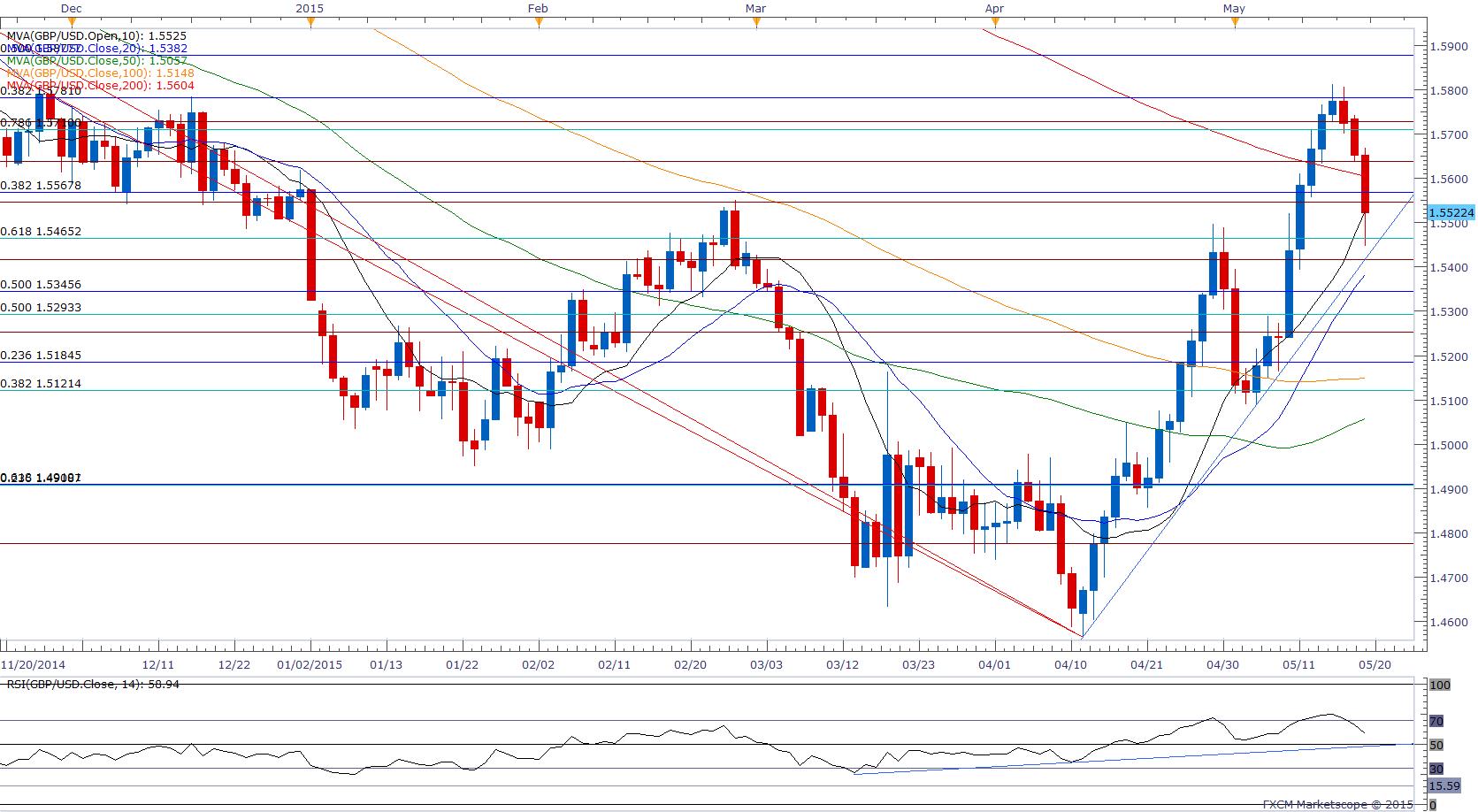

Chart - Created Using FXCM Marketscope 2.0

- GBP/USD remains at risk for a further pullback following the failed attempts to close above 1.5780 (38.2% retracement), while the pair continues to carve a series of lower highs & lows this week.

- Despite the unexpected slowdown in the U.K. Consumer Price Index (CPI), Bank of England (BoE) Governor Mark Carney anticipates to see stronger price growth towards the end of the year; will stay constructive on GBP/USD as long as the Relative Strength Index (RSI) preserves the bullish momentum carried over from March.

- BoE Minutes are widely expected to show a unanimous vote, but the DailyFX Speculative Sentiment Index (SSI) shows retail crowd flipped net-long GBP/USD following the dismal inflation print, with the ratio currently standing at +1.12.

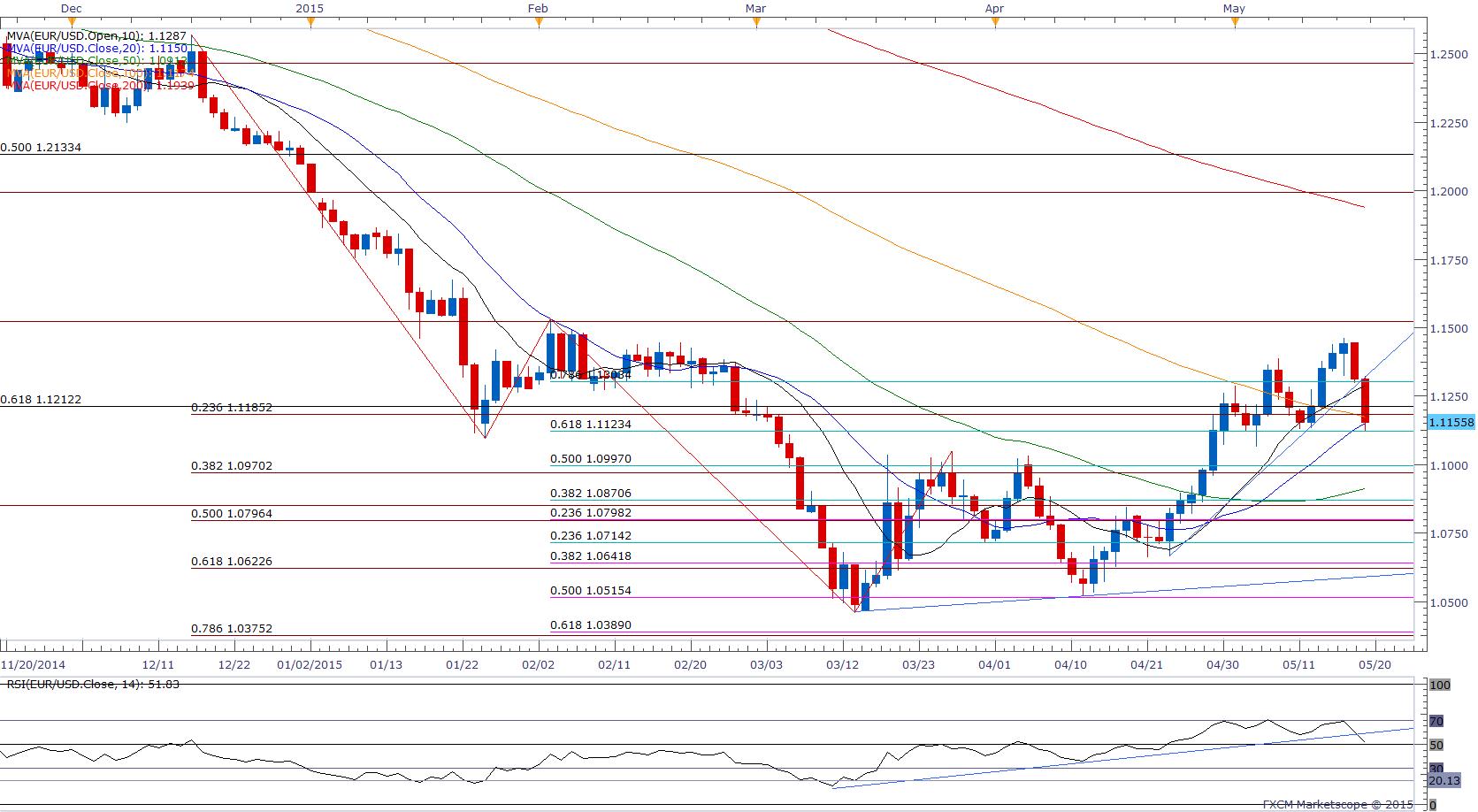

- EUR/USD faces a greater risk of carving a near-term top in May following the failed attempted to test the February high (1.1532), while price & RSI struggle to retain the bullish formations.

- Dovish rhetoric from European Central Bank’s (ECB) Benoit Coeure & Christian Noyer encourages a long-term bearish outlook for the single currency as the Governing Council retains a highly dovish tone for monetary policy.

- Break/close below 1.1120 (61.8% retracement) may open up former resistance around 1.0970 (38.2% expansion) to 1.0990 (50% retracement).

Chart - Created Using FXCM Marketscope 2.0

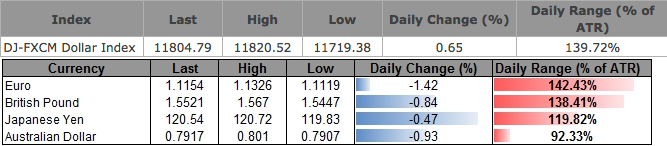

- Dow Jones-FXCM U.S. Dollar looks poised for a further advance as it breaks out of the downward trending channel; Federal Open Market Committee (FOMC) Minutes may set the tone ahead of the Consumer Price Index (CPI) as market participants weigh the outlook for monetary policy.

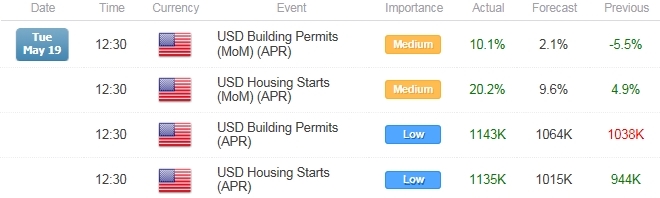

- Marked expansion in Housing Starts & Building Permits may align with Fed expectations and highlight a stronger recovery for the second-quarter.

- Waiting for a push above the Fibonacci overlap around 11,826 (61.8% expansion) to 11.843 (38.2% retracement) to reinforce a bullish outlook for the dollar.

--- Written by David Song, Currency Analyst

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.