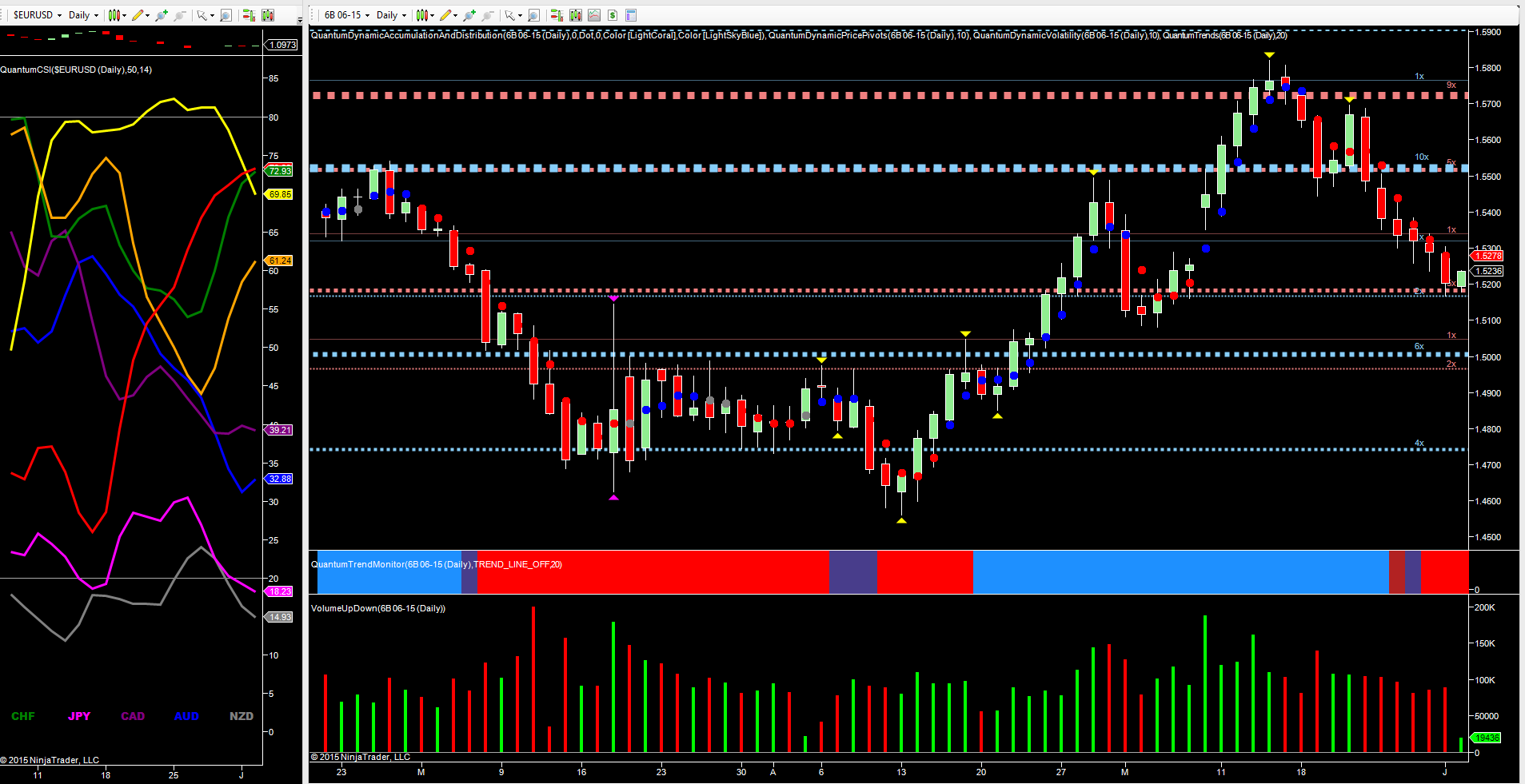

With the euphoria of the UK election now just another statistic in the history books, the positive momentum the shock result injected into the British pound has well and truly dissipated over the last two weeks, with the combined effects of weak UK data and resurgence in the US dollar helping to move the pair rapidly from the 1.5820 region to trade at time of writing at 1.5198 ahead of the Construction PMI data.

From a technical perspective we are now at a key level for cable, with the platform of support in the 1.5170 now approaching fast, as denoted with the red dotted line at this level. This is a region that has seen strong distribution in the past, and was tested strongly in yesterday’s price action with the pair duly holding firm as the market closed with a wide spread down candle and accelerating the bearish tone once again. Should cable duly move through this level and hold below, then the next target for a pause is clearly defined precisely at the 1.5000 and denoted with the blue dotted line. Should this level eventually fail, then a deeper move towards the 1.4730 region of mid April then becomes increasingly likely. However, the most significant price action of the last two weeks was the bearish engulfing signal of May 22nd, which effectively drove the cable through the deep platform of potential support in the 1.5520 region, helping to increase the downwards momentum.

Moving to the currency strength indicator to the left of the chart, the British pound (the yellow line) is now moving firmly lower from the overbought region, but with some distance to travel in this time frame before reaching an oversold state once again. The US dollar, (the red line) continues to rise strongly driven by the FED and the prospect of a potential interest rate rise later in the year.