Nvidia shares jump after resuming H20 sales in China, announcing new processor

Talking Points

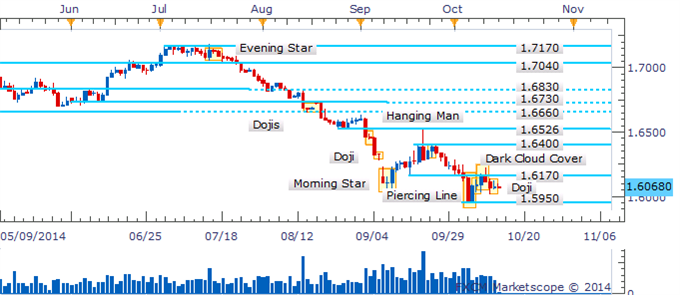

- GBP/USD Technical Strategy: Sidelines Preferred

- Dark Cloud Cover Receives Limited Response

- Consolidation Within 1.5950 and 1.6180 Endures

GBP/USD continues to search for direction within the 1.5950 to 1.6170/80 region with a Dark Cloud Cover pattern in its wake. Thus far the key reversal candlestick formation has found little-follow through with a subsequent Doji highlighting hesitation from traders. This leaves a more constructive setup desired to offer a clearer directional bias for the Sterling.

GBP/USD: Doji Denotes Indecision Within Trading Band

The four hour chart highlights a lack of conviction amongst traders as GBP/USD continues to be capped below 1.6130 in intraday trade. A Dark Cloud Cover formation at the nearby ceiling suggested the bulls were losing their grip on the pair. Yet with follow-through limited the pair is left lacking cues from candlesticks at this stage.

GBP/USD: Dark Cloud Cover Finds Limited Response As Consolidation Endures

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI