Stock market today: Nasdaq notches closing record as Nvidia hits $4T

In the last few days the GBP/USD has undone some of its good work recently and fallen away sharply from the resistance level at 1.54 back down below 1.5200 to around 1.5150 and a two week low. Earlier last week it was sold off after running into the wall of supply at 1.54 however it was able to reverse and move to a new one month high to finish last week. The 1.54 resistance level has stood firm and now the pound has fallen away. After having done very little for about a week, a couple of weeks ago the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. For the most part a couple of weeks ago, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It eased off a little as well and established a trading range in between 1.51 and 1.52 after it took a breather from its excitement from a few weeks ago when it experienced a strong surge higher moving back to within reach of the 1.52 level before easing off a little and then rallying a off support at 1.5080.

A few weeks ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. Earlier this month, it experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. This recent movement saw it resume its already well established medium term down trend from the last few weeks and move it to a four month low. Over that month, it moved back from above 1.57 and fell strongly, only to see it recover very well over the last few weeks.

Throughout the first half of June, it enjoyed its best run in a long time as it surged from 1.50 to 1.57 in just a few weeks. Its multiple key levels during its movement up towards 1.57 have appeared to have little impact during its recent decline, although 1.52 seemed to halt the decline a little a couple of weeks ago. This level has resurfaced again and provided further resistance after the pound’s surge higher last week. With the exception of last week’s surge higher, the pound has completely reversed its fortunes from the strong first half of June which saw it climb so strongly from 1.50 up to the four month highs above 1.57. Throughout the month of May the pound fell strongly and return almost all of its gains from the few weeks before that. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year.

Tuesday’s weak UK releases were not much help for the struggling pound. GfK Consumer Confidence, which has been mired deep in negative territory, did improve from -22 to -16 points, but continues to indicate deep pessimism on the part of the British consumer. BRC Shop Price Index posted a decline of -0.5%, its worst showing this year. On Thursday, the Bank of England will be in the spotlight, as the central bank sets the benchmark interest rate and bond-purchase program. Most analysts expect no changes to current levels, with interest rates pegged a record low of 0.50% and the bond purchase program at 375 billion pounds. With the recent change in top management at the BOE, new governor Mark Carney will be under a lot of scrutiny. Carney has the respect and attention of the markets, as his tenure at the Bank of Canada was widely judged as a success. Analysts note that Carney practiced forward guidance at the BOC, and is expected to continue his pro-active approach at the BOE.

GBP/USD August 1 at 03:30 GMT 1.5164 H: 1.5254 L: 1.5125

During the early hours of the Asian trading session on Thursday, the GBP/USD is continuing to fall away from the 1.52 level drifting back towards 1.5150. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid recovery over the last few weeks. Current range: Right around 1.5160.

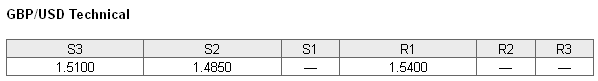

Further levels in both directions:

• Below: 1.5100 and 1.4850.

• Above: 1.5400.

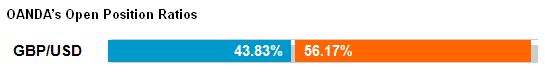

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved well below 50% as the GBP/USD has fallen strongly through 1.52. Trader sentiment remains in favour of short positions.

Economic Releases

- 01:30 AU Export & Import price index (Q2)

- 01:30 AU Retail Sales (1st-7th) (Q2)

- 05:00 JP Vehicle Sales (Jul)

- 06:30 UK Nationwide House Price Index (29th Jul – 2nd Aug)

- 07:00 UK Halifax House Price Index (1st-6th) (Jul)

- 07:58 EU Manufacturing PMI (Jul)

- 08:28 UK CIPS/Markit Manufacturing PMI (Jul)

- 11:00 UK BoE MPC – APF Total (Aug)

- 11:00 UK BoE MPC – Base Rate (Aug)

- 11:45 EU ECB – Interest Rate (Aug)

- 12:30 US Initial Claims (26/07/2013)

- 14:00 US Construction Spending (Jun)

- 14:00 US ISM Manufacturing (Jul)

- 21:00 US Vehicle Sales (Jul)

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.