Talking Points:

- GBP/JPY Technical Strategy: Flat

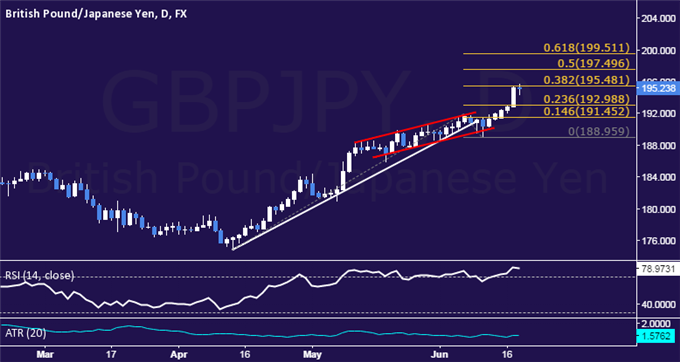

- Support: 192.99, 191.45, 188.96

- Resistance: 195.48, 197.50, 199.51

The British Pound paused to digest gains after failing to overcome a chart barrier above the 195.00 figure against the Japanese Yen. Near-term resistance is at 195.48, the 38.2% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 197.50. Alternatively, a turn below the 23.6% Fib at 192.99 opens the door for a challenge of the 14.6% expansion at 191.45.

Risk/reward considerations argue against entering long with prices in close proximity to resistance. On the other hand, the absence of a defined bearish reversal signal suggests taking up the short side is premature. We will remain flat for now, waiting for an actionable opportunity to present itself.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI