GB Group (LON:GBGP) delivered another excellent performance in FY18 with reported adjusted EPS up 37%. With over 75% of revenues now from the global product lines, a clear organic growth plan and a healthy acquisition pipeline, we retain our forecasts and believe the shares, which trade among identity access management and cyber security peers to be well supported at these levels.

FY18 results: Strong organic growth and PCA Predict impact

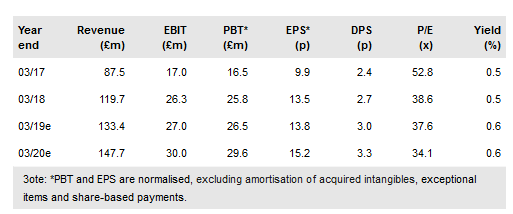

Revenues of £119.7m (+37% y-o-y, of which 17% was organic) and EBITA of £26.3m (+55%) were in line with April’s trading update, with EBITA 12% above our forecast due to a higher margin – stripping out the impact from the one licence sale during H1, margins of 20% were in line with management’s targeted rate and are expected to fall back to this level in FY19. Adjusting for the licence, underlying organic growth of 15% picked up slightly in H2 (12% in H1) as the synergy benefits of the PCA Predict acquisition start to present, along with some ‘one-off’ effects from a flurry of Bitcoin trading and first revenues being back-recognised from the GOV.UK Verify service. A final dividend of 2.65p (+13% y-o-y) has been proposed.

To read the entire report Please click on the pdf File Below:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI