Apple edges up premarket as investors weigh estimated tariff costs, iPhone sales

While everyone has become bearish waiting for an extended pullback in the Nasdaq and Russel 2000 to drag down the S&P 500 and Dow Jones Industrial Average (SPDR DJ Industrial Average (ARCA:DIA)), the Dow has not made a new low yet. Not even a short term new low.

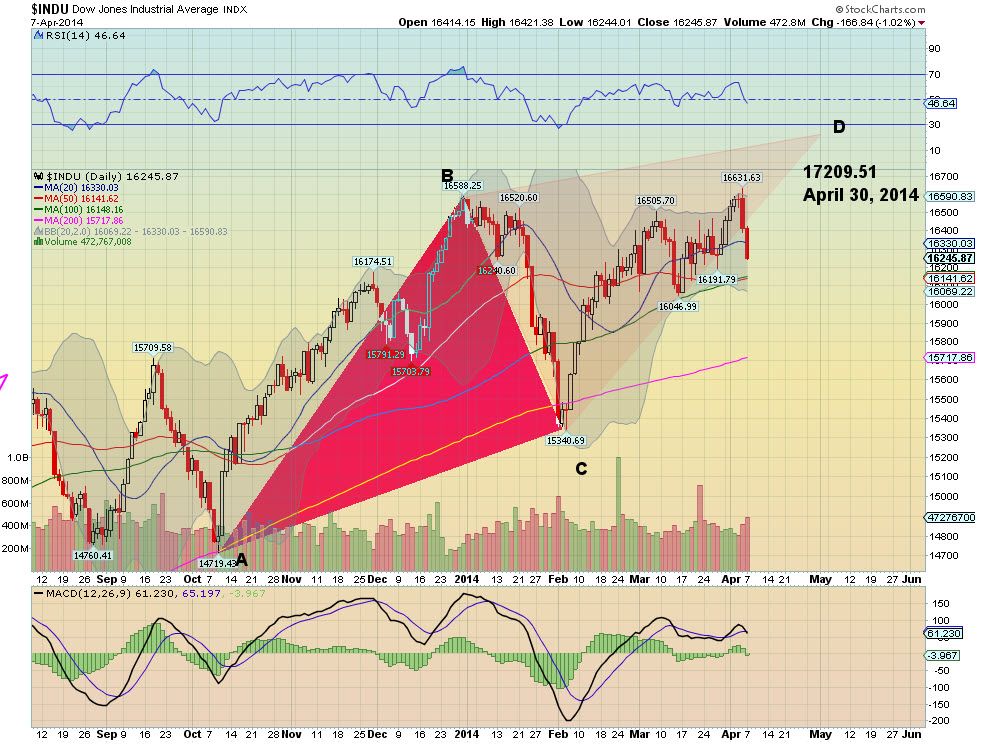

It might happen today, or it might not. But either way, there are certainly not many traders or investors that are putting any money behind the AB=CD pattern that has been playing out. Since its October low, the Dow has moved to a high at year end, then pulled back in early February, defining the A, B and C positions and leaving the D at 17209.51 around April 30th. 1000 points in 3 weeks seems like a lot, but the time element of the AB=CD pattern is not strict.

One has to ask, 'are there any catalysts that could move it like that'? Hmmm, earnings season starts tonight. What if earnings beat expectations handily, across the board handily?

There is a FOMC Meeting April 29-30. What if they decide to taper the taper? I have no idea if these catalysts will move the market or something else will, or nothing will. But there is a lot of weight leaning over the rail on just one side of the boat right now. I will not be convinced that the end is coming until the boat tips over and sinks.

A move under 16046.99 would get me putting on my life vest; Under 15340.69 I'd start searching for the lifeboat. Until then, the Dow has just broken the 20 day Simple Moving Average and is a mere 2.4% off the all time high. Right now I am not broadly buying, but I am not selling either.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.