There are various ways to describe the current rally in gold. Exciting, promising, enduring—they all fit.

One word, however, doesn't apply: parabolic.

Parabolic is what the oil rally is—rising 25% in just six weeks. Parabolic is also what the pandemic-fueled gold rally of 2020 was—rising from a low of $1,485 an ounce in March that year to a record high above $2,121 by August—before recovery from the virus unleashed new peaks in stocks that just peeled away the safe-haven appeal of bullion.

But with 2022 here, two new catalysts have arrived for equities and both are wreaking havoc on Wall Street while bolstering gold: Russia’s potential invasion of Ukraine and runaway inflation in the United States.

Yet, gold’s rally hasn’t been keeping pace with the decimation of stock prices on the S&P 500 or NASDAQ, which have been losing 40 and 400 points, respectively, on many days since the year began.

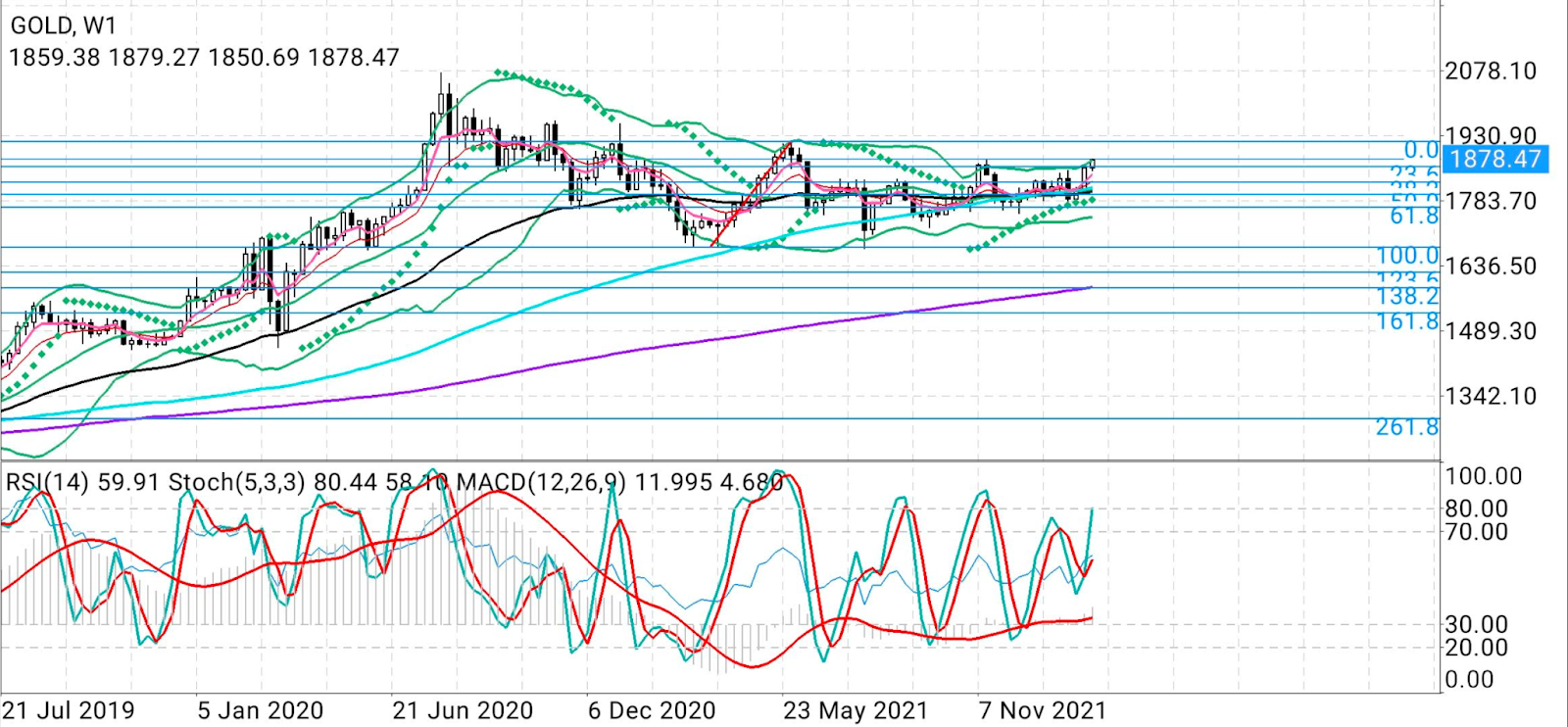

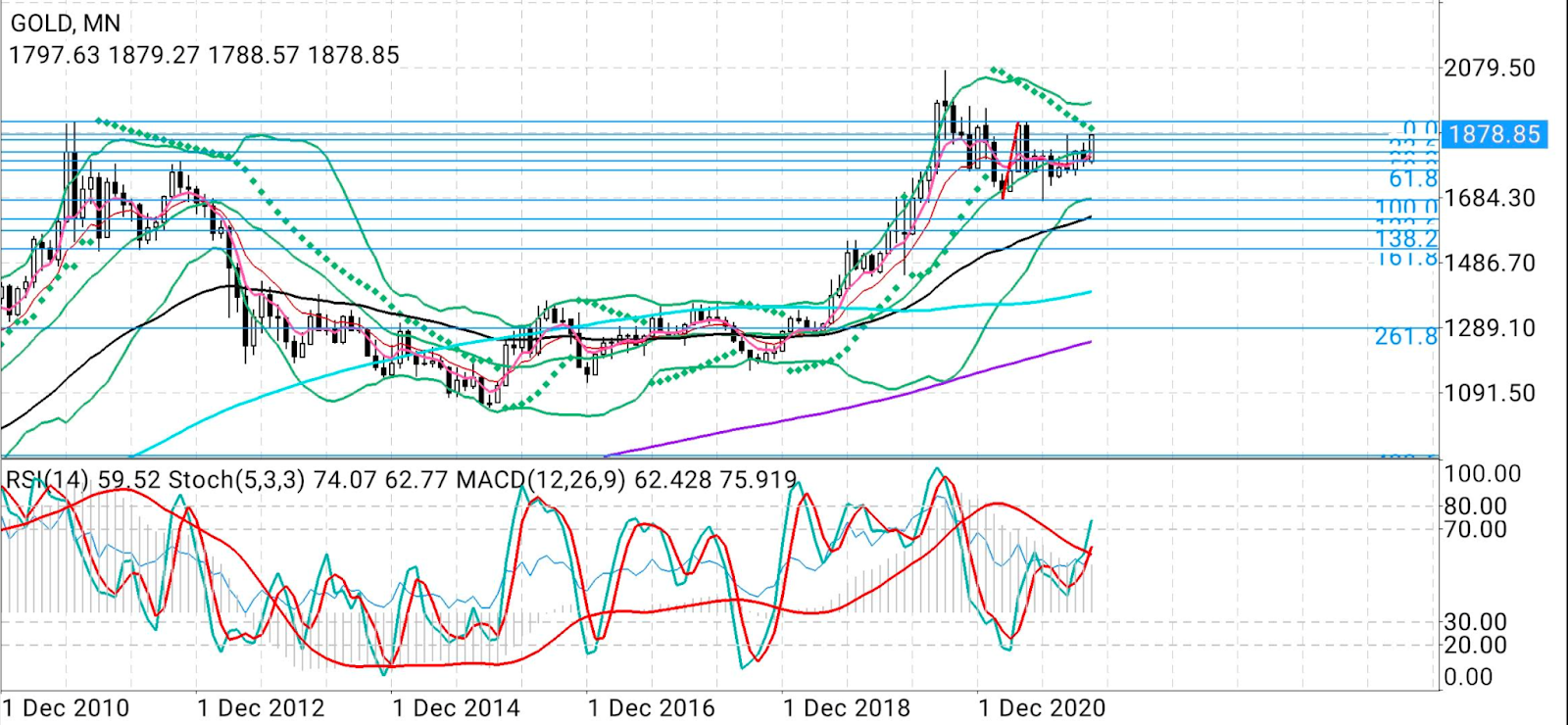

Charts courtesy of skcharting.com

Bullion started January above $1,800, then fell to around $1,781 before systemically gaining strength by breaking past one resistance point after another—first at $1,830, then $1,850 and on Monday at $1,870 (which incidentally marked a three-month high too).

It’s this organic, block-upon-block build that’s giving confidence to those following bullion’s charge since the start of the year that it isn’t going to stop until it reaches at least $1,900—and could very likely continue thereafter in a bid for a new record high above $2,000.

“It's been a one-way run for gold from the low of $1,780 in late January,” economist Adam Button said in a post on the ForexLive platform on Monday.

"The next major hurdle is the November high of $1,876 and we're now within striking distance of that. Also notable is that a close above $1,866 would be the highest since June."

As Button puts it, it's tough to separate the inflation story and the Russia-Ukraine story from the price action in gold.

"I can see a compelling argument for buying gold on central bank instability. The bond market is getting hammered daily and gold is a shelter from that."

“On Ukraine, there's always a bid in gold on geopolitical fears but Russia has enormous gold reserves and if it's sanctioned, those could be sold down to prop up the ruble. So, there are two-ways risks around a conflict. That said, the market is only moving in one direction and this could be the breakout of the massive wedge on the chart that's been building for two years.”

Ed Moya, analyst at online trading platform OANDA, had a similarly strong view on gold.

“Despite a 6.6 basis move higher to 2.003% with the 10-year Treasury yield, gold is rallying,” said Moya.

"The $1,880 level should prove to be key resistance for gold, but if that does not hold, bullish momentum could take prices to the $1,900 level. Gold is starting to garner strong interest as the need grows for protection against a Fed policy mistake, geopolitical risks, and growth concerns."

After months of dreary price action, gold bulls began seeing some sustained upward momentum from January as US inflation began blowing up.

Senior Federal Reserve banker James Bullard said on Monday that the Fed’s credibility will be on the line if it doesn't hike US interest rates adequately to fight runaway inflation.

"Our credibility is on the line here and we do have to react to the data,” Bullard, who is St. Louis Fed President, said during an appearance on CNBC.

"I do think we need to front-load more of our planned removal of accommodation than we would have previously. We’ve been surprised to the upside on inflation. This is a lot of inflation."

The Fed slashed interest rates to almost zero after the outbreak of the coronavirus pandemic in March 2020. It is expected to resort to a series of rate hikes this year to counter inflation, growing at its fastest pace in 40 years on the Consumer Price Index as well as the central bank's preferred inflation indicator—the Personal Consumption Expenditures Price Index.

Goldman Sachs said last week that it expects the Fed to institute seven quarter-percentage-point rate hikes this year, up from the Wall Street bank's previous forecast of five. The Federal Reserve has seven policy meetings scheduled between March and December, meaning it could raise rates every time it meets this year, if Goldman is right.

Bullard shocked markets last week by saying that he wished for the Fed to have a full percentage point increase by July 1. The central bank meets three times between March and July 1, meaning it has to increase rates by more than a quarter percentage point at least one time to achieve Bullard’s target.

"I think my position is a good one, and I’ll try to convince my colleagues that it’s a good one," Bullard said, adding that he would, however, defer to the decision by Fed Chair Jerome Powell. One of the more moderate voices of the central bank, Powell has said that the Fed will be "nimble" with rate hikes to ensure no excessive disruptions to the economy and markets.

Bullard said the inflation experienced by the United States was "very bad" for low- and moderate-income households.

"People are unhappy, consumer confidence is declining. This is not a good situation. We have to reassure people that we’re going to defend our inflation target and we’re going to get back to 2%."

The Fed is mandated to keep inflation at or below 2% a year while striving to grow the economy and achieve maximum employment, defined by a jobless rate of 4.0% or below.

Gold has also benefited from the rumblings of war from the Russia-Ukraine conflict.

Moscow invaded and annexed the Crimean Peninsula between February and March 2014, sparking an international outcry and a wave of economic sanctions. Experts fear the same fate for Ukraine this time, after a massive buildup of Russian forces at the Ukrainian border in recent weeks.

White House National Security Advisor Jake Sullivan said Russia could invade Ukraine "any day now," based on US intelligence. Moscow says it wants to end NATO’s expansion into Eastern Europe and has called for intensified talks between Washington and the non-aligned treaty organization.

Not all are too bullish about gold in the event of a non-invasion.

“When all is said and done with the whole Russia-Ukraine situation, gold may be left hanging with few reasons to be too optimistic amid a backdrop of rising interest rates across the globe,” currency analyst Justin Low said in a post on ForexLive.

“That will be something to consider even if commodities in general are facing a rather strong bullish cycle potentially.”

Still, gold’s charts don’t lie and bullion’s current charts point to a breakout, not fake out, said Sunil Kumar Dixit, chief technical strategist at skcharting.com.

"Gold confirms strong breakout above the previous $1,877 top and bullish mood is all pervasive across major time frames, be it daily, weekly and monthly with strong stochastics and RSI.

"As long as gold sustains above $1,860—which is a 23.6% Fibonacci level of retracement measured from $1,678 to $1,916. Bullish momentum remains intact in hot pursuit for $1,898-$1,916.

"If heat on the Russia-Ukraine conflict intensifies, the rush for flight to safety will take gold to $1,975, which is another $100 from its current price.”

In the event of any Russian de-escalation on Ukraine, the risk premium in gold could dilute and trigger sharp correction due to overbought RSI at 73 on the daily chart, said Dixit. "Gold could go through 1860 to 1825 in a flash. But since the main trend is bullish, buyers are likely to come in for value buying at the test of support areas."

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.