Telegram founder Pavel Durov has refused to hand over encryption keys to Russian authorities, showing his willingness to sacrifice the app’s Russian users to maintain the integrity of the project as a whole. This move will likely lead to further growth for the app’s user base and an increase in value for the platform’s coin, TON.

In some cases, attempts to avoid state control are made for less romantic reasons. Former offshore banks have rebranded into offshore crypto exchanges. Recently, Bermuda legislators announced their intentions to take a “measured approach” to regulating the crypto industry. Malta also attracts crypto exchanges, with Binance having already moved their headquarters there and OKEx preparing to follow suit.

Governments are actively struggling with money laundering and tax evasion, while simultaneously trying to tighten regulations. This is one of the reasons why offshore exchanges and anonymous cryptocurrencies like Zcash, DASH and Monero could catch a second wind.

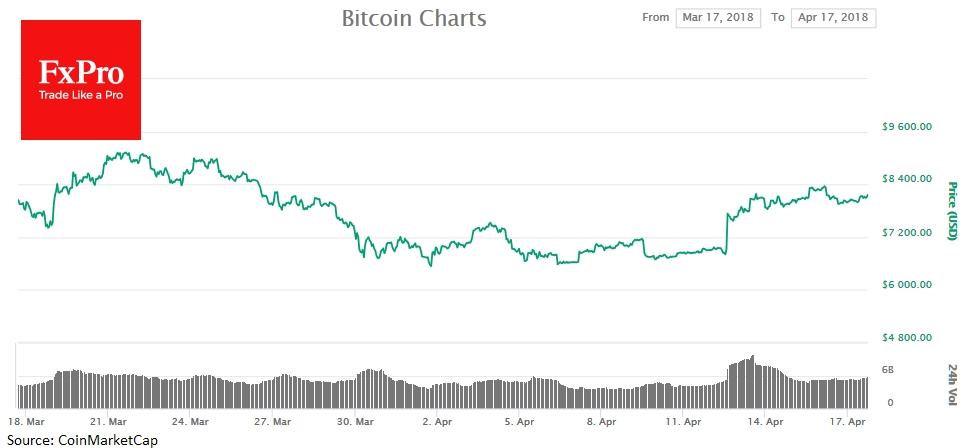

The crypto market is optimistic again, as Bitcoin has managed to maintain gains made on 12-13 April. The “benchmark” cryptocurrency is moving in a sideways pattern and currently trading at around $8,100. According to CME’s Bitcoin contracts futures report, large players anticipate a decrease in BTC price, while ordinary investors expect growth.

Nevertheless, market participants, and the community overall are optimistic and hope that cryptocurrencies will resume their growth, once geopolitical tensions disappear from news headlines.

Alexander Kuptsikevich, The FxPro Analyst

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

From banking offshores to crypto-offshores and romantic of online rebellion

Published 04/17/2018, 11:23 AM

Updated 03/21/2024, 07:45 AM

From banking offshores to crypto-offshores and romantic of online rebellion

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.