Moments after the closing bell Fossil (NASDAQ:FOSL) announced its fourth quarter earnings. Top and bottom line misses have the stock getting decimated in after hours action. As of 4:30 pm shares were trading 12% cheaper.

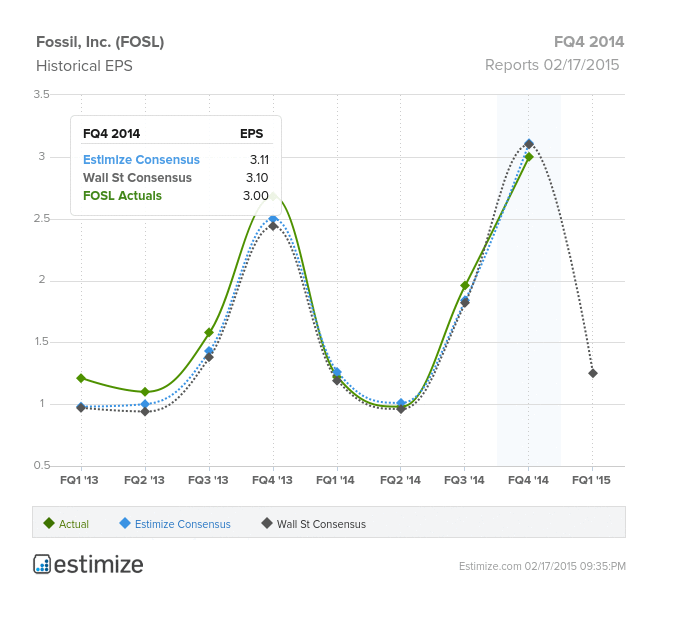

Contributing analysts on Estimize had predicted that Fossil would report earnings of $3.11 per share, just a penny better than the Wall Street consensus of $3.10. The watchmaker’s fourth quarter profits came in 11 cents shy at $3.00 per share.

Net sales for the quarter came in flat. They would have been up 3% if it hadn’t been for currency headwinds.

Currency played it a part in Fossil’s weak quarter, but it doesn’t shoulder all the blame. Fossil saw a decline in two of its three core businesses, watches and leathers. After adjusting for currency watch revenue dipped 1% and leathers decreased 2%. The company’s third most important segment, jewelry, was its sole improvement. Jewelry sales were up 13% compared to the fourth quarter of last year.

Throughout each of the first three quarters of the year net sales of watches had increased by double digits. Estimize contributors had expected to see Fossil’s fourth quarter revenue rise 6.6% to $1.132 billion. Instead Fossil’s sales came in flat against last year at $1.065 billion compared to $1.062 billion.

Looking forward Fossil isn’t painting all that pretty of a picture. The company posted guidance for next quarter between 59 cents per share and 69 cents per share. That’s less than half of what Wall Street was looking for, $1.25.

Fossil also says that it sees ‘significant currency impacts’ influencing its outlook for the year. That impact has Fossil guiding to a tepid profit range of $5.45 per share to $6.05 per share for 2015. Before the closing bell the Street had been setting its sights on $7.59.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.