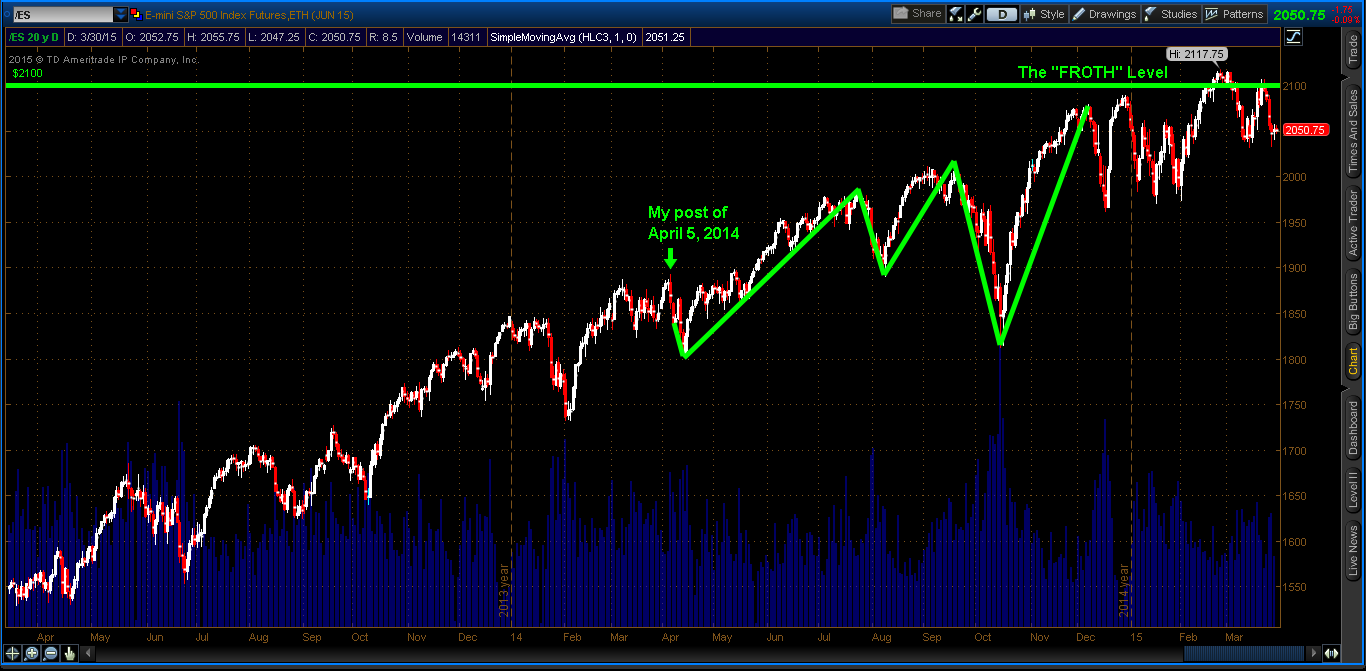

My post of April 5, 2014 refers to the below.

The following Daily chart of the {{8839|ES S&P 500 E-Mini Futurs Index}} shows what happened from that date up to the present. The ensuing swings overshot my projected targets a bit, and it took a bit longer for the "FROTH" level around 2100 to be reached, but price action generally followed the path that I forecast a year ago...price has been consolidating, basically, below that level since December 2014. Additionally, volatility did become the "name of the game" over those weeks and months, as I had anticipated.

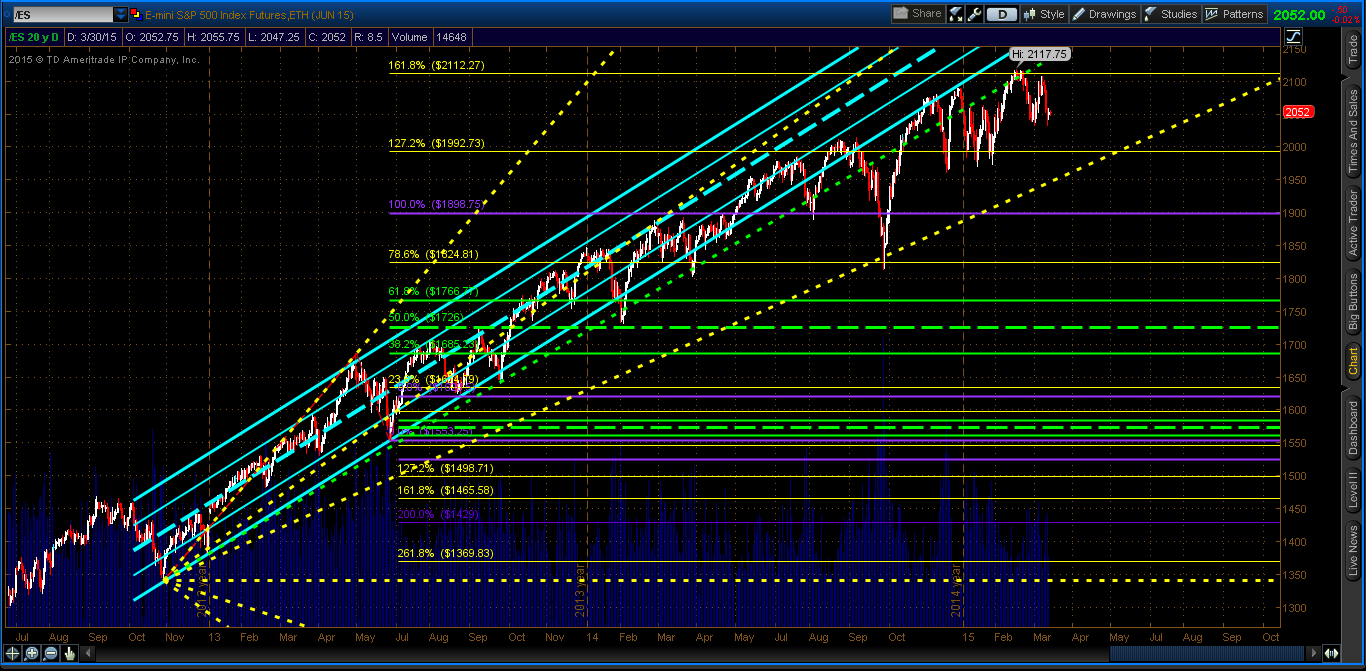

As can be seen on the next Daily chart of the ES, 2100 represents a double Fibonacci confluence major resistance level that will have to be solidly overcome and held before bulls can resume any kind of sustainable uptrend. A break and hold below 1992 could see bears take the ES down to 1813, or lower. Until we see a solid break one way or the other, I expect volatile swings to continue in both directions to plague both the bulls and the bears.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI