Heading into Wednesday’s conclusion of the Federal Reserve’s October monetary policy meeting, traders have almost completely priced out any possibility of action from the central bank, despite Fed Chair Janet Yellen’s comments that this would be a “live” meeting. To wit, the CME’s FedWatch tool shows that Fed Funds futures traders believe there’s just a 5% chance of the central bank raising interest rates on Wednesday.

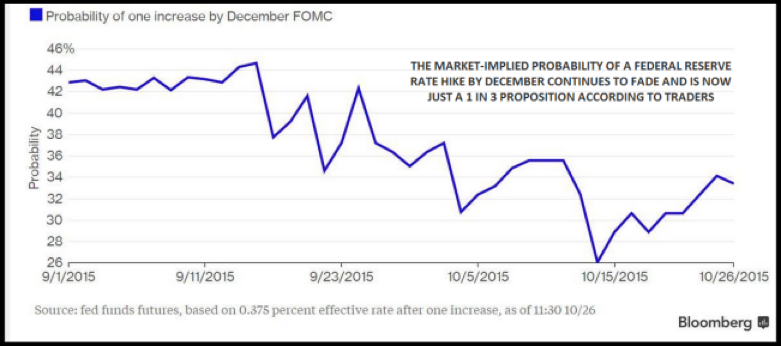

Indeed, the far more important figure to watch around the FOMC statement will be the likelihood of an interest-rate hike come December. As we go to press, the market views a December rate increase as a minority proposition as well, with an implied probability of just 30%, though economists are predictably more optimistic, with 64% expecting a rate hike by December according to a recent Wall Street Journal poll.

From a communication perspective, the Fed’s shift toward a more transparent decision-making process has been an abject failure. As recently as June, the Fed’s Summary of Economic Projections (SEP), including the infamous “dot chart” of interest-rate expectations, implied an interest-rate hike was almost certain this year, with 15 of 17 FOMC participants anticipating such a move.

Internal Strife

As the central bank has backed away from these hawkish views, it clarified that voters needed to see sufficient progress on the job market and rates would rise when the voters were “reasonably confident” that inflation would rise back to the bank’s 2% target. Of course, “sufficient progress” and “reasonable confidence” are fairly nebulous terms -- which led to even more confusion among traders. There are even growing fissures among the inner-circle of FOMC policymakers, with Yellen’s right- and left-hand men, Stanley Fischer and William Dudley, recently publicly disagreeing on whether interest rates should rise this year.

Looking at the recent economic figures, the market’s pessimism is understandable. The marquee Nonfarm Payrolls jobs report showed that a disappointing 142k jobs were created in September, while negative revisions drove the August jobs total down to just 136k. In addition, retail sales came in weaker-than-expected at just 0.1% m/m, while the Producer Price Index (PPI) figure for September dropped by -0.5%, the weakest reading since January. The subdued consumption and producer prices suggest there is minimal inflation in the pipeline, meaning that the Fed can afford to be more cautious about raising rates.

In our view, the central bank will make only minimal changes to its monetary policy statement. In particular, traders will latch on to any optimistic comments about financial markets stabilizing or “transitory” weakness in the labor market (potentially supporting a December hike), as well as any concern with the recent increase in the value of the US dollar, which could help push a rate hike back into 2016.

As we noted last week, even a neutral statement could still lead to more dollar strength as the market sentiment pendulum recently swung to a potentially bearish extreme on the greenback. That said, we believe that the overall market reaction to the Fed statement may be more subdued than usual and that Thursday’s Q3 Advance GDP report could be even more market-moving, as it will heavily influence (not just relay) Fed policy views heading into the December meeting.

Source: Bloomberg, FOREX.com

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI