Tuesday afternoon I put out a few thoughts as we head into the FOMC rate decision. They are shown above. This morning I wanted to explain them a bit more fully using the Nasdaq 100 as an example. The crux of my point is that if you expect nothing to happen then you would protect against that to see if your view does in fact play out.

This results in either hedging your existing positions or, if you have cash to deploy, waiting until the event happens. With the bearish sentiment in the market over the last month or more I suspect the latter is more prevalent than normal. I also see that this can be viewed in the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) ETF.

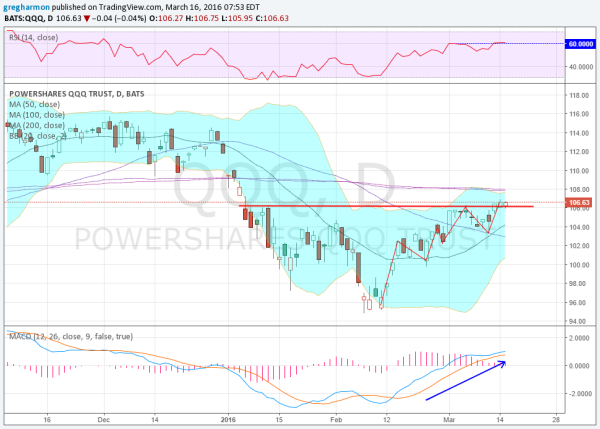

The Nasdaq 100 started lower in January as the calendar turned, and progressively moved lower until a bottom was found from February 8th through the 11th. Since then it has moved higher in a jagged path. But look where it is into the FOMC meeting this afternoon. Holding steady at resistance, just under the 100 and 200 day SMAs. The RSI, a measure of momentum, is also holding steady right on the edge of the bullish zone. And the MACD is rising, but slowly and barely positive.

These all point to a creep of money into the index, but not a flood, a hesitancy. It might turn out to be exhaustion, and without the Fed meeting, many more would likely be leaning this way. But this event is widely anticipated to be a non event. No change in rate policy. Zero percent chance of a rate hike built into Fed Funds futures. That suggests money waiting to be sure that nothing happens. Now lets wait and see.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI