One of the most popular investment topics in the fourth quarter has to do with the impending fiscal cliff discussion taking place in Washington, DC as can be seen in the Google Trends graph below. One area of interest for investors is the impact on the taxation of dividends if Washington policy succumbs to going over the cliff. Going over the cliff would result in the tax rate on dividend income increasing to as high as 43.4% versus the current 15% rate.

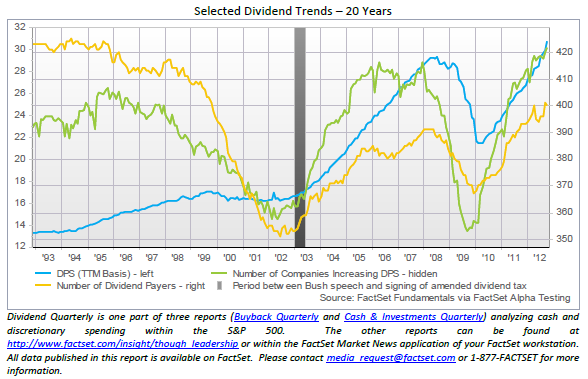

Interestingly, this potentially higher tax rate does not seem to be having a "negative" impact on the long term dividend policy for companies. Factset Research notes in their Dividend Quarterly report for Q3:

- aggregate dividends per share (“DPS”) grew 15.5% year-over-year at the end of Q3.

- the number of companies paying a dividend in the trailing twelve-month period again surpassed 400 (80% of the S&P 500 index).

- the S&P 500 also hasn’t shown a slowdown in companies initiating dividend payments. In Q3, 3.0% of non-payers “initiated” dividends, which is nearly triple the average over ten years (1.2%).

- the aggregate dividend payout ratio is 2.0% below the ten-year median, it is at its highest level (29.1% at the end of Q3) since the recession (when payout ratios were distorted by low aggregate earnings during the recession...).

- while there have been a number of companies that are signaling short-term changes in dividend policy or a shift towards more share buybacks..., a majority of companies have not yet responded, including the top ten dividend-payers in the S&P 500.

- the aggregate, forward twelve-month DPS estimate for the S&P 500 was 10% above the actual trailing twelve-month (“TTM”) payout at the end of November, which is a premium that is well above the ten-year average of 3%... Also, even when excluding the periods during the financial crisis (when forward DPS estimates fell below trailing figures), the forward consensus premium is in-line with the stabilized average starting in 2011.

One reason dividend practices may not be changing for a large majority of companies may be due to the fact that many shareholders own company stock in retirement accounts and/or shares are held by foreign investors. In Factset's Dividend Quarterly one Treasurer cites this very fact.

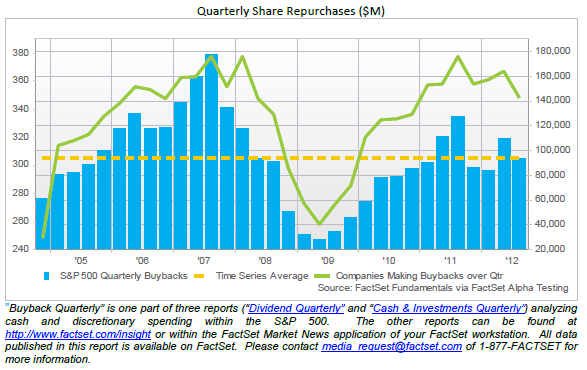

Lastly, just to reiterate a point about dividends versus buybacks we have made on this site in the past is the fact divdend payments are more consequential when evaluating companies. We prefer dividends since company practices around their dividend policy offer more insight into potentially negative financial outcomes since firm's are less likely to cut dividends.

For example, companies may take on debt in order to maintain adherence to a certain dividend growth rate. This may result in debt/equity levels increasing as well as payout ratios increasing. These are red flags for investors and may enable investors to reduce positions before negative financial results are reported.

Conversely, company buyback announcements may be just that and do not equate to a longer term commitment of a company's cash flow. It is far easier for a company to come up short on their buyback program than to announce a change in their dividend policy. As the below chart notes, the number of companies making buybacks and the aggregate dollars spent on buybacks has been on the decline since the fourth quarter of last year.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.