Today I add a new chapter to my life. Many of you know I have been teaching classes in Risk Management at Case Western Reserve’s Weatherhead School of Management for the past few years. I was asked and joined their business advisory board this past fall to help shape curriculum changes to better prepare students for the working world. At the first board meeting we discussed the great strides Weatherhead had made. The head of the Finance Department presented that two of the three streams had been STEM accredited, Big Data and Risk Management. That left Corporate Finance.

Those that know me well are already picturing me trying to hide my head. I despise many if not all of the concepts of Corporate Finance. Well that is not fair. I do agree with the time value of money. But as a technical analyst and trader the thoughts around corporate valuation, CAPM etc give me chills. So of course the discussion turned to Corporate Finance. But in a way that was stomachable, thank goodness. Krish, the department head, started talking about Cryptocurrencies, ICO’s, crowd funding, alternative payment systems. How can we add a course in one of these areas or more broadly in FinTech, he asked.

My head was still, down avoiding eye contact, and then I snuck a peek and noticed everyone was doing the same thing. I decided to add my two cents and avert the risk. I noted that I knew nothing about FinTech, but that through my contacts over the last 9 years on social media I have met many experts in several of these areas. I could see if there was interest in some of them coming to give insights to the students. Krish ran with this idea and to make a long story short the class starts tonight!

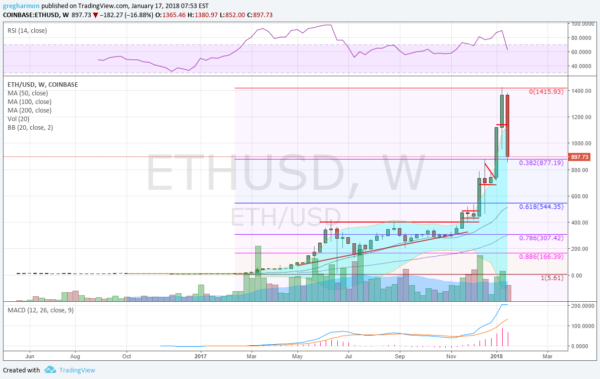

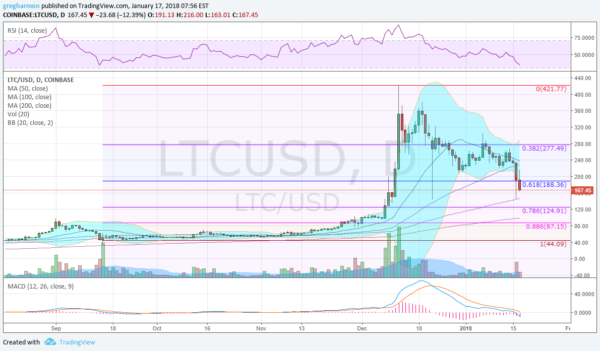

So it is only fitting that on the eve of my class the crypto-currency market crashes. I had decided around Thanksgiving that I had better put some money in crypto-currencies so that I could experience the raw emotion of it first hand. I bought a little Ethereum and then some Litecoin. And yes I still hold it. The insanity of these markets is that with Etherium about 38% off its top and Litecoin down by more than half, my wallet is still bigger than when I started.

As I put the finishing touches on the opening class notes, I thank all of you that are coming to help me out. And I am taking a look at my holdings. Etherium has traded very much along technical lines. The current pullback or crash has retraced 38.2% of the move up. A hold here would be welcome of course, and a break lower looks to have possible support at 685 or 485 then 400. Litecoin has dropped more than 61.8% of its move up and does not seem done falling. The 100 day SMA is now close by at 145 and might be a resting point with the 200 day SMA below that at about 99.

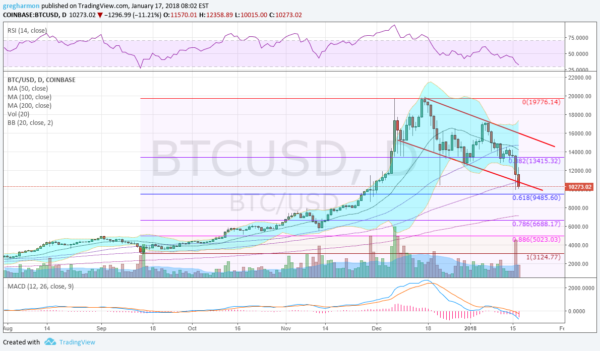

The king of the cryptos, Bitcoin, had been hemorrhaging since early December, and had been falling in a well structured channel. As I write Bitcoin is threatening to break below the bottom of this channel. The 61.8% retracement is close at 9485 and the 200 day SMA below that at 7175.Either could be a stopping point. Or it could fly back up to 20,000! That is the pain and joy of the crypto world. Enjoy your day!

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.