Since November 15th the S&P 500 Index has managed to gain over 4% in spite of the rhetoric surrounding the consequences of going over the fiscal cliff. Finding a "balanced" solution to the budget issues in Washington is more than a near term issue.

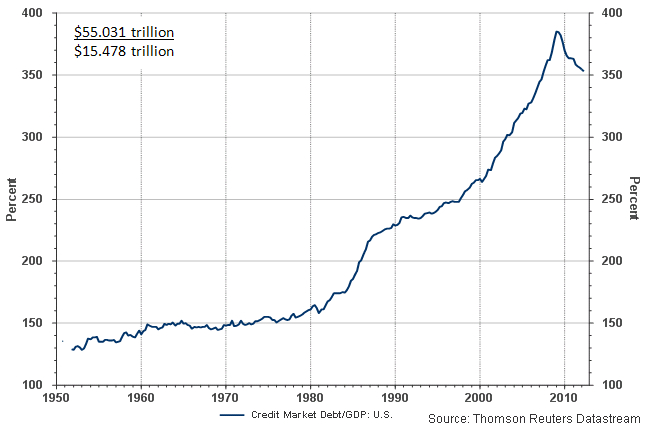

As the below chart shows, total credit market debt to GDP has been on an increasingly higher growth trajectory. A contributor to this debt increase is the growth in debt at the U.S. government level due to the significant budget deficit from year to year. Additionally, the economy continues to grow at a rate that is below its long term trend potential.

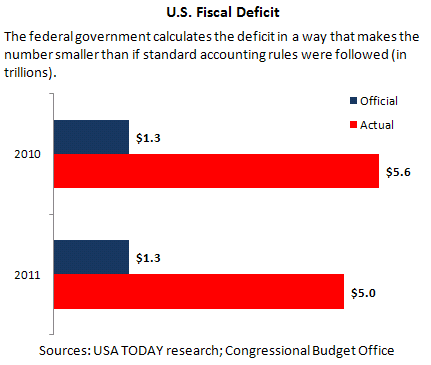

USA Today reported recently that the deficit in 2011 would actual total $5 trillion if standard accounting rules were utilized by the government.

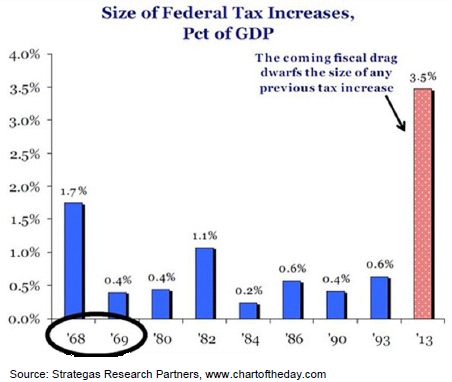

The point in noting the aforementioned data is a balanced approach to closing the deficit is a must. It is fine to focus on revenue on the on hand; however, the revenue increase must consider a structure that also creates an environment where the economy is likely to grow. Simply raising taxes, and thinking that is the answer to growing revenue, is sure to tip the economy into a recession.

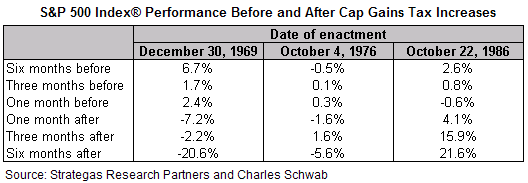

The below table provides market performance data during past time periods when the capital gains tax rate was increased. One of the tax changes that will go into effect if Washington goes over the fiscal cliff is a higher capital gains tax rate. The table was reproduced from a recent market comment by Liz Ann Sonders, Chief Investment Strategist for Charles Schwab & Co. She notes the mixed market results that occurred when capital gain tax rates were increased. However, she goes on to note, "but looking more closely, you can see that the capital gains tax hike in 1986 was met with very strong market performance. Why? Because it was part of President Ronald Reagan's bipartisan tax reform, which slashed marginal and corporate tax rates while also eliminating many deductions. I hope our policy-makers heed the message of this particular history."

The important takeaway from the above table is the necessity to craft a budget solution that includes components that are conducive to economic growth.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI