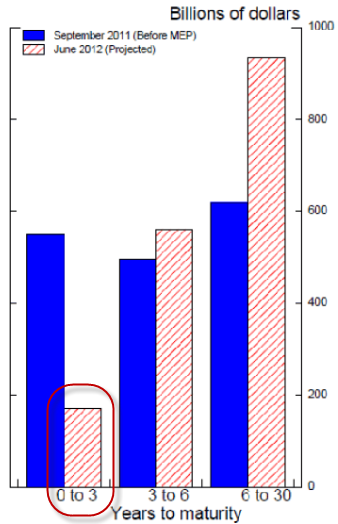

Here is a quick follow-up to an earlier post discussing the Fed's diminishing short-term Treasury note position. The Fed is basically running out of the 2-3 year notes to sell in order to buy long-term Treasurys as part of Operation Twist (officially known as Maturity Extension Program or MEP). BofA is projecting that by the time of the FOMC meeting this month, the Fed will have $175bn of short-term Treasurys on its balance sheet. That's enough to extend Operation Twist only through September. Beyond that point the Fed is likely to embark on sterilized purchases (possibly MBS) in order to extend the easing program.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.