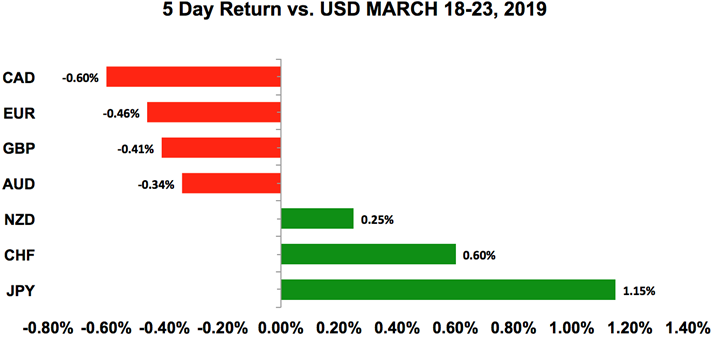

What a difference a week can make in the forex market. There were three big revelations – the Federal Reserve doesn’t expect to raise interest rates again this year, Europe is on the verge of recession and the UK received a short unsatisfying extension to Article 50.

As a result, consolidations turned into breakouts as economic data and central bank policy gave investors a clearer sense of where the dollar, euro and other currencies should head next. The greenback ended the week sharply lower against the Japanese Yen but higher against the euro, Canadian and Australian dollars. At one point after the Federal Reserve meeting, it looked like it could have been a week where all of the major currencies would be pushed higher by a depreciating US dollar. However, a less hawkish Fed can only hurt the dollar so much when the bigger problem is weaker global growth. Looking ahead, we expect that many of the new trends established last week will continue because while the economic calendar is busy, the events this week are not as market moving as the last and have far less potential to completely alter market sentiment.

US Dollar

Data Review

- Fed leaves rates unchanged, downgrades interest rate, GDP and inflation forecast

- NAHB Housing Market Index 62 vs 63 Expected

- Factory Orders 0.1% vs 0.3% Expected

- Durable Goods Orders Revision 0.3% vs 0.4% Expected

- Philadelphia Fed Index 13.7 vs 4.8 Expected

- Jobless Claims 221K vs 225K Expected

- Existing Home Sales 5.51M vs 5.1M Expected

Data Preview

- Housing Starts, Building Permits, S&P House Prices – Likely to be weaker as housing market activity peaks

- Consumer Confidence Index – Likely to be stronger given equity market improvements and higher University of Michigan Consumer Sentiment Index

- Trade and Current Account Balance – Lower manufacturing ISM index signals trade weakness but last month, trade deficit hit record high

- Q4 GDP Revisions – Revisions are difficult to predict but changes can be market moving

- Personal Income and Spending – Potential for upside surprise given stronger average hourly earnings and retail sales

- Chicago PMI and New Home Sales – Stronger Philly Fed offset by weaker Empire State

Key Levels

- Support 109.00

- Resistance 112.00

Fed Cuts Rate Forecast From 2 To 0 Hikes This Year

The biggest surprise last week came from the Fed who made it clear that they no longer expect to raise interest rates this year and in doing so, they set a strong downward course for USD/JPY, which broke below 110 for the first time since early February. Back in December, the Fed forecasted 2 rate hikes this year and at worst, investors thought they would downgrade those expectations to 1 hike. However, 11 out of 17 US policymakers think that rates should remain unchanged for the rest of the year. This dramatic shift in expectations reflects the severity of the central bank’s concerns. According to the monetary policy statement, the main problems are muted inflation, slower household spending and business investment. While the Fed still feels that the labor market is strong and job gains are solid, the deeper than expected slowdown and decline in inflation allows them the flexibility to keep monetary policy accommodative for the rest of the year. Fed Chair Powell confirmed that trade talks, Brexit, European tariffs, twin deficits and weaker global growth are risks and until some of these are lifted “it’s a great time for the Fed to be patient, to watch and wait.” Although the Fed Chair laced part of his speech with optimism, the greenback plunged as the lower interest rate, GDP and inflation forecasts cast a dark cloud over the dollar. 10-year Treasury yields also dropped to its lowest level since January 2018. In light of the Fed’s new outlook, improvements in existing home sales, jobless claims and the Philadelphia Fed manufacturing index had zero impact on the greenback. The same can be said of this week’s housing market, consumer confidence, trade balance, personal income and personal spending reports. The uptrend in USD/JPY has been broken and a move to 108 is likely.

AUD, NZD, CAD

Data Review

Australia

- House Price Index -2.4% vs -2% Expected

- Employment Change 4.6K vs 15K Expected

- Unemployment Rate 4.9% vs 5% Expected

- Full Time Employment Change -7.3K vs 65.5K Previous

- Part Time Employment Change 11.9K vs -27.3K Previous

New Zealand

- PMI Services 53.8 vs 56.2 Previous

- Westpac Consumer Confidence 103.8 vs 109.1 Previous

- Q4 GDP MoM 0.6% vs 0.6% Expected

- Q4 GDP YoY 2.3% vs 2.5% Expected

Canada

- Retail Sales -0.3% vs 0.4% Expected

- Retail Sales ex autos 0.1% vs 0.1% Expected

- CPI 0.7% vs 0.6% Expected

- CPI YoY 1.5% vs 1.4% Expected

Data Preview

Australia

- None

New Zealand

- RBNZ Rate Decision – Expected to leave rates unchanged, maintain a cautious outlook

- NZ Trade Balance – Potential upside surprise given higher business PMI index

Canada

- Trade Balance – Potential downside surprise given lower IVEY PMI index but the past month’s read was very weak

- GDP – Potential for downside surprise given weaker trade and retail sales

Key Levels

- Support AUD .7000 NZD .6800 CAD 1.3200

- Resistance AUD .7100 NZD .6950 CAD 1.3450

AUD, NZD, CAD – Trading On Risk Appetite

The Australian and Canadian dollars also came under pressure but the New Zealand dollar proved to be one of last week’s best performers. When the Reserve Bank of Australia last met, they made it clear that they are watching labor market and consumption. While the unemployment rate dropped below 5% for the first time in 8 years, the labor market is shrinking and job growth is slowing as full time jobs were shed last month. Investors are also worried that US-China trade talks are going nowhere fast. The US will be sending Mnuchin and Lighthizer to China next week for more trade talks but with reports that President Trump wants China to double or triple their purchases of US goods, an agreement still appears far away. With both the RBA and the Fed on hold for the rest of the year, the biggest driver of AUD flows is risk appetite and the market’s negative reaction to FOMC forced AUD to reverse its gains at the end of last week. With no Australian data on this week’s calendar, the market’s appetite for risk and US dollars will drive AUD/USD flows.

The unexpected drop in Canadian retail sales at the start of the year sealed the fate for the loonie. USD/CAD broke through 1.34 after retail sales dropped -0.3% for the second month in a row. The case for Bank of Canada dovishness strengthens by the day as spending and trade crater. GDP numbers are scheduled for release on Friday and growth could fall even further. The one good news was inflation which rose 0.7% in February but at 1.5%, the annualized pace of growth is still running well below the central bank’s target levels.

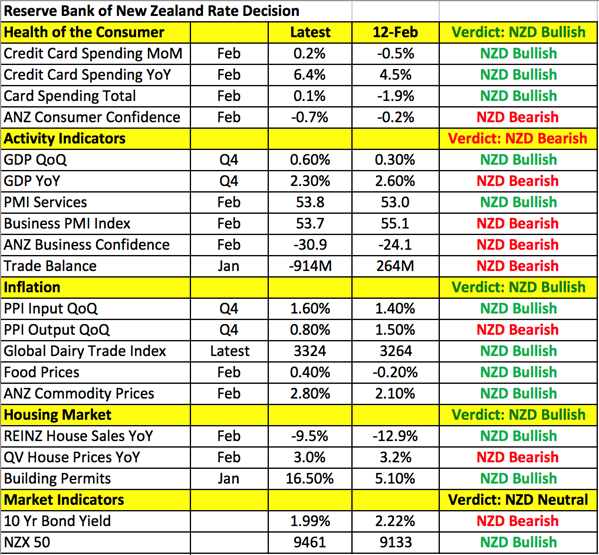

Last but certainly not least is the New Zealand dollar – which has been one of the most resilient currencies. The latest economic reports weren’t great with consumer confidence falling and service sector activity slowing. However, traders are hoping that improvements in other parts of the economy will be enough to keep the RBNZ squarely neutral. When the central bank met in February, they pushed back their forecast for a rate increase to early 2021 but NZD soared after RBNZ Governor Orr said the chance of easing has not increased and noted that growth should pick up. Since then, manufacturing, business and consumer confidence slowed but credit card spending, growth, prices and home sales are on the rise. Stocks also hit a record high which will help consumer and business sentiment.

British Pound

Data Review

- Bank of England Leaves Interest Rates Unchanged

- Rightmove House Prices 0.4% vs 0.7% Previous

- Jobless Claims 27K vs 15.7K Previous

- Average Weekly Earnings 3.4% vs 3.2% Expected

- ILO Unemployment Rate 3.9% vs 4% Expected

- CPI MoM 0.5% vs 0.4% Expected

- CPI YoY 1.9% vs 1.8% Previous

- CBI Trends Total 1 vs 5 Expected

- Retail Sales 0.4% vs -0.4% Expected

- Retail Sales ex Autos 0.2% vs -0.4% Expected

Data Preview

- Q4 GDP Revisions – Revisions are difficult to predict but changes will be market moving

Key Levels

- Support 1.3000

- Resistance 1.3350

EU Gives UK Two Weeks Or Two Months – But That’s It.

The UK Prime Minister May finally requested a three-month extension of Article 50 and the European Union approved a delay but not the one she was looking for. They said that if May can persuade Parliament to accept the current Withdrawal Agreement, the UK would leave the European Union on May 22, one day before the European Parliament elections. However, if she fails, they have until April 12. In that time, they will need to decide if the current deal, no deal or no Brexit is their next course of action. The EU is telling the UK that for better or worse, they want to be done with Brexit. They refuse to be trapped in a long extension. Unfortunately, this means that a disruptive Brexit is still on the table so while sterling ended the week off its lows, the risk is to the downside. Brexit completely overshadowed the Bank of England’s monetary policy announcement and UK data. The BoE voted unanimously to leave interest rates unchanged and said Brexit could prompt policy moves in either direction. They also warned that employment growth could moderate significantly as more companies trigger no-deal Brexit plans. Instead of falling, sterling rallied after the rate decision because the central bank said: “gradual, limited tightening is probably needed.” UK retail sales, wage growth and inflation reports were also stronger than expected. However, nothing mattered to GBP except Brexit and that will remain the case for the next few weeks.

Euro

Data Review

- German ZEW Current 11.1 vs 13 Expected

- German ZEW Expectations -3.6 vs -11 Expected

- German PPI MoM -0.1% vs 0.2% Expected

- German PPI YoY 2.6% vs 2.9% Expected

- EZ Trade Balance 17B vs 15B Expected

- EZ ZEW Survey Expectations -2.5 vs -16.6 Expected

- EZ Consumer Confidence -7.2 vs -7.1 Expected

- German PMI Manufacturing 44.7 vs 48 Expected

- German PMI Services 54.9 vs 54.8 Expected

- German PMI Composite 51.5 vs 52.8 Expected

- EZ PMI Manufacturing 47.6 vs 49.5 Expected

- EZ PMI Services 52.7 vs 52.7 Expected

- EZ PMI Composite 51.3 vs 52.0 Expected

Data Preview

- German IFO Index – ZEW survey was mixed

- EZ Confidence – Will have to see how German business confidence fares but investor sentiment (ZEW) was mixed

- German CPI – Prices most likely increased due to higher oil prices and weaker euro

- German unemployment report – Potential downside surprise as the pace of job growth eases to slowest since May 2016

Key Levels

- Support 1.1250

- Resistance 1.1400

Euro crashes – Is Europe On The Verge Of Recession?

While the US dollar should extend its slide against the Japanese Yen, it could extend its gains against the euro as investors worry about Europe teetering on the verge of recession. The latest Eurozone PMI numbers were horrible. The flash PMI readings out of both France and Germany missed their mark by a wide margin with German Manufacturing PMI plunging to a 79-month low. The German PMI was already projected to print at 48 - below the 50 boom/bust line - but came in at a shockingly low of 44,7 suggesting that Germany's key economic sector is now fully in a contractionary mode which likely to depress growth not only in Germany but through the whole of EZ as well. German 10-year yields turned negative at one point as risk-off flows picked up markedly. This news only adds pressure on ECB not only to hold off on its normalization process but perhaps to completely reverse course and resume quantitative easing as credit conditions in the region have undoubtedly deteriorated. The poor performance data from the EZ core economies also puts European authorities at a massive disadvantage at a time when they can afford it the least. The Trump administration has been threatening the EZ with import tariffs on cars which is a key industry in the region and would no doubt tip the continent into contraction should they be enacted. Mr. Trump - ever ready to trample his opponents when they are down, will no doubt harden his negotiation stance, adding further economic pressure on Europe. All of this suggests that euro may now test the recent swing lows at the 1.12 and could even head to 1.10 as the year proceeds. This, in turn, should actually help the export-dependent region but the adjustment may take months and if exchange rates remain sticky at these levels, growth will no doubt deteriorate further.