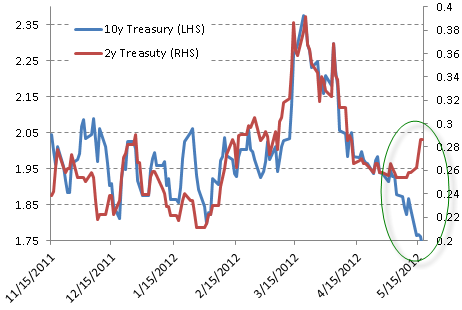

Fed's Operation Twist is starting to introduce some "unintended consequences" into the market. The 10-year treasury yield has collapsed on the back of Eurozone's latest troubles. One would expect the two-year note to trade with a lower yield as well. But in fact the 2-year yield has been moving up. The Fed wanted to lower long-term rates without impacting shorter term rates - and that is proving difficult.

Even today, in the face of new fears about Spain (with a potential run on the banks there), the two-year treasury yield is still moving higher.

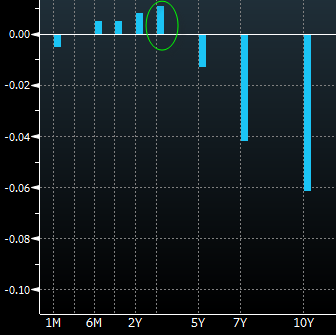

The question now is whether these yields will reverse direction once Operation Twist ends this summer. Given the global economic backdrop, the Fed will likely not want to end the program, but the central bank will soon run out of two-year treasuries to sell. The next step will be sterilized purchases.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.