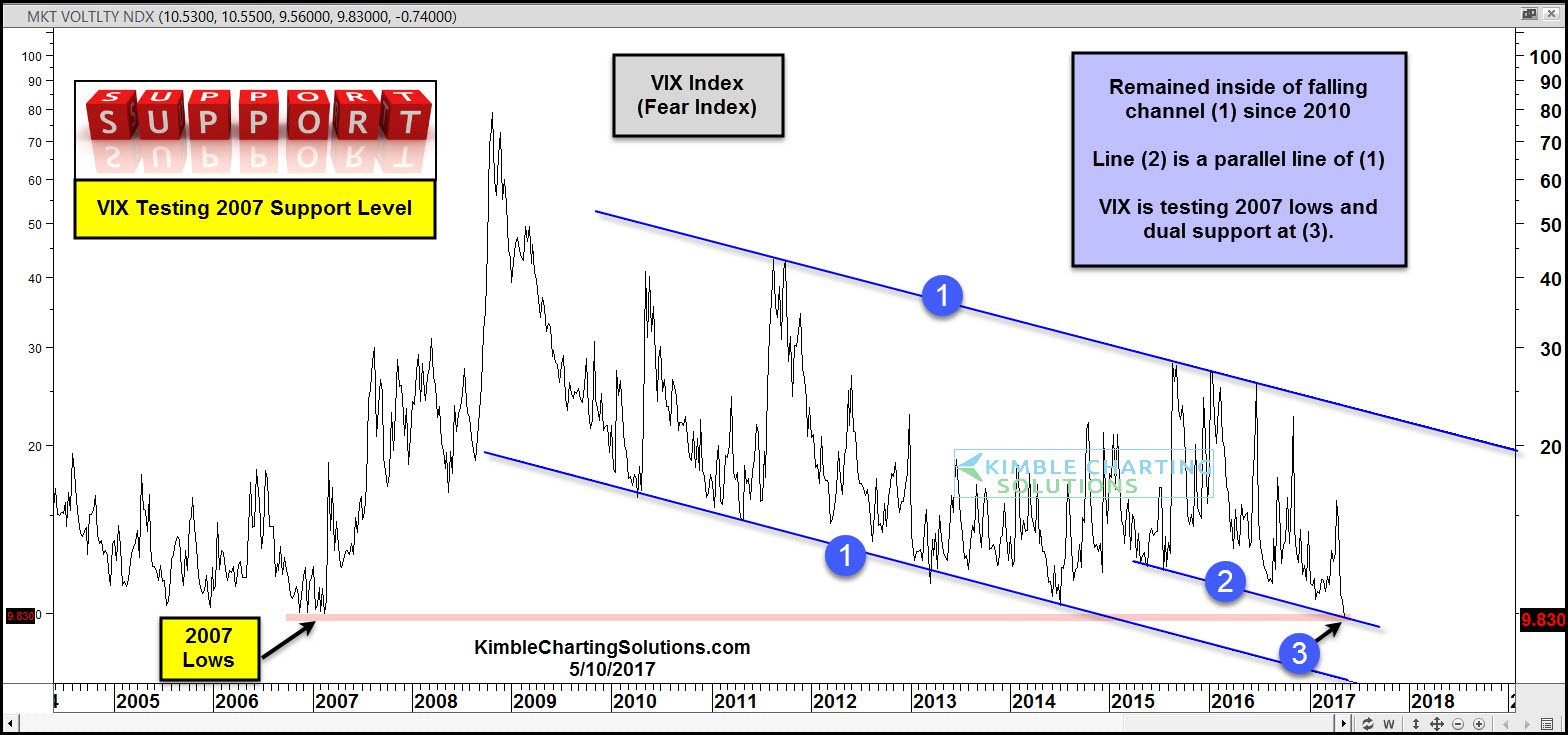

The chart below looks at the VIX index over the past decade. Over the past three weeks, the VIX has been falling sharply by more than 40%.

Over the past 7 years, the VIX has remained inside of falling channel (1). Line (2) is a parallel line of falling channel (1). The index is now testing the lows of 2007 and line (2) at (3). When the VIX hit this level in 2007, it skyrocketed.

This price level could become a very important level for the VIX and potentially could send an important message to the bullish trend in stocks.

The collapse in fear has been great for ETF XIV, which has rallied over 25% in the past three weeks. Premium and Sector members have been long the XIV trade and are now harvesting gains and pulling up stops. The VIX's collapse has been good news for the anti-fear trade.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI