The chart above looks at the NASDAQ 100 and the NASDAQ Fear Index (VXN) over the past 15-months. Since last fall, the NDX 100 has continued to create a series of lower highs.

Falling resistance was hit at (1) of late, at the top of a small bearish rising wedge and support has been taken out. At the same time, the NASDAQ Fear index was near lows of the past 15-months.

Over the past two weeks the VXN has pushed above a 90-day resistance line at (2).

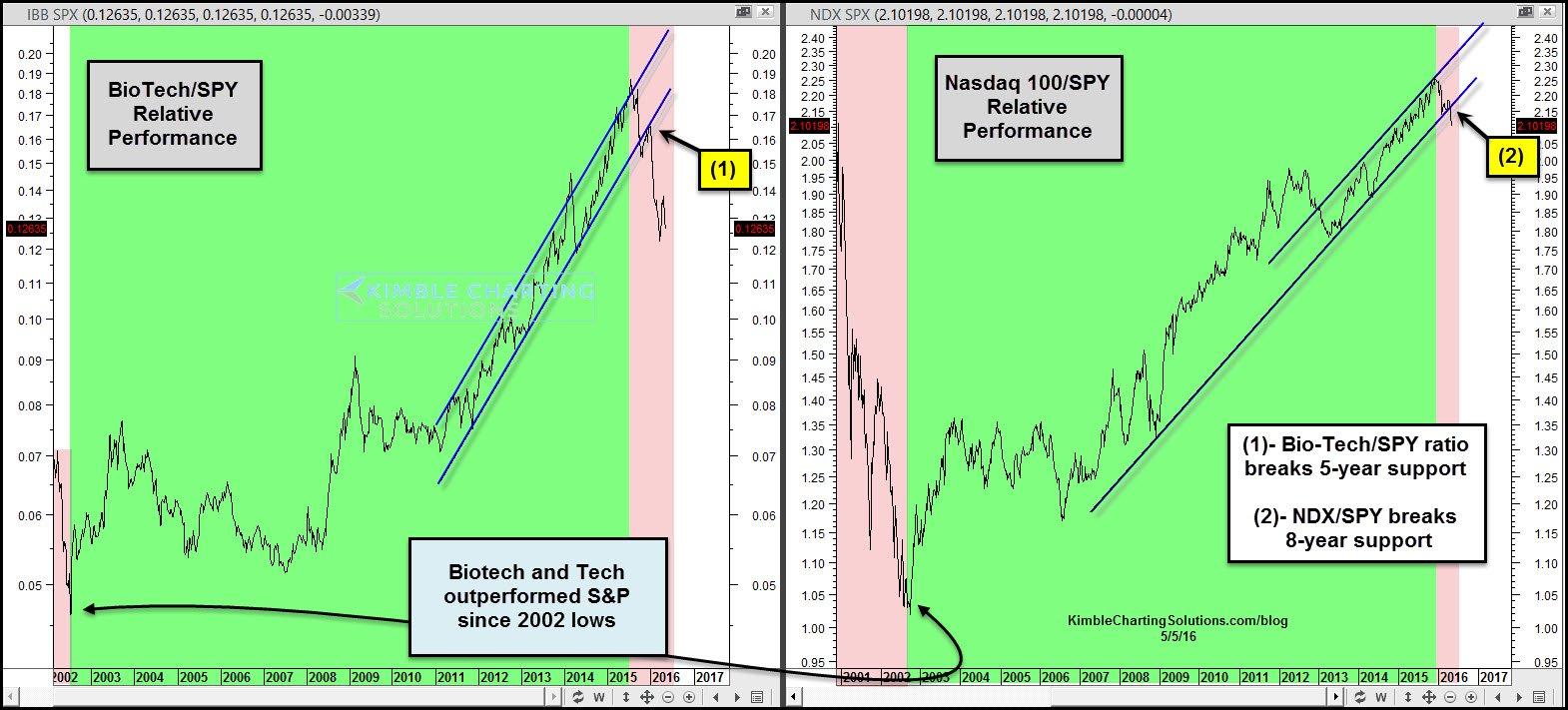

Biotech and Tech stocks have been upside leaders since the 2009 lows, outpacing the broad market by a large percentage. The above chart reflects that both have broken multi-year support lines, which suggests that these upside leaders could turn into downside leaders.

For the broad markets to push to all-time highs, bulls want/need Tech and Bio-Tech to act stronger.

Full Disclosure: Short the NDX with a tight stop.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.