Ethereum price target raised at Standard Chartered. Here’s the new forecast

Economists expect no change in interest rates today when the Fed publishes its monetary policy statement at 2:00pm eastern. Briefing.com’s consensus forecast calls for Fed funds to remain at the zero-to-0.25% target rate that’s prevailed since 2008. Surprising? Not really, courtesy of the recent run of wobbly economic data. Does market data agree? Oh, yeah.

The numbers speak loud and clear. If Yellen and company announce a rate hike later today, it’s going to be a major surprise by Mr. Market’s reckoning, as we’ll see in the following tour of the numbers.

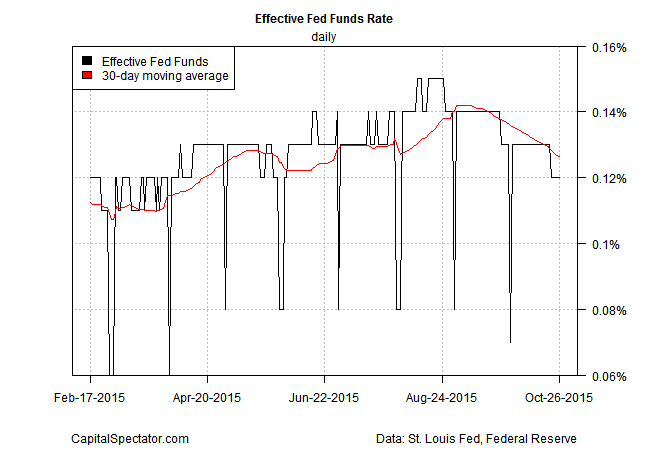

Fed funds futures are currently assigning a 94% probability that the target rate will remain unchanged today, based on CME data. The ongoing slide in the effective Fed funds (FF) rate agrees. The 30-day moving average of FF has been falling since mid-September and the downside momentum shows no signs of easing, much less reversing. After climbing in August through early September, the 30-day FF average as of Oct. 26 has given up all its recent gains and is now at its lowest level since June.

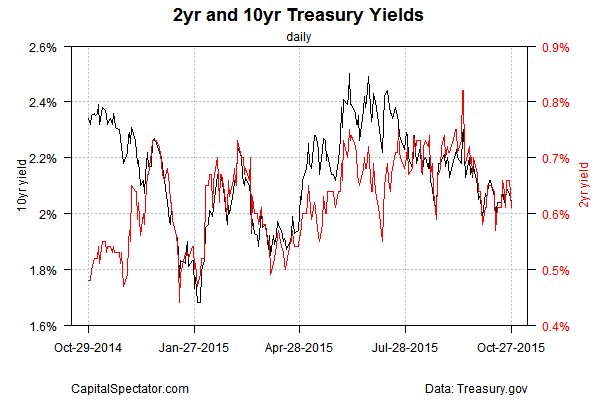

The 2-Year Treasury yield is priced for no change as well. Considered the most sensitive spot on the yield curve for rate expectations, the 2-year yield closed yesterday (Oct. 27) at 0.65%, which is close to the lowest level since the spring, based on Treasury.gov data. A similar downside bias applies to the benchmark 10-Year yield these days.

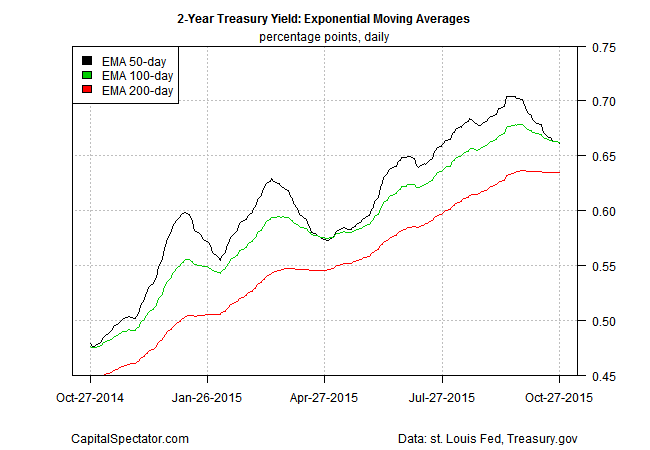

The recent slide in yields looks set to roll on, based on exponential moving averages (EMAs). The 2-year yield, for instance, is now flirting with a bearish pattern.

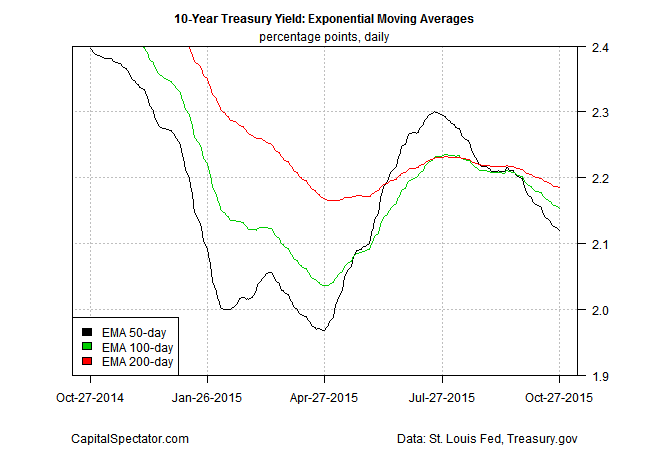

Meanwhile, the 10-year yield’s downward trajectory is even stronger.

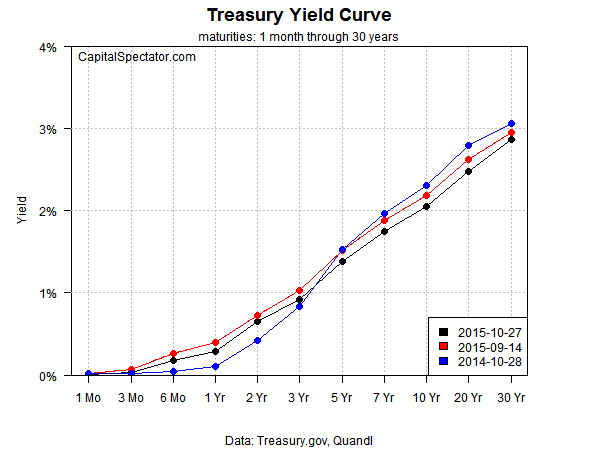

The Treasury curve is still positive, but recent trading has moved the yield structure closer to a flatter position. Note that most maturities as of yesterday (black dots) have inched below the yields of 30 trading days previous (red dots).

In short, the crowd’s in near universal agreement: a rate hike announcement in today’s FOMC statement would be a rather large surprise.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI