I have a watchful eye on initial unemployment claims. They have been trending higher (unexpectedly of course) since mid-October.

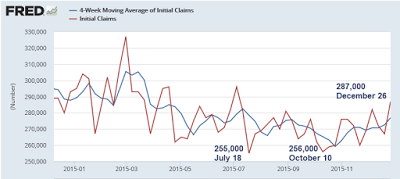

Initial Claims 2015

Econoday economists were surprised by the jump.

Initial jobless claims unexpectedly jumped 20,000 to 287,000 in the December 26 holiday week, the highest level since the July 4 holiday week. The Econoday consensus expected an increase of 3,000 to 270,000. The 4-week moving average was up 4,500 to 277,000 in the December 26 week, the highest since the July 18 week. The level of continuing claims increased 3,000 to 2.198 million in the December 19 week. The seasonally adjusted insured unemployment was unchanged at 1.6 percent in the December 19 week. It should be noted that readings in this report can be volatile during the holiday weeks.

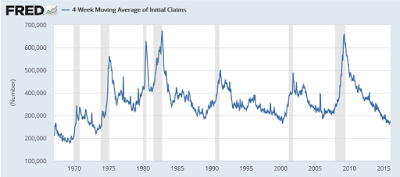

Long-Term Perspective

A long-term chart shows the claims are still at historic lows dating all the way back to the 1970s. Does that imply there is little cause for concern?

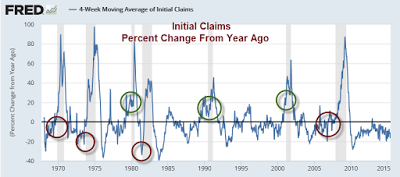

Let's look at the chart another way.

That chart shows recessions sometimes start with year-over-year changes still negative and sometimes not. Moreover, there is a tremendous amount of noise as evidenced by huge swings that did not lead to recession.

Low claims in and of themselves are pretty inconclusive even though huge spikes tend to mark recessions.

Where to in 2016?

Jobs have been strong, but some of us believe part-time jobs and Obamacare artifacts have skewed the numbers. Regardless, jobs are a hugely lagging indicator, even if you believe the numbers.

Since there was a burst of seasonal hiring, it stands to reason there will be a burst of seasonal firing.

With corporate profits under pressure from rising wages, and with many big box retailers struggling, upcoming layoffs are likely to be huge.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.