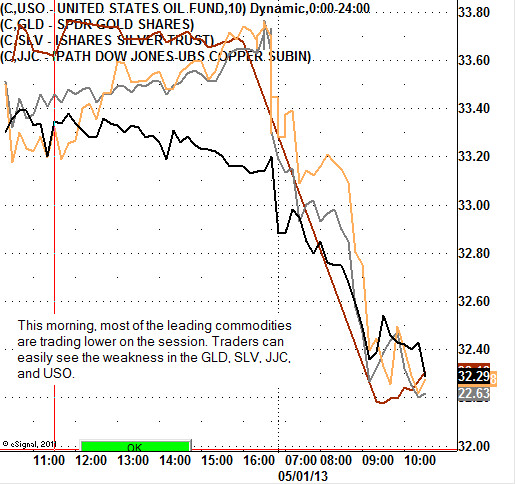

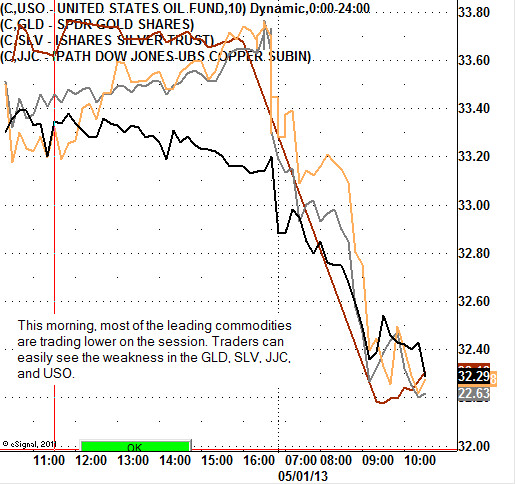

This morning, almost every leading commodity is declining ahead of the highly anticipated Federal Open Market Committee meeting announcement. Traders can see the early weakness in the SPDR Gold Trust (GLD), iPath Dow Jones UBS Copper Subindex Total Return ETN (JJC), United States Oil Fund (USO), and the iShares Silver Trust (SLV). Often, weakness in the commodity complex will signal global economic weakness. Recently, the economic data from around the world supports the weak economy thesis.

Traders and investors should also follow the U.S. Dollar Index very closely when trading the leading commodity ETF's. Usually, the leading commodity ETF's will trade inversely to the U.S. Dollar Index. Today, the U.S. Dollar Index futures (DX-M3) are trading lower by 0.17 cents to $81.63 per contract. It should be noted that the U.S. Dollar Index was sharply lower at the start of the trading day.

Later today, the Federal Reserve will announce its policy statement for the U.S. economy. The central bank is not expected to make any changes to its current $85 billion per month asset purchase program, known as quantitative easing, or QE3. Any hint of the central bank scaling back on these asset purchases could cause a stock market decline. The announcement by the Federal Reserve will be made at 2:15 pm EST.

Traders and investors should also follow the U.S. Dollar Index very closely when trading the leading commodity ETF's. Usually, the leading commodity ETF's will trade inversely to the U.S. Dollar Index. Today, the U.S. Dollar Index futures (DX-M3) are trading lower by 0.17 cents to $81.63 per contract. It should be noted that the U.S. Dollar Index was sharply lower at the start of the trading day.

Later today, the Federal Reserve will announce its policy statement for the U.S. economy. The central bank is not expected to make any changes to its current $85 billion per month asset purchase program, known as quantitative easing, or QE3. Any hint of the central bank scaling back on these asset purchases could cause a stock market decline. The announcement by the Federal Reserve will be made at 2:15 pm EST.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI