Trump says U.K. would fight for U.S., doubts EU commitment

Forex News and Events

As widely reported Germany rejected the Greek six-month loan proposal, suggesting it failed to honor any prior obligations. The German rational was that Greece was asking for cash but giving nothing in return. German wants a clear plan on how Greek will pay back its current debt load. There is still a chance that at today’s Eurogroup will overturn the German response or even less likely, convince Germany to reverse their view. Outside some halfhearted optimistic rhetoric (Finland) the ideological divide in our view is too great to find a compromise.

With the ECB extension and increase of the emergency liquidity to shaky Greek banks, negotiations can continue next week, should a special Eurogroup meeting get called. We suspect that a comprise will not be found and Greece will be force to leave. In short, by allowing Greece to default on its massive current debt burden is the only way Greece can achieve economic long lasting expansions that is culturally acceptable to the Greek people. The lack of contagion in financial markets (stress isolated in Greek yields and stock markets), suggests Europe could manage this extreme event. True there are some significant uncertainties with this type of massive structural event but we suspect that Europe is prepared to take this critical path now rather than in six months. First is that European growth is soft but stable getting a solid kick from the weak Euro. Second is that the market is full aware that “Grexit” is possible and has had plenty of time to manage the risk. But finally, the rise of the ECB in the last five years is now prepared to provide a strong hand to manage the transition and limiting disruption. ECB already scheduled launch of QE could be used to limited market blowback . While this strategy is clearly high risk it will clear the way for a stronger EU and lessen expected nation dissension(eroding confidence in EU). In addition, using recent examples of Lehman’s and Detroit there are blueprints on how to manage a strategically critical insolvency. This scenario would lead to EUR weakness but nothing extreme such as the SNB abandoning the EUR/CHF “floor”. We continue to seek opportunity to reload on EUR/USD short positions

EUR/USD is weakening

| Today's Key Issues | Country / GMT |

|---|---|

| Feb Consumer Confidence, last 98.6 | SEK / 08:00 |

| Feb Economic Tendency Survey, last 105.6 | SEK / 08:00 |

| Feb Manufacturing Confidence s.a., last 107.3 | SEK / 08:00 |

| Feb P Markit France Manufacturing PMI, last 49.2 | EUR / 08:00 |

| Feb P Markit France Services PMI, last 49.4 | EUR / 08:00 |

| Feb P Markit France Composite PMI, last 49.3 | EUR / 08:00 |

| Jan Retail Sales MoM, last -0.50% | DKK / 08:00 |

| Jan Retail Sales YoY, last 2.30% | DKK / 08:00 |

| Feb P Markit/BME Germany Manufacturing PMI, exp 51.3, last 50.9 | EUR / 08:30 |

| Feb P Markit Germany Services PMI, exp 54.5, last 54 | EUR / 08:30 |

| Feb P Markit/BME Germany Composite PMI, last 53.5 | EUR / 08:30 |

| Feb P Markit Eurozone Manufacturing PMI, exp 51.3, last 51 | EUR / 09:00 |

| Feb P Markit Eurozone Services PMI, exp 53, last 52.7 | EUR / 09:00 |

| Feb P Markit Eurozone Composite PMI, last 52.6 | EUR / 09:00 |

| Dec Industrial Orders MoM, last -1.10% | EUR / 09:00 |

| Dec Industrial Orders NSA YoY, last -4.10% | EUR / 09:00 |

| Dec Industrial Sales MoM, last -0.60% | EUR / 09:00 |

| Dec Industrial Sales WDA YoY, last -1.60% | EUR / 09:00 |

| Jan Public Finances (PSNCR), last 21.4B | GBP / 09:30 |

| Jan Central Government NCR, last 23.7B | GBP / 09:30 |

| Jan Public Sector Net Borrowing, last 12.5B | GBP / 09:30 |

| Jan PSNB ex Banking Groups, last 13.1B | GBP / 09:30 |

| Jan Retail Sales Ex Auto MoM, last 0.20% | GBP / 09:30 |

| Jan Retail Sales Ex Auto YoY, last 4.20% | GBP / 09:30 |

| Jan Retail Sales Incl. Auto MoM, exp 0.10%, last 0.40% | GBP / 09:30 |

| Jan Retail Sales Incl. Auto YoY, exp 6.30%, last 4.30% | GBP / 09:30 |

| Jan CPI FOI Index Ex Tobacco, last 107 | EUR / 10:00 |

| Bloomberg Feb. Sweden Economic Survey | SEK / 10:00 |

| Jan F CPI EU Harmonized YoY, last -0.40% | EUR / 10:00 |

| Bloomberg Feb. Norway Economic Survey | NOK / 10:05 |

| Bloomberg Feb. Denmark Economic Survey | DKK / 10:10 |

| Revisions: Consumer Price Index | USD / 13:30 |

| Dec Retail Sales MoM, last 0.40% | CAD / 13:30 |

| Dec Retail Sales Ex Auto MoM, last 0.70% | CAD / 13:30 |

| Feb P Markit US Manufacturing PMI, exp 54, last 53.9 | USD / 14:45 |

The Risk Today

Peter Rosenstreich

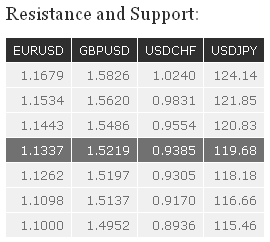

EUR/USDis moving below its short-term horizontal range defined by the hourly support at 1.1320 and the hourly resistance at 1.1443, invalidating our short-term bullish bias. Another support stands at 1.1262, while a key support lies at 1.1098. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. Key resistances stand at 1.1679 (21/01/2015 high) and 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD has thus far failed to break the resistance at 1.5486. A key resistance stands at 1.5620. Hourly supports can be found at 1.5317 and 1.5197. In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potentials are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). A strong support stands at 1.4814.

USD/JPY has retraced roughly 50% of its recent decline. The potential bearish head and shoulders favours a bearish bias. An hourly resistance lies at 119.60 (61.8% retracement), while a key resistance stands at 120.83. Hourly supports are given by 118.18 (16/02/2015 low) and by the rising trendline (around 117.73). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favoured. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF is approaching the resistance at 0.9554 (16/12/2014 low). Hourly supports stand at 0.9454 (intraday low) and 0.9385 (19/02/2015 low). Another resistance can be found at 0.9831 (25/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low). A key support can be found at 0.9170 (30/01/2015 low).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.