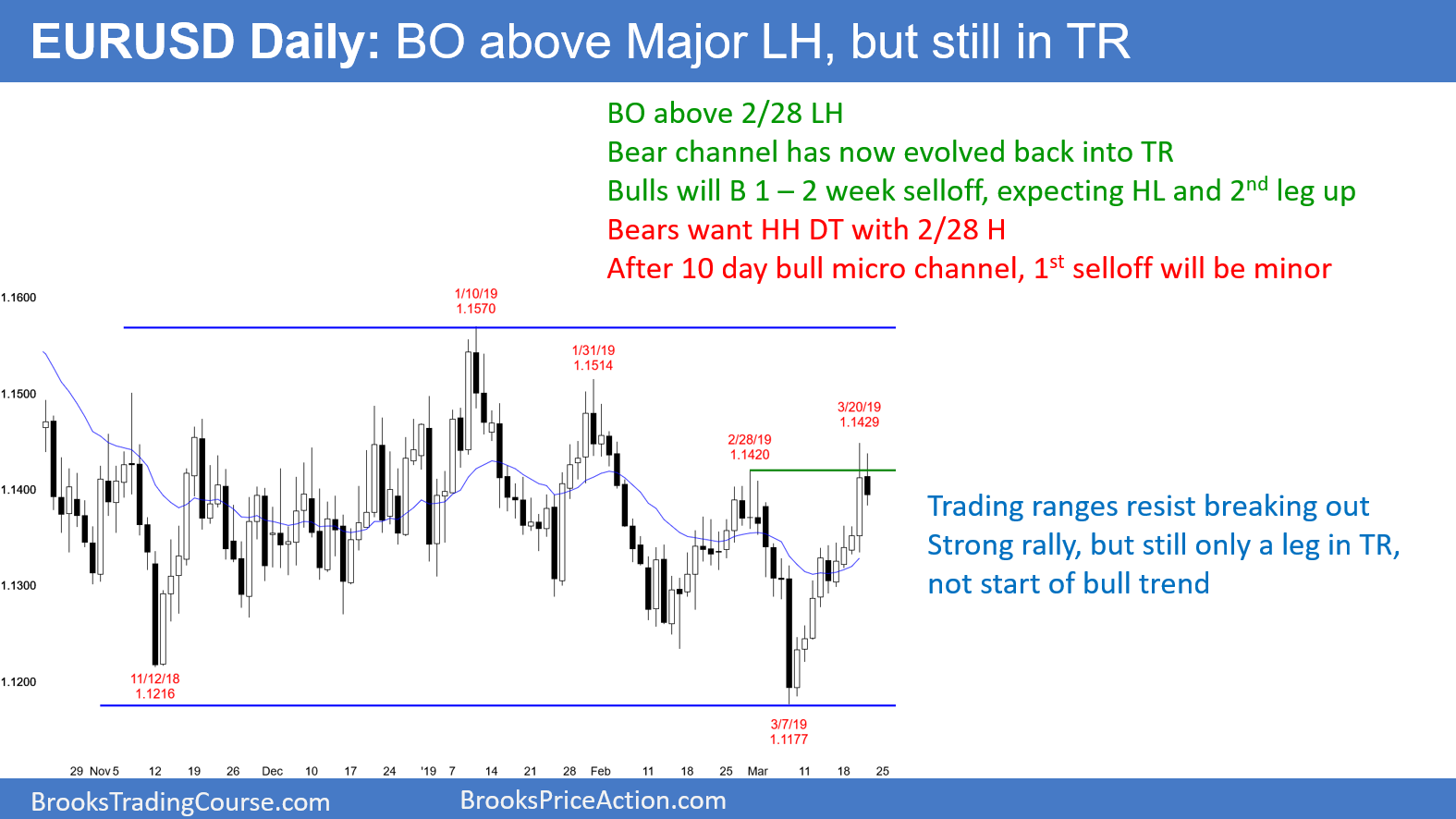

The EUR/USD daily Forex chart had a big bull trend day yesterday. By breaking above the February 28 major lower high, it ended the bear trend that began on January 10. The chart is once again neutral.

Yesterday was a big day and it was late in a rally. It was therefore a buy climax. Bulls will start to take profits and bears will begin to short.

However, the rally has not had a pullback in 10 days. A 10-day bull micro channel is a sign of strong bulls. Typically, the 1st reversal down will be minor. The bears usually will need at least a micro double top before they can start a 2 – 3 week leg down.

The 1st targets of a selloff are yesterday’s buy climax low, the 20-day EMA, and a 50% pullback. All are usually close to one another.

Since the bears typically need a micro double top after a strong rally, the bulls will buy the 1st 1 – 3 day pullback. That will limit the downside for a few days.

Because yesterday was a buy climax in a 4-month trading range and every leg for 4 months has lasted 2 – 3 weeks, the upside is probably limited as well for a few days. The result will probably be a few sideways days.

Overnight EUR/USD Forex Trading

After breaking above the February 28 major lower high yesterday, the EUR/USD 5-minute chart has sold off 50 pips. This was likely because the daily chart is still in a trading range, and a buy climax typically attracts profit takers. It usually transitions into a trading range. Consequently, the next few days will probably be sideways.

The range is currently big enough for day traders to scalp for 20 pips. However, that will probably shrink to 10 pips as the day goes on. The odds favor a 100 pip tall trading range for several days.

Can the rally continue up to the top of the range? Probably not without at least a 1 week pullback. They bulls will likely need a test of the March low. That would create a higher low major trend reversal.

Can a reversal from here continue down for 2 weeks? After 10 days without a pullback, the bulls will be eager to buy below the low of the prior day. The 1st reversal down will probably only last a few days.