Fundamental: EUR gave back a portion of Wednesday’s gain, fell 0.8 percent versus the dollar to a low of 1.0924 after the comments from ECB’s members doubted about how much Fed and ECB policy will diverge. Traders widely expect the Fed to tighten monetary policy while the ECB eased, the drop of ECB’s bank deposit rate was smaller than expected. However, the dollar was supported since traders are convinced the Fed will raise rates at the next meeting

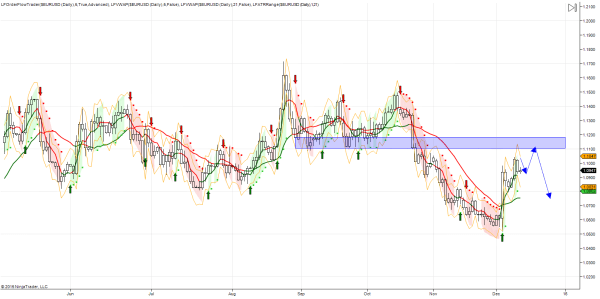

Technical: While 1.0850 caps intraday downside corrections expect a grind higher to test 1.1050/1.11

Trade Idea

- I am looking for the Euro to form a wedge pattern as we approach 1.11, I am anticipating an interim pull back from current levels to set up another leg higher that will lack momentum and ulitmatley run into decent offers on the initial move above the figure. Watching for intraday reversal patterns I will venture short as per the chart below, targeting a minimum correction back towards 1.07 and a potential broader trend continuation pattern to retest and break current cycle lows.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI