EUR/USD is sliding down due to a slower GDP growth, trade wars and uncertainty around Brexit.

The euro to US dollar rate failed to stay above figure 14 base and the euro to the British pound has dropped on the fifth day after Theresa May’s government defeated Labour’s non-confidence motion in the UK Parliament with 325 votes to 306. The Prime Minister comes up with plan B, which retains uncertainty in the UK-EU trade relationships and continues pressing down European exports. That is the biggest flaw of the euro-area economy.

Since the exports contribution in European GDP growth is quite big, the euro-area economy has suffered a lot from the US-China trade war. Chinese economic expansion is slowing down, foreign demand for European goods and services is declining. At the same time, Forex discusses the rumours that Donald Trump is willing to boost the import tariffs on European vehicles up to 25% in order to increase the access to the euro-area agricultural market for the US companies. Tariffs is one of the means of pressure on Brussels, even if Volkswagen (DE:VOWG_p) and other car manufacturers claim that they will raise the price of US vehicles by a total of $83 billion annually and cost hundreds of thousands of jobs.

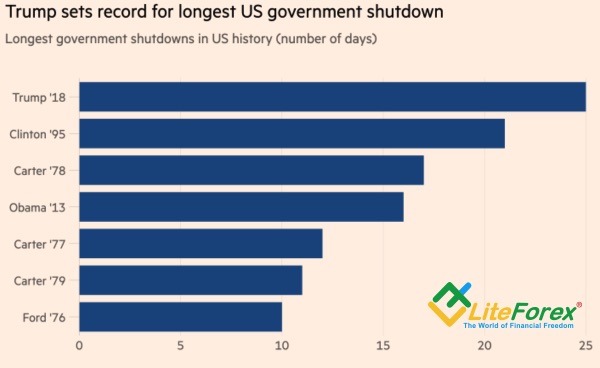

The euro-area is challenged by a slower GDP growth, a potential trade war with the U.S. and the uncertainty around Brexit. Is the EUR/USD drop surprising then? Yes, the greenback is pressed by the longest government shutdown in the US history; yes, the FOMC policy course has considerably changed during the past 6 months, and the chances that the Fed will continue monetary restriction in 2019 are down to 13.5%. However, the stabilized stock indices lure investors back to the US securities. Based on a decline in volatility, the Fed willingness to pause its monetary normalization outweighs the concerns about a slowdown in global economic growth.

Term of US government shutdown

Source: Financial Times

Volatility in financial markets

Source: Bloomberg

It is remarkable that central banks seem to depend on the financial markets’ indicators too much. The former FOMC hawk, Kansas City Fed president Esther George is surprised by the S&P 500 crash in December and would like to find out the reasons. The Governor of the Bank of England Mark Carney stresses the pound stability after the Brexit vote in the Parliament, therefore investors expect favorable conflict resolution. Even if nobody now suggests that Donald Trump has persuaded the Fed to end monetary restriction, the fact is that the US president’s attention to the financial markets was passed on central banks.

The EUR/USD rate is back in the trading range of 1.1265-1.1485 and seems to be rather stable there. I don’t think that middle-term trades make any sense in the situation when both opponents are weak and fresh drivers are missing. There is more point in intraday trading.