- EUR/USD meets familiar support and returns above 1.1300

- Technical Signals don’t yet confirm a meaningful rally

- Sellers may stay on the sidelines until price falls below 1.1200

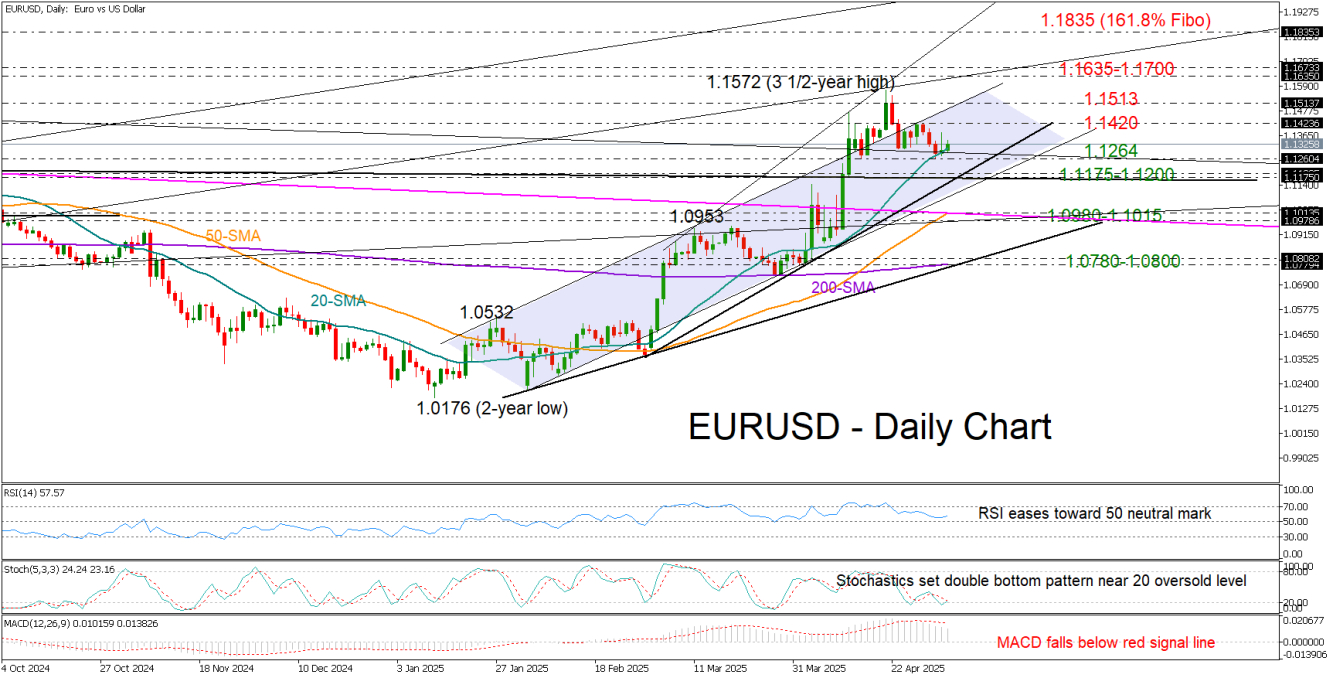

EUR/USD halted last week’s downside pressure near the 1.1265 support zone, which previously paved the way to the three-and-a-half-year high of 1.1572 reached on April 21.

The long-term descending trendline from the May 2014 peak, along with the 20-day simple moving average (SMA), are currently keeping the price above 1.1300. However, aside from the stochastic oscillator – currently forming a double bottom pattern near its oversold threshold of 20 – other declining technical indicators cast doubt on the potential for a sustained rebound.

Nevertheless, only a bearish extension below the 1.1175–1.1200 area and a break below the bullish channel would significantly weaken the short-term outlook. If that scenario materializes, the pair could correct sharply toward the 1.0980–1.1015 support zone and the 50-day SMA. A break below this area could lead to a deeper decline toward 1.0780-1.0800, where the 200-day SMA and a tentative support trendline from January intersect.

Should the bulls regain momentum near the 20-day SMA, the price could initially pause around the 1.1420 resistance level before challenging April’s resistance zone at 1.1513–1.1572. A decisive close above this region could establish a new higher high between 1.1635 and 1.1700. Further up, the bulls could head for the 161.8% Fibonacci extension of the September-January downtrend seen near 1.1835.

In brief, EUR/USD is trading near a key support zone, but technical indicators suggest that a clear confirmation is needed before buyers step in.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.