EUR/USD: Fed will remove accommodation patiently and gradually

Macroeconomic overview: Fed Governor Jerome Powell said the impact of the new Trump administration's effect on the economy remains too uncertain for the U.S. Federal Reserve to react or begin recasting its outlook.

Asked about the collapse of the healthcare bill last week, Powell said that uncertainty about "the scope, the timing and the contents" of President Donald Trump's policies were making it difficult for Fed policymakers to assess what they might mean. Powell added,

It is appropriate we stay on this path to gradually raise interest rates. March was a good time... There will be scope for more.

Kansas City Federal Reserve President Esther George said she needs to see more details on the Trump administration's fiscal proposals before factoring them into her economic forecasts. U.S. Federal Reserve Vice Chair Stanley Fischer that two more rate hikes this year seemed about right.

Dallas Federal Reserve Bank President Robert Kaplan said the Fed should be careful not to jolt the economy with aggressive rates hikes. He added,

I think it would be healthy to remove accommodation... patiently and gradually.

The Conference Board said U.S. consumer confidence index hit 125.6 in March, surpassing expectations for a reading of 114, and much higher than 116.1 in February. The March level marked the highest since December 2000. The data pushed up U.S. Treasury yields and supported the USD.

European Central Bank Governing Council member Jan Smets said that hawkish views are reflecting a "minority position". This is an important comment given the comments from other ECB members of late especially those from Mersch and Nowotny. In February ECB Executive Board member Mersch indicated a desire for the ECB to adjust its forward guidance on rates in its communication. Then, earlier this month, ECB's Nowotny said that the ECB will only decide later whether to raise rates before or after QE stops.

These comments from Mersch and Nowotny cast doubt and helped fuel an expectation that the ECB could announce a change in forward guidance. The ECB's current forward guidance is that rates will remain "at present or lower levels" for an "extended period of time" and "well past the horizon" of net asset purchases. Our own expectation is for the ECB to drop the reference to "or lower" in its forward guidance in June and to announce a tapering of QE at the October ECB meeting.

Smets' comment does little to help clear the uncertainty over the speed at which the ECB wants to move toward the exit. Core inflation has yet to rebound strongly and is likely to play an important role. Progress is still needed on Draghi's criteria that an improvement in inflation should be over the medium term, any rise should be durable, self-sustainable, and for the whole of Eurozone. It is likely that Draghi will provide greater clarity at the next meeting on April 27 and detail the position of the ECB majority.

It is likely that Draghi will leave sufficient wiggle room for a change in forward guidance, while sticking to the current script that current policy will remain in place until the end of the year, as well as reiterate current forward guidance. However, following the March meeting there was a dilution of the forward guidance language from Draghi who said that the "present or lower level" is an expectation, and that the probability of this expectation has gone down.

It is likely that at the June meeting the probability of an expectation that rates will remain at "present or lower levels" will have adjusted sufficiently to promote an adjustment in communication. This should help please the hawks and not displease the doves as the latter will still find comfort in that current policy will remain in play until end-2017. The debate over an ECB exit is likely to help support EUR/USD.

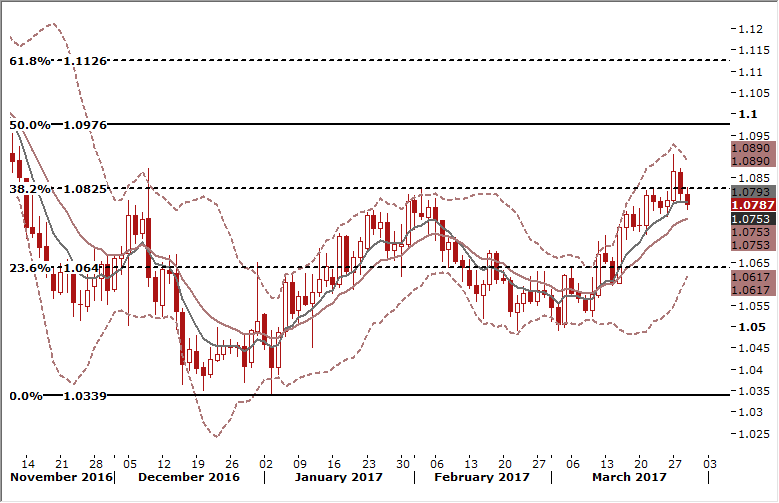

Technical analysis: In line with our expectations, we see some corrective moves on the EUR/USD. We think that the rate is likely to fall near 14-day exponential moving average, currently at 1.0753. Long-term charts remains bullish.

Short-term signal: We think that the reaction to stronger U.S. consumer confidence data could be a good opportunity to buy EUR/USD, as medium-term outlook has not changed. We have opened EUR/USD long at 1.0780 for 1.0960.

Long-term outlook: We stay long for 1.1125.

USD/CAD: Loonie supported by oil prices rise

Macroeconomic overview: The CAD hung in with a broadly stronger USD, helped by rising prices for oil, a major Canadian export, as the Bank of Canada stuck to its cautious tone.

Oil prices on Wednesday extended gains from the previous session, lifted by supply disruptions in Libya and expectations that an OPEC-led output reduction will be extended into the second half of the year.

Oil production from the western Libyan fields of Sharara and Wafa has been blocked by armed protesters, reducing output by 252k barrels per day.

Iranian Oil Minister Bijan Zanganeh said that a global oil cuts deal is likely to be extended, but that time is needed to discuss the subject thoroughly first. Asked whether Iran would be ready to cut its own output under the possible extension, Zanganeh said: "I think it is necessary that all members comply with their commitments." The OPEC, along with some other producers including Russia, have agreed to cut production by almost 1.8 million bpd during the first half of the year in order to rein in a global fuel supply overhang and prop up prices.

Bank of Canada Governor Stephen Poloz said Canada's economy has a lot more room to grow, with higher unemployment and more excess capacity than the United States, and if interest rates were raised today Canada would tip into recession. Poloz defended the bank's dovish outlook - which contrasts with the U.S. Federal Reserve's hike earlier this month and plan for more - in the face of recent stronger-than-expected growth in jobs, GDP and retail sales. Canada is due to report GDP data for January on Friday.

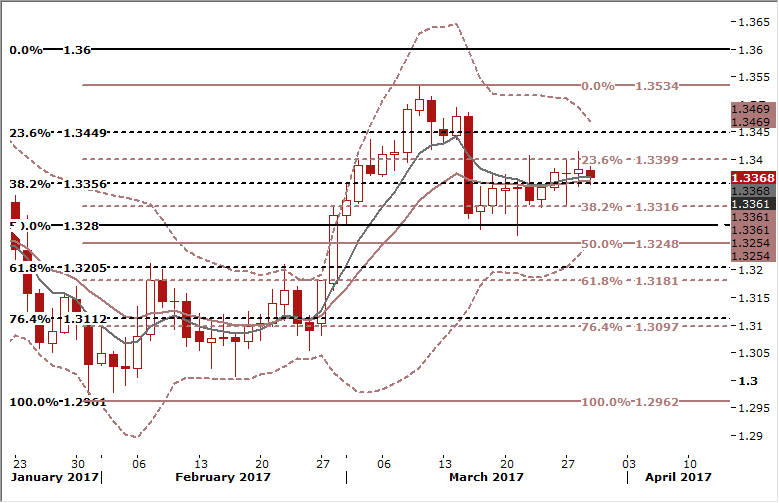

Technical analysis: The USD/CAD has not managed to close above the 23.6% fibo of January-March rise. The technical analysis does not provide a clear signal, but a recovery in oil prices suggest that downward move is more likely now.

Short-term signal: We have opened a short position at 1.3370. Our target is at 1.3260

Long-term outlook: Long-term target of our short position is 1.3100.

GBP/USD: We closed all GBP positions in the run up to Brexit

Macroeconomic overview: The GBP/USD is under pressure as investors braced for British Prime Minister Theresa May's move later on Wednesday to formally file paperwork to leave the European Union.

Investors were also assessing news that Scotland's parliament had backed a vote for independence even though the British government said it would not enter independence negotiations with Scotland.

Further weighing on the pound, Bank of England interest rate-setter Ian McCafferty highlighted a weak outlook for the economy on Tuesday, and said he did not know if he would vote to increase borrowing costs at the next BoE meeting in May.

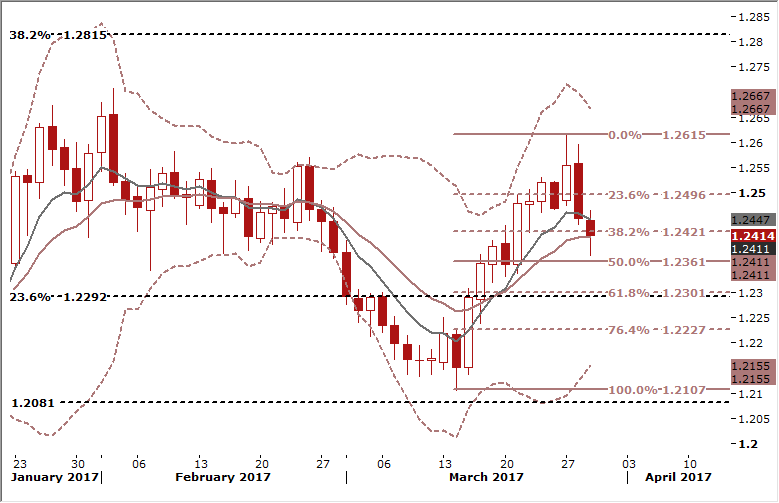

Technical analysis: The GBP/USD continues to pullback in the daily cloud, the base is at 1.2356. 50% fibo support of the March rise at 1.2361 is just ahead. Technical analysis suggests further GBP/USD fall, but these suggestions will be overshadowed by Brexit news.

Short-term signal: We have closed all our GBP positions today due to high uncertainty in the run up to Brexit . The GBP/USD long hit the stop-loss at 1.2400. We closed EUR/GBP long at 0.8690 with a smaller profit than initially planned.

Long-term outlook: We stay sideways on all GBP pairs.

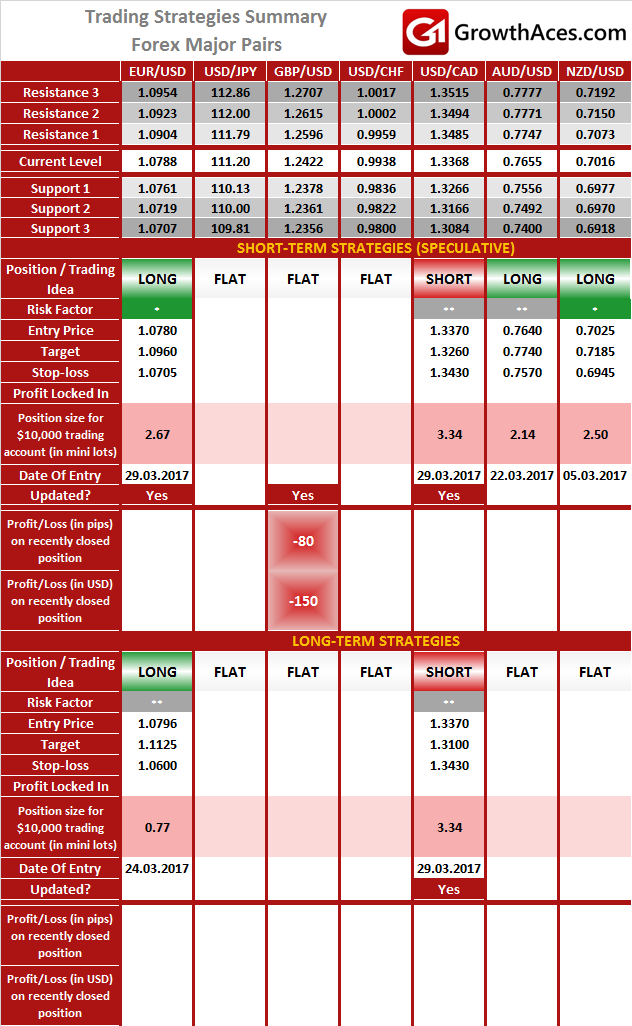

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

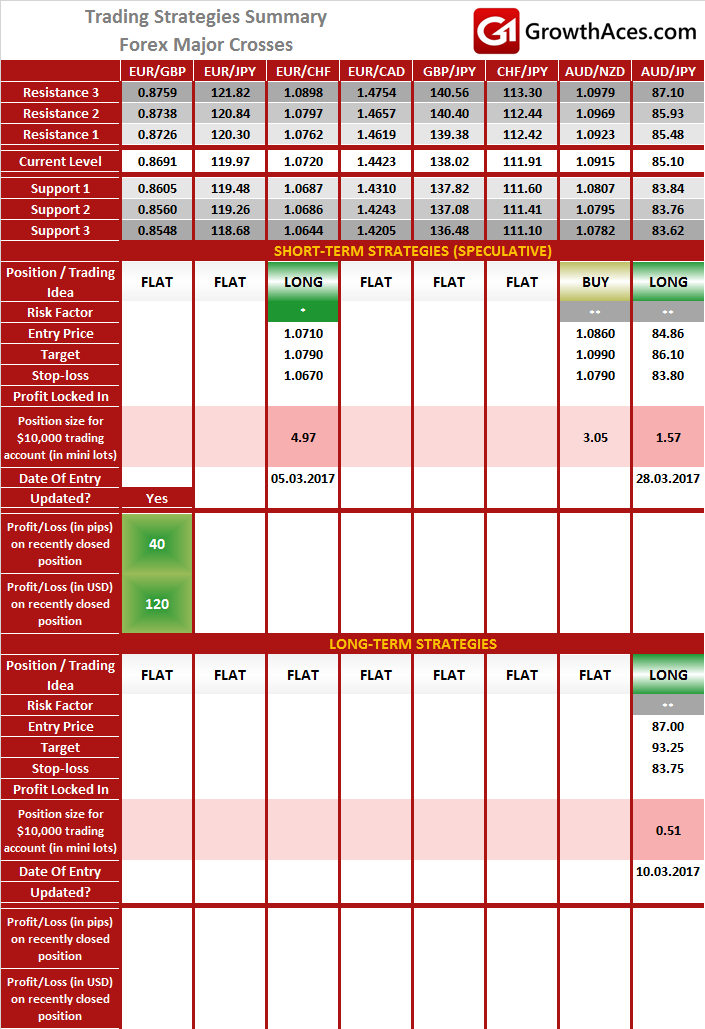

FOREX - MAJOR CROSSES:

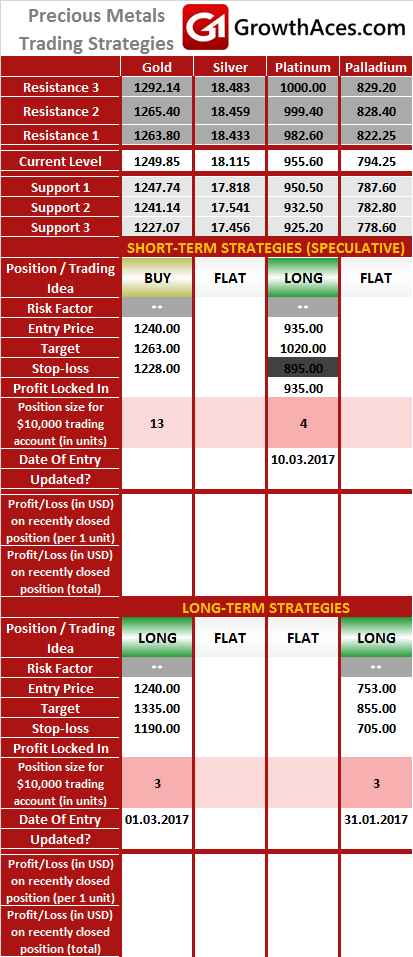

PRECIOUS METALS:

Source: GrowthAces.com - your daily forex trading strategies newsletter