Bitcoin price today: inks new record high near $119k as ETF inflows surge

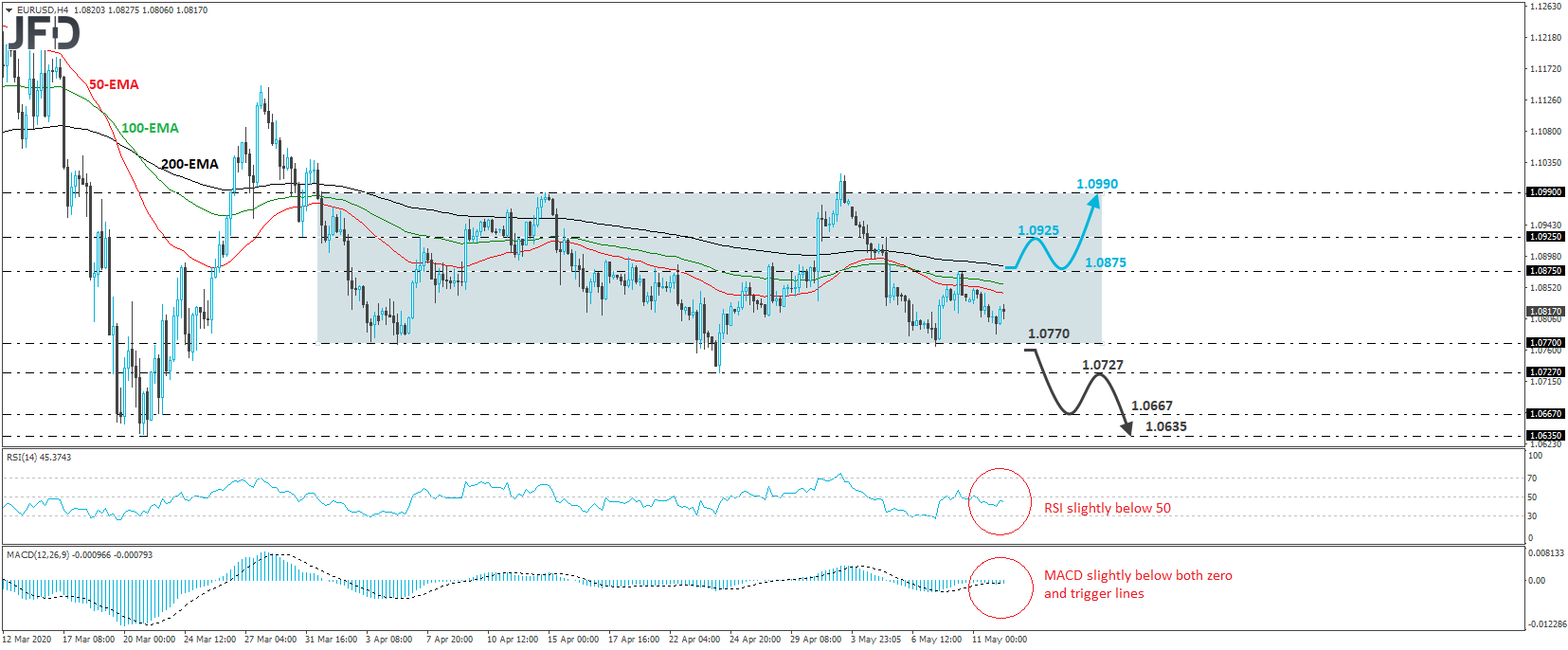

EUR/USD traded higher on Tuesday, after hitting support slightly above the 1.0770 barrier, which has been acting as the lower boundary of the range that’s been containing most of the price action since April 1st. The upper end stands at around 1.0990. As long as the rate continues to trade between those two boundaries, we will hold a flat stance.

That said, bearing in mind today’s rebound, we would see more chances for the pair to continue drifting higher within the range, rather than breaking the lower end trading south. However, in order to get more confident on that front, we would like to see a move above Friday’s high, at 1.0875. Such a move may initially pave the way towards last Tuesday’s peak, at around 1.0925, the break of which may allow extensions towards the upper end of the range, at 1.0990.

Looking at our short-term oscillators, we see that the RSI rebounded recently, but before hitting its 50 line, it ticked down again, while the MACD lies fractionally below both its zero and trigger lines. Neither indicator is pointing to clear directional momentum, which adds further credence to our view of waiting for a break above 1.0875 before getting confident on more recovery.

On the downside, we would like to see a dip below the range’s lower end, at 1.0770, before we start examining whether the bears have gained the upper hand. This may initially trigger declines towards the low of April 24th, at 1.0727. Another break, below 1.0727, may set the stage for the 1.0667 level, or the 1.0635 hurdle, defined as support by the low of March 22nd.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.