- Trade war, US Unemployment, Wages and FOMC minutes.

Fundamentally:

Trade war began. Dollar passed the week under the bearish pressure caused by the trade war worries. USD hit by soft unemployment data and wages growth figures under the expectations on the last day of the week.

On the euro side, less hawkish but far from dovish minutes were the catalyst for the bullish move. Reports indicating that “ECB’s policymakers believe that rising rates by the end of 2019 would be too late” was another catalyst.

This week we will have the inflation figures both from eurozone and U.S. But I believe that the trade war will be the most determining factor of this week.

Technically:

EUR/USD tested 1.17700 EMA 50 in the daily chart and ended the week at 1.17420. This is the Fibonacci 23.6 % retracement of the latest decline started in April. We can easily say that the medium term trend is bearish and the pair will be under selling pressure as long as it holds below 1.18500.

In the H4 chart time frame, the price is above EMA 50,100 and 200. And we see a bullish crossover of EMA 50 and EMA 100 with bullish RSI value.

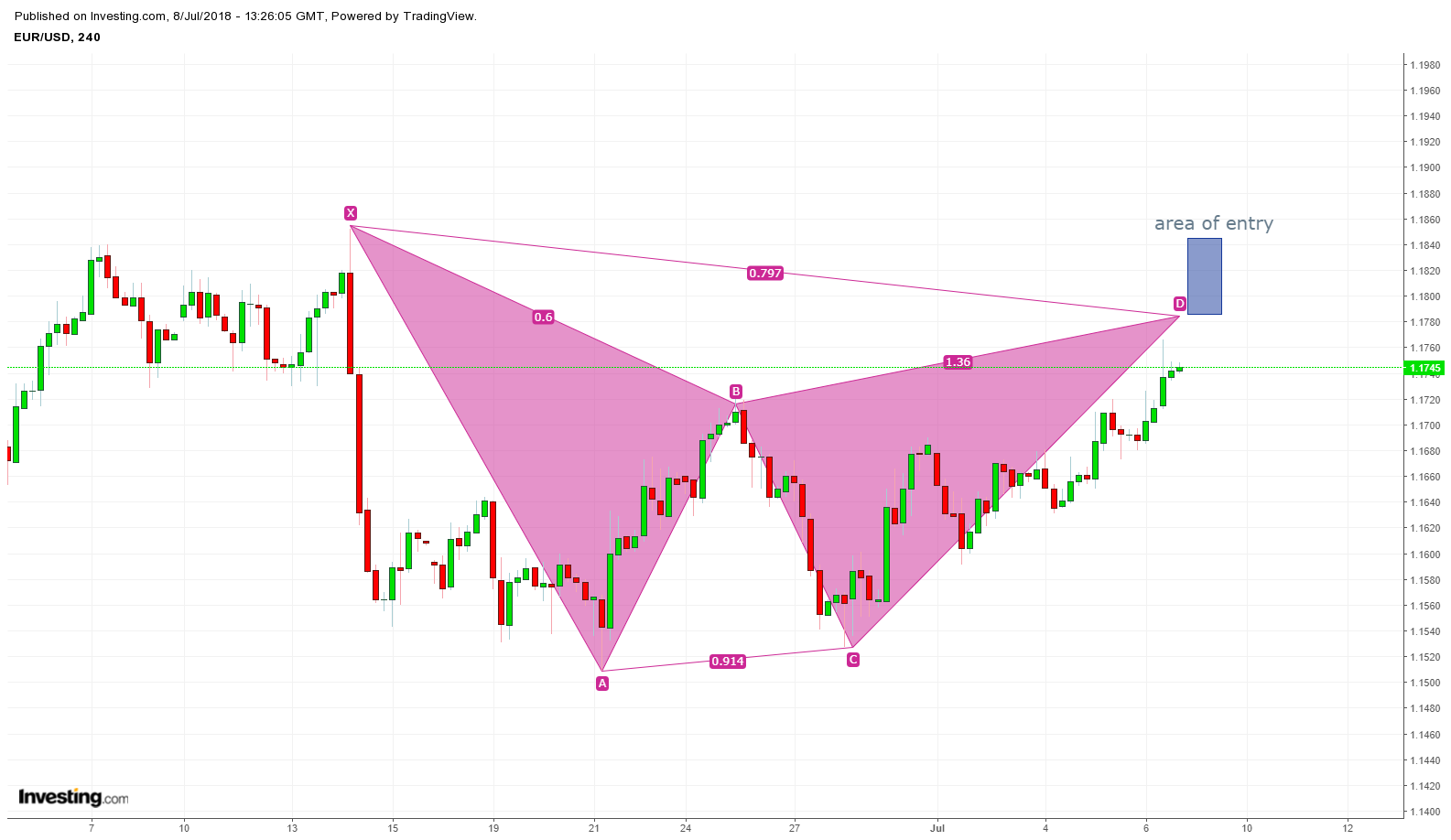

We see a Bearish Gartley Harmonic Pattern as seen in the below chart. As the price dropped below Fib 78.6 % of AB but did not close below, we can say this is a valid Gartley . The area of entry is between 1.17780 – Fib 1.27 of BC 0.96% – and 1.18400 Fib 1.618 of BC 0.96% . Although 1.17780 is confirmed by the MM +2/8 extremely overshoot, considering the C dropped below the perfect ratios, I predict the major retracement will take place near 1.18400.

Conclusion: Upward price movements are selling opportunities until the price breaks and make daily closings above 1.18500.

Key Levels:

Upside: 1.17800 1.18200 1.8500

Dowside: 1.17180 1.16880 1.16500