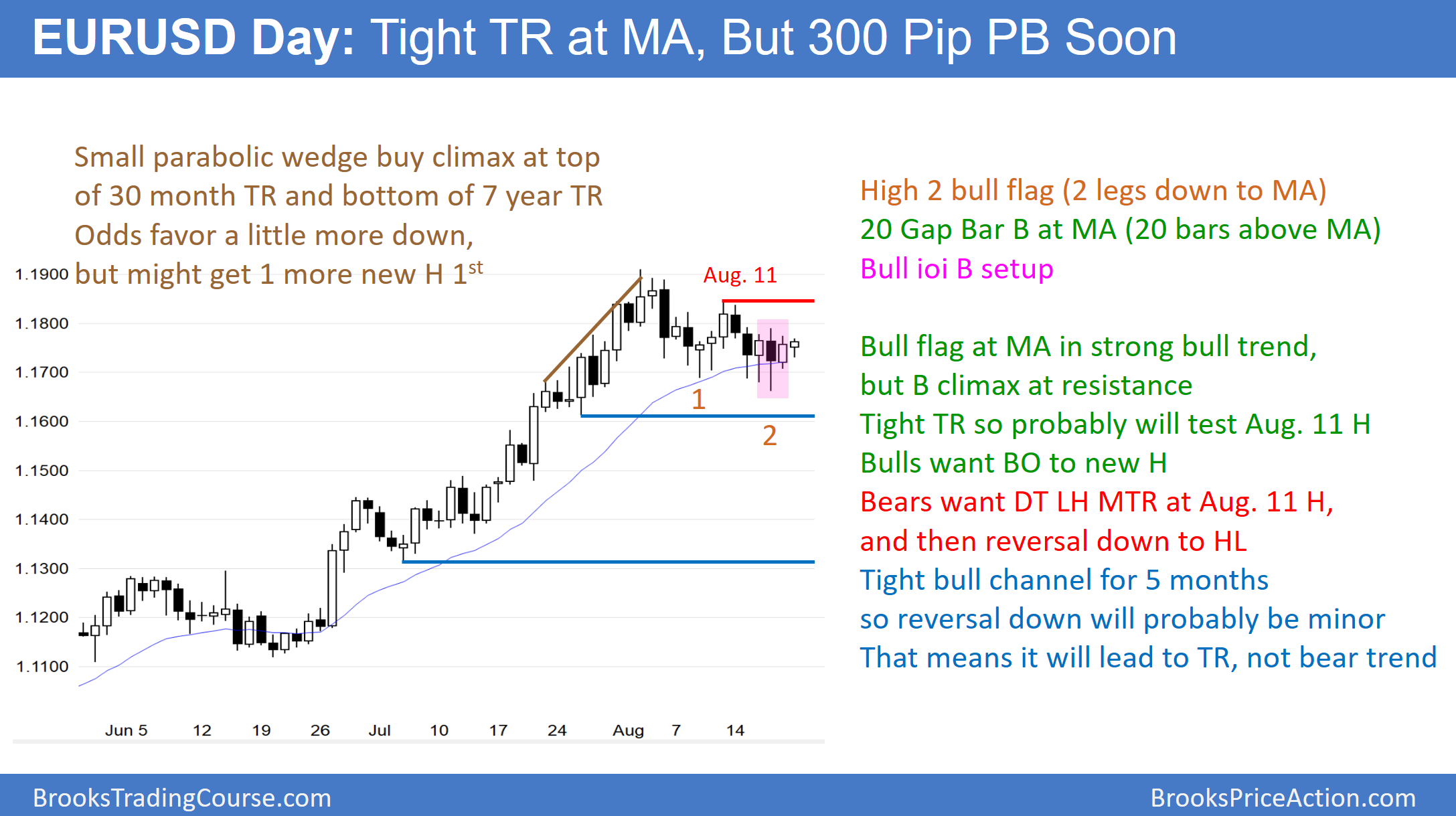

After a small buy climax, the daily EURUSD Forex market pulled back to the moving average. The bulls have a bull flag and Friday is a good buy signal bar. The odds favor at least a 70 pip rally to the August 11 lower high.

While there was a parabolic wedge buy climax at resistance 3 weeks ago, the break above the tight bull channel was small. This is not very extreme behavior. Furthermore, once the bulls see that the bears cannot get a reversal within 10 bars, the bulls buy again. In addition, the bulls have a good buy signal bar on Friday, and the bull flag is holding above the moving average.

Consequently, the odds favor a resumption of the bull trend. Since the chart is in a tight range, the initial target is the top of the range. Therefore, the EURUSD will probably rally 70 pips to the August 11 lower high this week. Once there, the bears will try to create a double top. If they get a good sell signal bar, they would have at least a 40% chance of a reversal down to the July 26 low. Hence, that would be a 300 pip pullback.

Bull trend resumption?

Alternative, if the bulls can get 20 or more pips above the August 11 high, the rally will probably continue up to the August 11 top of the bull trend. However, a trading range late in a bull trend is usually the final bull flag. Furthermore, the chart is at resistance on the monthly chart. Therefore the odds favor a bigger pullback if the bulls get their new high. The 1st target is the July 26 low. The next target is the bottom of the tight channel at the July 5 low.

Overnight EURUSD Forex trading

The bull’s broke above Friday’s high in the past few minutes. This triggered the buy signal on the daily chart. When a buy signal triggers on a higher time frame chart, there is often a pullback. Consequently, this initial breakout might fail. Yet, unless the day becomes a strong reversal day, the odds favor at least a 70 pip rally to the August 11 high this week. As a result, bulls are swing trading, betting on that test.

While that 3 hour rally is only 45 pips, the odds still favor the bulls today. Therefore day traders looking to short will only scalp unless there is a strong reversal down.