Trump says he will sue Wall Street Journal, NewsCorp, over Epstein letter report

European equity markets are poised to open a little higher on Monday as traders turn their focus to the flash manufacturing and services PMI releases this morning ahead of some more key Fed speeches this afternoon.

It’s going to be interesting to see just how involved traders are this week given that next week we have monetary policy decisions from the Fed, the BoJ and the BoE. To cap it off we’ll get the latest US jobs report on Friday and I’m wondering whether this could affect risk appetite over the course of this week.

Fortunately, we’re not short of major economic events this week either and corporate earnings season will continue to tick along as well which will hopefully ensure there’s few dull moments. We get underway with some flash PMI data from the eurozone, France and Germany which will be released throughout the morning.

Once again the numbers are expected to be uninspiring while offering some small positives, with both French numbers seen moving back into growth territory which is a rarity. The euro area manufacturing PMI is expected to remain steady 52.6 while the services PMI is expected to rebound slightly to 52.5 but remain in a trend of slowing growth, probably driven largely by similar declines in the German data.

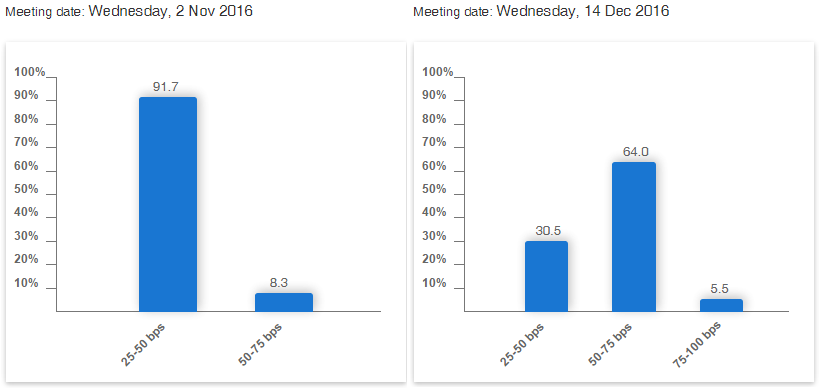

The Fed speeches this afternoon will also be of great interest, coming a little over a week before the November meeting. Markets continue to price in a high probability of a rate hike in December, still around 70%, while November has been all but written off due to the Presidential election a week later and the absence of a press conference after.

James Bullard’s comments will be of particular interest today, being an FOMC voter who did not dissent at the last meeting, while Charles Evans – who will be a voting member next year – will speak shortly after. We could also hear from William Dudley and Jerome Powell at some point during today’s session.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.