Focus over the weekend has remained on Ukraine and the ability of a new government of national unity to heal the wounds of the past months. Obvious emerging market risk remains from this situation with the Russian ruble the main currency to watch; Russia is probably Ukraine’s largest creditor and any fears of a default will hit the ruble hard. Money is quick to leave Russia – and has been for a while – and fears over a confrontation will only increase this propensity.

There’s the possibility that Russia withdraws its financial support for Ukraine amid the ousting of Yanukovich or pressures gas pipelines into reducing supply into Western Europe as a retaliatory move. It would not be the first time. From a western consumer’s point of view it will come as a small relief that this is happening in February and not October.

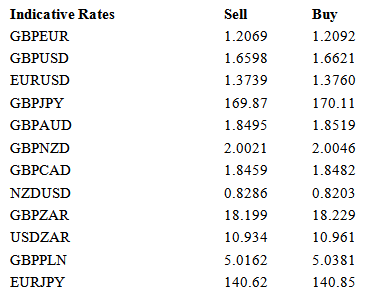

Emerging market currencies all performed well on Friday as a result of movements in Ukraine. Turkish lira, Mexican peso and the South Africa rand all regained poise from recent lows and the hopes will be that the near-term pressures on emerging markets will soften.

Friday’s UK retail sales numbers were slightly lower than expected as sales fell by 1.5% on the month. Both clothes and food sales were over 3% lower as it seems that the average British consumer took a break from the shops in January. We’ll be eager to see if the overall trend of growth can be continued though despite this momentary hiccup, given the relative improvements in the price/wage divergence seen in the past month. Even so, a gradual recovery in spending is expected as consumers remain eager to repair debt levels and not over-extend themselves while unemployment remains above long-term average levels.

European news is once again a mix of the encouraging and infuriating. Matteo Renzi was fully sworn in as the Italian Prime Minister over the weekend and promised to bring growth back to the Italian economy and prosperity to the Italian people. I’m sure none of his predecessors thought of that. Italian bonds are unmoved as we open this Monday morning. We’re now 10 days from the next ECB meeting and inflation is very much in focus.

Last month’s drop in CPI from 0.9% to 0.7% was not enough for the ECB to consider cutting rates this month as core prices remained relatively stable. The latest Eurozone inflation numbers are due at 10am this morning and following last week’s poor PMIs, should be enough in our eyes to prompt Frankfurt into some movement. Draghi has said as such over the weekend; speaking in Sydney at the G20 the ECB Chair said that policy makers would add stimulus if the outlook for prices deteriorated further.

Chinese house price data has started markets in Asia on a poor footing. Home price gains slowed for the first time in 12 months in January, it was shown overnight, in another symbol that the Chinese banking sector may be tightening the lending reins. Throughout 2013, national home prices accelerated each month from 0.8 per cent in Jan to 9.9 per cent in December. The Chinese yuan is lower for the seventh trading day in a row following further guidance by the People’s Bank of China. We suspect that this is down to a central bank determined to restrict inflows into an already overly hot market.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.