The U.S. dollar posted strong gains on Friday as investors piled into the greenback amid global concerns. This led to most of the currencies giving up the gains logged from earlier in the week.

Economic data on the day showed that the Eurozone flash manufacturing PMI was at 51.4, which was lower than the forecasts of 51.9. Flash services PMI was also the same, rising to 51.4 and came in below than estimates of 53.4.

Data from the U.S. showed that core retail sales rose 0.2%, matching estimates. Previous month's data rose 1.0%. Headline retail sales were up 0.2% which was better than the forecasts of a 0.1% increase. Past month's data was revised higher to show a 1.1% increase.

Industrial production data showed a 0.6% increase beating forecasts of a 0.3% increase. The data follows the downward revised estimates of a 0.2% decline.

Looking ahead, the economic data on the day will see the Eurozone's final inflation data coming out for November. Inflation is forecast to remain steady at 2.0%. Data for the rest of the day covers the second tier data.

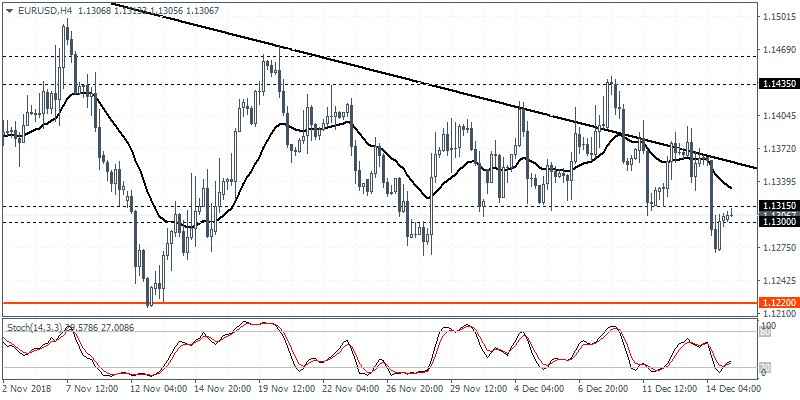

EUR/USD intraday analysis

EUR/USD (1.1306): The EUR currency was seen trending lower on Friday as the USD posted strong gains. Price action briefly broke past the support level at 1.1315 - 1.1300 only to recover those losses by Friday's close. With the support being breached, the EUR/USD is likely to push lower. The previously held lows near 1.12200 remains a key target of interest to the downside. To the upside, a close above the falling trend line will see some upside momentum building up. However, the resistance near 1.1435 remains another key challenge for the euro.

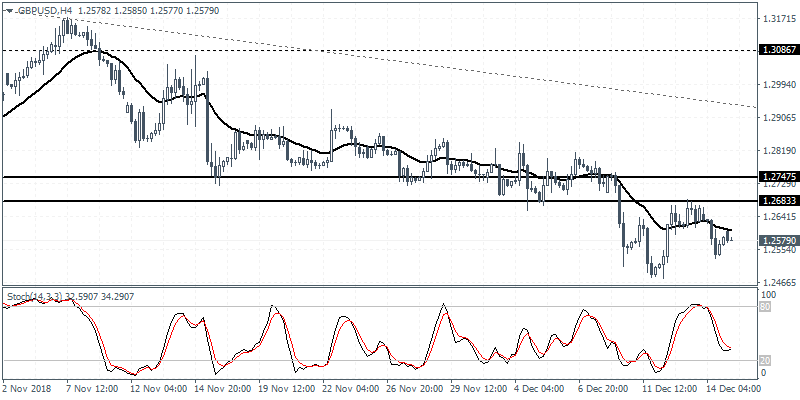

GBP/USD intraday analysis

GBP/USD (1.2579): The GBP/USD continues to trade below the recently breached support level of 1.2683. Price action posted a modest rebound which saw a brief retest of the breached support level. We expect a solid retest of this level to establish resistance. The GBP/USD is most likely to trade below this level with the potential to break past the previously established lows of 1.2485. However, the Cable could settle into a sideways range in the near term.

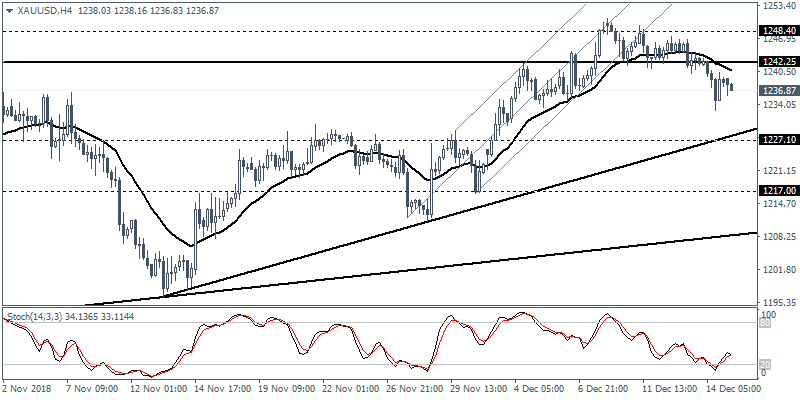

XAU/USD intraday analysis

XAUR/USD (1236.87): Gold prices slipped below the support at 1242.25 and thus invalidated the bullish flag pattern. The breakdown below the support at 1242.25 signals further declines in the near term. The lower support at 1227.10 remains a key target that could be tested for support. Forming support at this level could keep gold prices still biased to the upside. There is a risk that the precious metal could maintain a sideways range within 1242.25 and 1227.10 in the near term.