Eurodollar Futures Non-Commercial Speculator Positions:

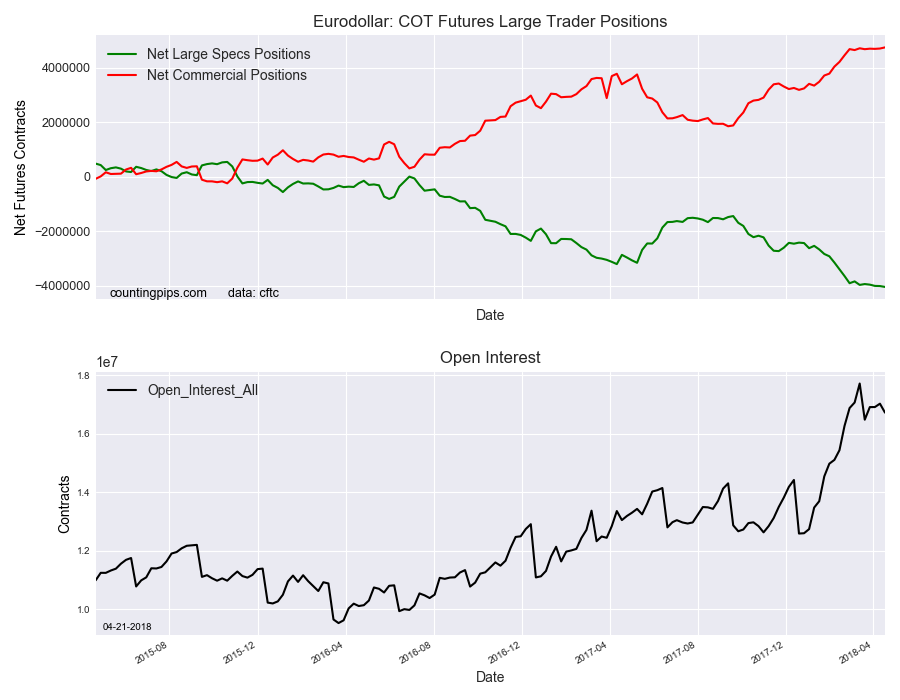

Large speculators continued to increase their bearish net positions in the Eurodollar futures (interbank dollar deposits, not euro currency) markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of Eurodollar futures, traded by large speculators and hedge funds, totaled a net position of -4,051,527 contracts in the data reported through Tuesday April 17th. This was a weekly fall of -32,874 contracts from the previous week which had a total of -4,018,653 net contracts.

Speculative bearish positions have gained for four consecutive weeks and the overall bearish level is above the -4,000,000 level for a third straight week.

Eurodollar Commercial Positions:

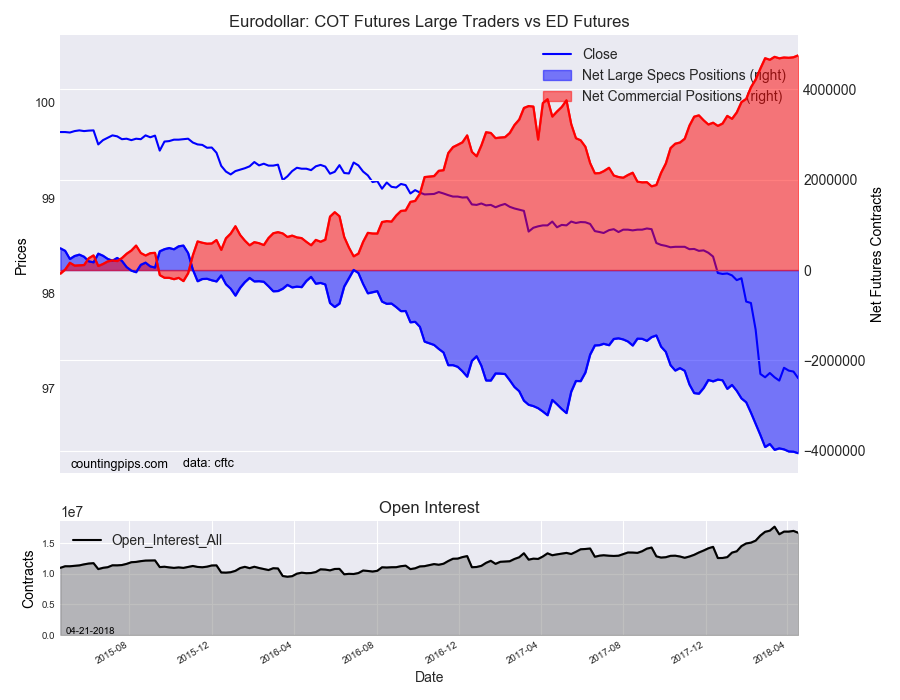

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of 4,751,690 contracts on the week. This was a weekly uptick of 42,169 contracts from the total net of 4,709,521 contracts reported the previous week.

ED Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Eurodollar Futures closed at approximately $97.11 which was a fall of $-0.07 from the previous close of $97.18, according to unofficial market data.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI