For the 24 hours to 23:00 GMT, the EUR rose 0.61% against the USD and closed at 1.2244.

The greenback nursed losses against its key counterparts, as investors were grappled with concerns of a possible US government shutdown as lawmakers struggled to forge a federal budget deal.

However, the US Dollar recouped some of its losses, after data showed that first time claims for the US unemployment benefits plunged more-than-expected to a level of 220.0K in the week ended 13 January, hitting its lowest level since February 1973, thus painting a rosier picture of the nation’s jobs market. Markets had expected initial jobless claims to fall to a level of 249.0K, after recording a reading of 261.0K in the prior week.

On the other hand, the nation’s housing starts fell more-than-anticipated by 8.2% on a monthly basis to an annual rate of 1192.0K in December, posting its biggest drop in just over a year, amid a steep decline in the construction of single-family housing units. Housing starts had registered a revised reading of 1299.0K in the previous month, while investors had envisaged for a fall to a level of 1275.0K. Further, the nation’s building permits eased less-than-expected by 0.1% MoM to an annual rate of 1302.0K in December, compared to a revised level of 1303.0K in the prior month. Markets were expecting building permits to drop to a level of 1295.0K.

Other data indicated that the US Philadelphia Fed manufacturing index declined to a 5-month low level of 22.2 in January, more than market consensus for a drop to a level of 25.0. In the previous month, the index had registered a level of 26.2.

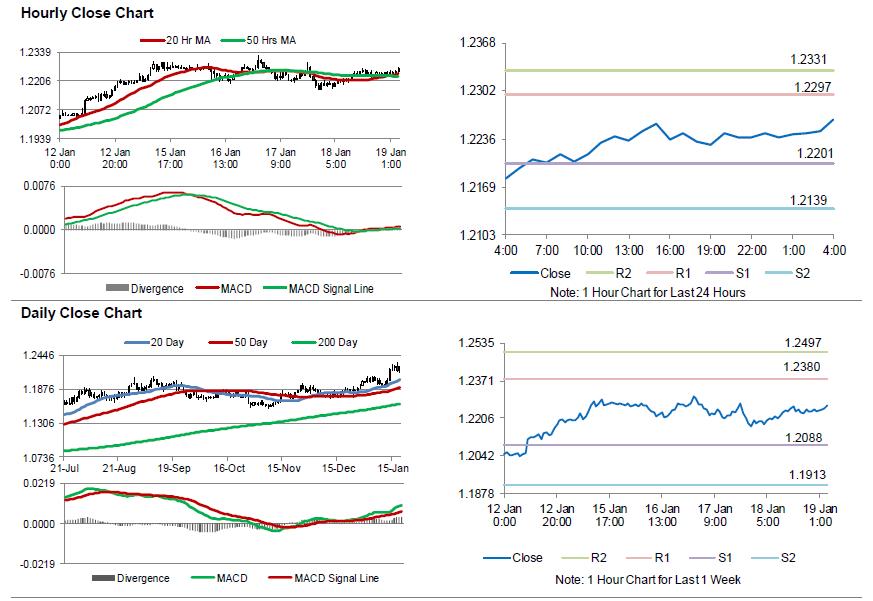

In the Asian session, at GMT0400, the pair is trading at 1.2262, with the EUR trading 0.15% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2201, and a fall through could take it to the next support level of 1.2139. The pair is expected to find its first resistance at 1.2297, and a rise through could take it to the next resistance level of 1.2331.

Going ahead, traders would look forward to the Euro-zone’s current account data for November and Germany’s producer price index for December, scheduled to release in a few hours. Moreover, the US flash Michigan consumer sentiment index for January, slated to release later in the day, will attract a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.