For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.0814.

In economic news, Italy’s seasonally adjusted industrial sales slid 3.5% on a monthly basis in January, following a revised rise of 2.5% in the previous month. Also, the nation’s seasonally adjusted industrial orders dropped 2.9% MoM in January, compared to a revised rise of 3.0% in the prior month.

The greenback traded higher against most of its major peers, on the back of robust economic data in the US.

Data revealed that the US consumer confidence index unexpectedly jumped to a level of 125.6 in March, surging to its highest level in more than sixteen years, as consumers expressed greater optimism regarding the short-term outlook for business, jobs and personal income prospects. Market participants expected the index to fall to a level of 114.0, compared to a revised reading of 116.1 recorded in the previous month. Additionally, the nation’s advance goods trade deficit narrowed more-than-anticipated to a level of $64.8 billion in February, as imports dropped sharply, compared to a revised deficit of $68.8 billion in the preceding month, while investors expected the nation’s goods trade deficit to narrow to a level of $66.4 billion. Also, the nation’s flash wholesale inventories rebounded 0.4% in February, compared to a revised drop of 0.3% in the previous month, whereas markets were anticipating for an advance of 0.2%.

Meanwhile, the Federal Reserve (Fed) Vice Chairman, Stanley Fischer, reinforced the case for two more rate hikes this year, stating that he expects the Fed to raise interest rates two more times this year.

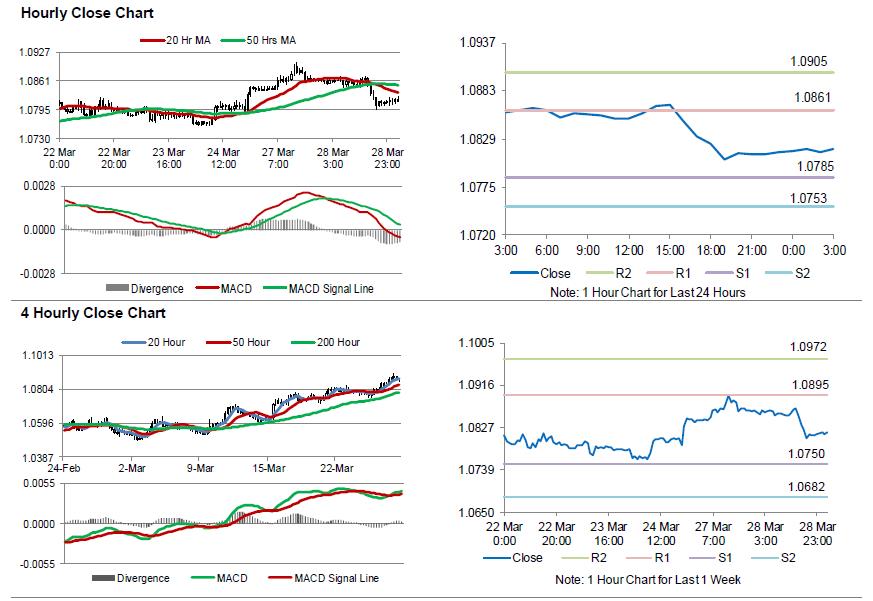

In the Asian session, at GMT0300, the pair is trading at 1.0818, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0785, and a fall through could take it to the next support level of 1.0753. The pair is expected to find its first resistance at 1.0861, and a rise through could take it to the next resistance level of 1.0905.

Moving ahead, traders look forward to Germany’s import price index for February, slated to release in a few hours. Additionally, the US pending home sales for February and weekly mortgage applications data, slated to release later in the day, will be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.