The EUR/USD continues to remain firmly bearish on the daily chart as the currency markets await the outcome of the US presidential election, with most pairs trading in a narrow range as polling gets underway, and with the result too close to call, markets are now nervously awaiting the result. In today’s trading session the pair have once again been testing the 1.2760 price level, repeating the price action of Monday as the pair trade around the 1.2800 level on the daily chart.

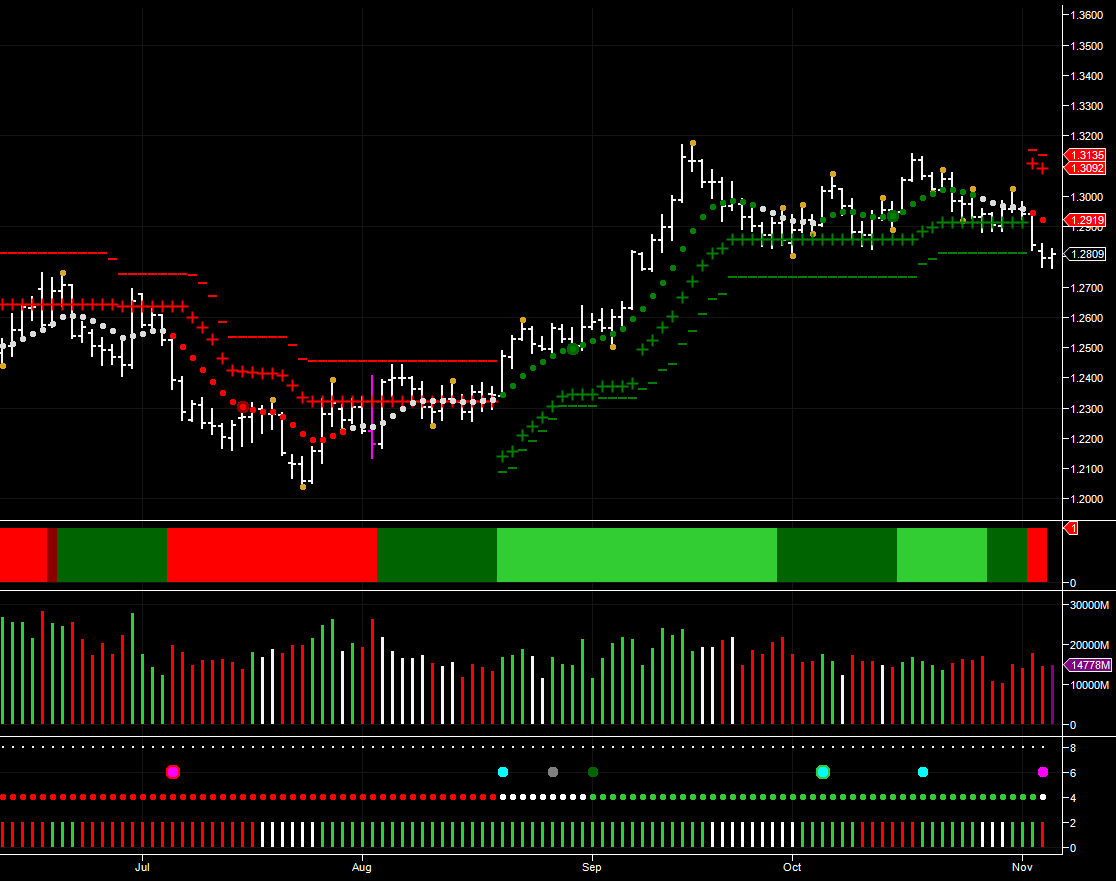

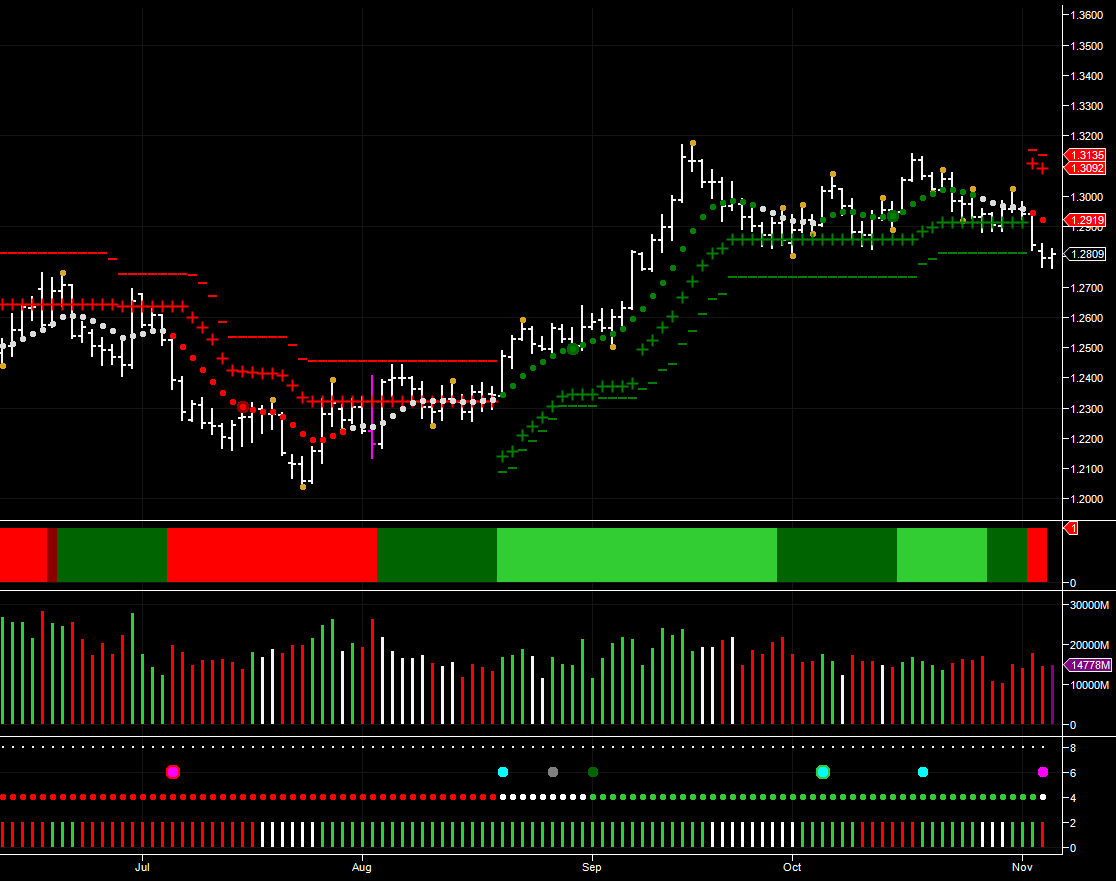

The EUR/USD continues to remain firmly bearish on the daily chart as the currency markets await the outcome of the US presidential election, with most pairs trading in a narrow range as polling gets underway, and with the result too close to call, markets are now nervously awaiting the result. In today’s trading session the pair have once again been testing the 1.2760 price level, repA feature of the last two weeks has been the heavy selling volumes which have added additional downwards pressure on the Euro, and this was given further weight yesterday as the three day trend finally moved into transition with the first white trend dot, which also coincided with selling volume on the three day chart, the first time this has occurred since mid October. In addition of course, the Hawkeye Heatmap has also completed it’s own transition to bearish on the daily chart, and with the price action now well below the recent platform of support in the 1.2850 area, this is adding further to the negative picture for the pair.

Finally, Hawkeye also delivered an aggressive short signal based on volume yesterday, and if this is confirmed with a conservative signal, as the three day trend moves to bearish, then we can expect to further weakness of the pair, and a test of the next level of potential support in the 1.2760 region.ating the price action of Monday as the pair trade around the 1.2800 level on the daily chart.

The EUR/USD continues to remain firmly bearish on the daily chart as the currency markets await the outcome of the US presidential election, with most pairs trading in a narrow range as polling gets underway, and with the result too close to call, markets are now nervously awaiting the result. In today’s trading session the pair have once again been testing the 1.2760 price level, repA feature of the last two weeks has been the heavy selling volumes which have added additional downwards pressure on the Euro, and this was given further weight yesterday as the three day trend finally moved into transition with the first white trend dot, which also coincided with selling volume on the three day chart, the first time this has occurred since mid October. In addition of course, the Hawkeye Heatmap has also completed it’s own transition to bearish on the daily chart, and with the price action now well below the recent platform of support in the 1.2850 area, this is adding further to the negative picture for the pair.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Finally, Hawkeye also delivered an aggressive short signal based on volume yesterday, and if this is confirmed with a conservative signal, as the three day trend moves to bearish, then we can expect to further weakness of the pair, and a test of the next level of potential support in the 1.2760 region.ating the price action of Monday as the pair trade around the 1.2800 level on the daily chart.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.