Nvidia to resume H20 chip sales in China, announces new processor

The second half of North American trade was not as kind to equity traders as the first half as green figures turned to red soon after lunchtime and stayed there until close. The losses weren’t extreme though with only a 0.45% drop for both the Dow and S&P. Commodities were also taking a moderate trip lower while King Dollar once again reasserted his dominance across a variety of currencies. Fears are beginning to heat up again for the euro though as the European Central Bank has a monetary policy decision this week, and Greece can’t seem to stay out of the headlines. The Greek charade this time around is that an anonymous Greek official essentially warned the Financial Times that a default was looming, and that they have come “to the end of the road.”

As much as we have all grown accustomed to Greek news of potential defaults, potential refusals of payment to the International Monetary Fund, and political infighting, all this still has a profound impact on the EUR no matter how tone deaf we get. If Greece’s Game Theory strategy really is to default on their obligations to show the Troika that they are willing to go that far, parity in the EUR/USD may be simply a speed bump on the way to further falls for the oft traded currency pair; and that wouldn’t be the only pair to suffer the consequences.

As the EUR has been beaten down against most other counterparts, it has performed surprisingly well against the GBP. Not to downplay the fact that the UK has plenty of problems of its own, but they pale in comparison to those of the Eurozone. The GBP may have been a little unfairly picked on over the last month or so (if that’s even possible in the currency realm), and it may be ripe for a bit of a comeback. If that comeback ends up playing out, there may not be a better place to witness it than in the EUR/GBP.

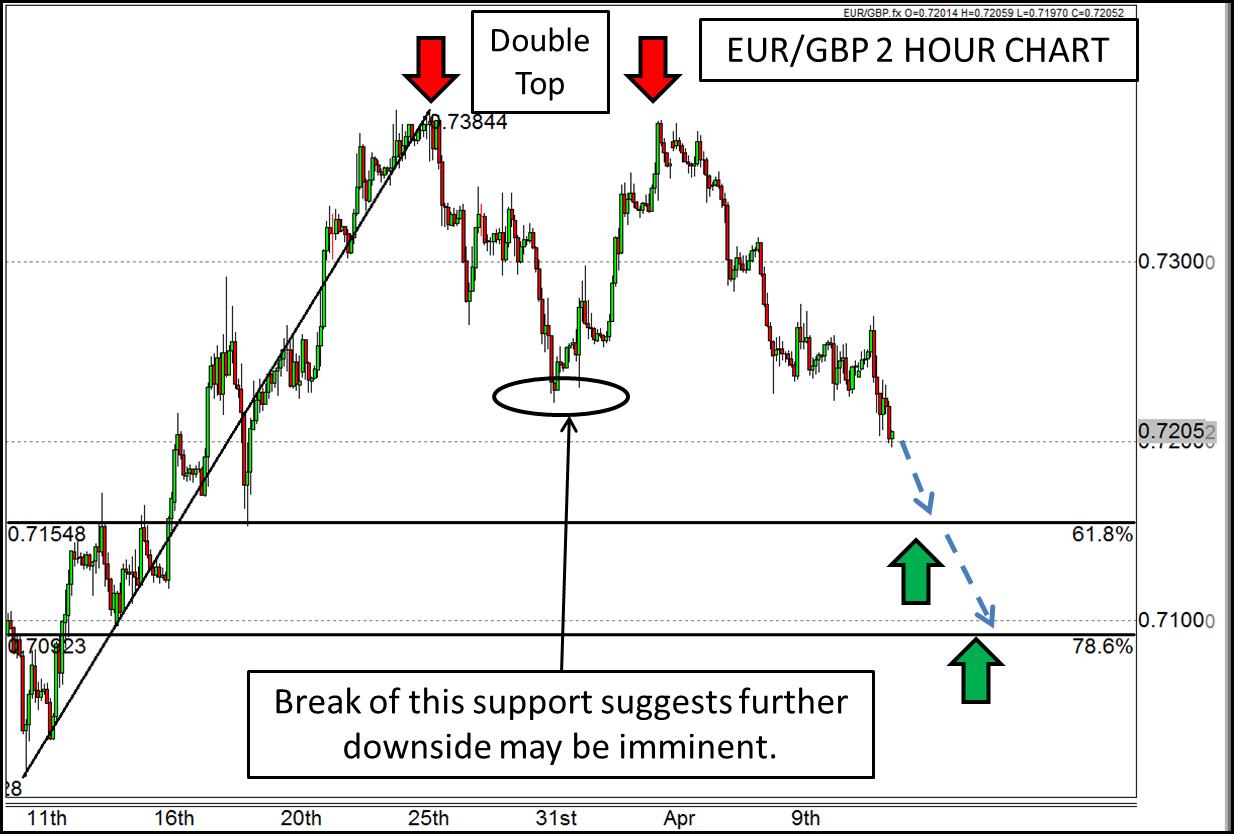

On the technical side of the EUR/GBP, a recently carved out Double Top pattern could portend even more downside to come. It is currently testing the psychological round handle support at 0.72, which also happens to correspond with the 50% Fibonacci retracement of the March low to high, but the Double Top patter and the fact that it broke previous price support near 0.7220 doesn’t bode well. If there is more downside to come, Fibonacci support may come in to play near 0.7160 or 0.71, but over the long haul this pair has been trending down since at least 2013, so seeing levels near 0.70 or below can’t be ruled out.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI