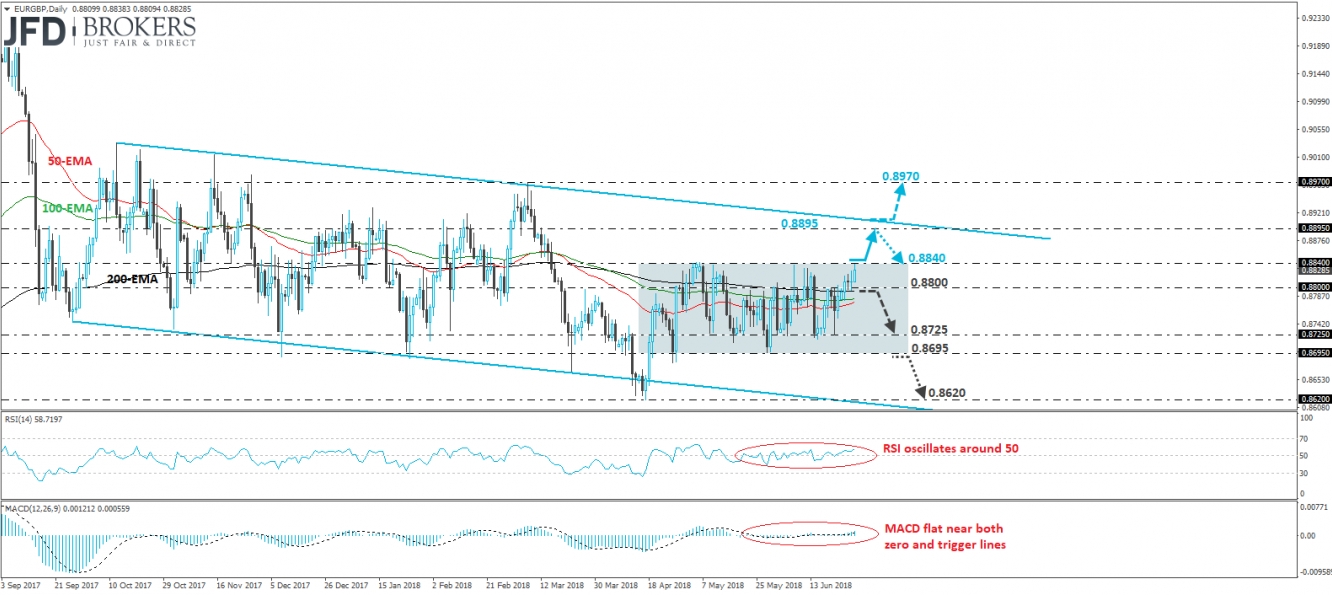

EUR/GBP edged north during the European morning Thursday, after it hit support near 0.8800 on Wednesday. However, the recovery was paused near the 0.8840 key resistance zone, the upper bound of the sideways range that’s been containing the price action since the 19th of April. Bearing in mind that the rate continues to trade within that range, we would consider the short-term picture to be flat for now.

We would like to see a break above 0.8840 before we assume that the bulls have taken the upper hand, at least in the short run. Such a move is likely to see scope for extensions towards the 0.8895 resistance or the upper bound of the medium-term downside channel that’s been in place since late September. That said, there is a decent chance for the bears to jump in from that zone, so we would prefer to wait for a decisive close above the channel’s upper bound before we start examining whether the medium-term outlook has turned positive as well. Such a break is possible to lead the rate towards the 0.8970 obstacle, defined by the peak of the 7th of March.

Looking at our daily momentum studies, we see that the RSI has been oscillating around 50 for some time, while the MACD has been moving sideways near both its zero and trigger lines. These indicators confirm the recent trendless mode of the price action and the lack of strong directional momentum.

On the downside, if the bears manage to take charge form near 0.8840, the upper bound of the aforementioned range, we may see them driving the battle back below 0.8800, something that could open the way for the 0.8725 level or the lower end of the range at 0.8095. A dip below that lower end could signal the downside exit of the range and is possible to pave the way for the 0.8620 support, defined by the low of the 17th of April.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.