EUR/CHF fell to 1.1447 on February 8th, but has been steadily recovering ever since. By March 28th, the pair was already testing the resistance near 1.1800, but could not breach it from the first try and fell to 1.1732 earlier today. Should we expect the next attempt soon, or maybe the bulls would need more time to regroup? Here, we try to find the answer to that question by examining the 3-hour price chart of EUR/CHF from an Elliott Wave perspective.

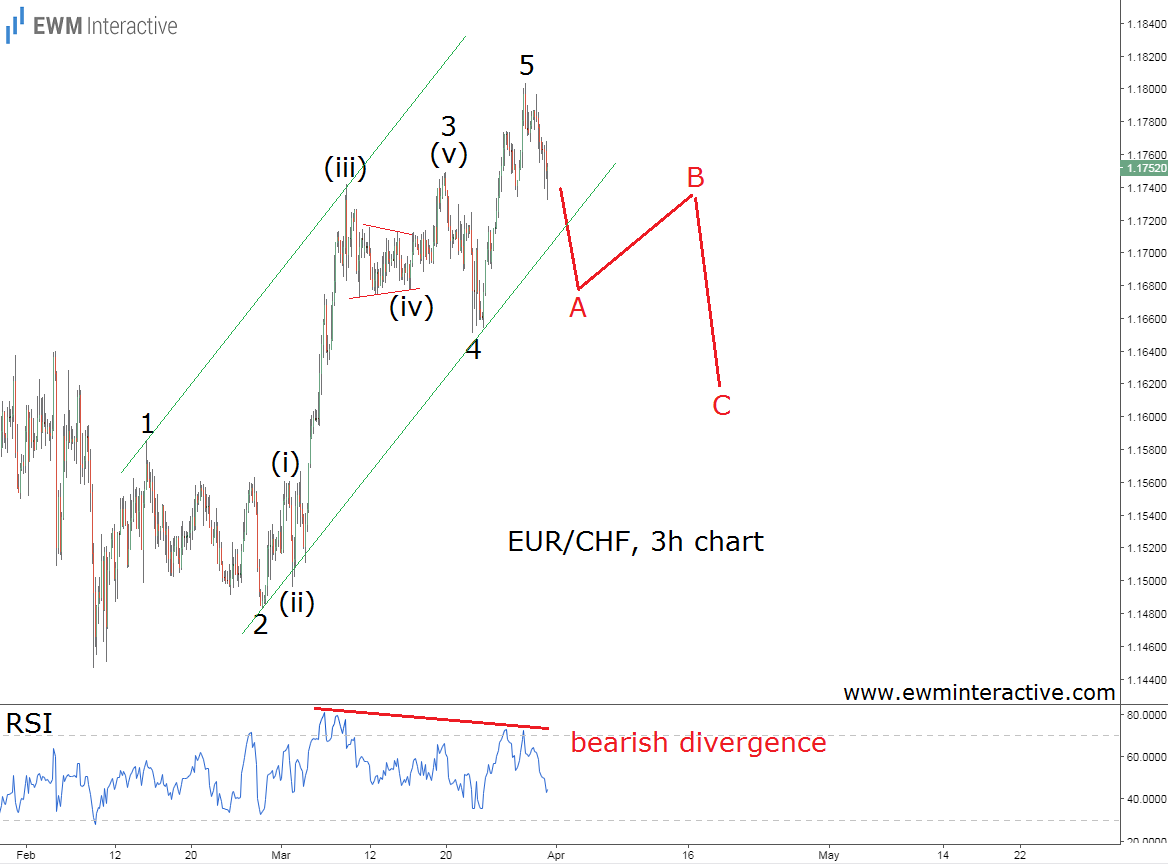

The chart depict the pairs rally from 1.1447 to 1.1803. It could easily be seen as a five-wave impulse, labeled 1-2-3-4-5, which has been developing between the parallel lines of a trend channel, drawn through the highs of waves 1 and (iii) of 3, and the lows of waves 2 and 4. The sub-waves of the extended wave 3 are also clearly visible. According to the Wave principle, a three-wave retracement follows every impulse. Since EUR/CHF has already drawn a complete impulsive pattern, we should expect a three-wave decline to drag the exchange rate back to the support area of wave 4 near 1.1650 or even 1.1600. The relative strength index confirms the negative outlook by showing a bearish divergence between waves 3 and 5.

If this count is correct, traders, who are waiting for the pair to bounce up from the lower line of the trend channel are likely to end up empty-handed, since the anticipated corrective decline is supposed to take its support out of the way. Trend lines work until they do not. At current levels, EUR/CHF looks vulnerable to bearish attacks.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.