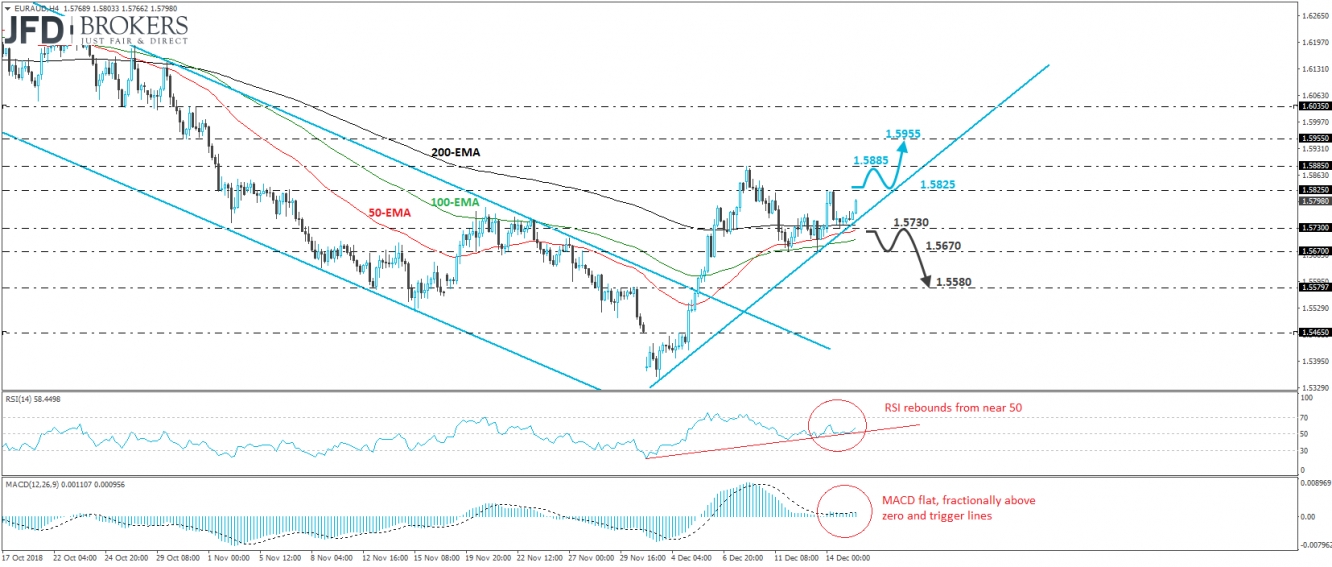

EUR/AUD traded higher during the European morning Monday, after it hit support near the 1.5730 zone, slightly above the short-term upside support line drawn from the low of the 3rd of December. On the 5th of the month, the rate emerged above the upper bound of the downside channel that had been containing the price action since the beginning of October, which combined with the fact that the pair is trading above the aforementioned upside line paints a positive near-term picture.

If the bulls are strong enough to overcome the 1.5825 barrier soon, marked by Friday’s peak, we may see them aiming for the high of the 9th of December, at around 1.5885. Another break above that peak would confirm a forthcoming higher high on both the 4-hour and daily charts and may allow the rate to travel towards the 1.5955 zone, defined by the inside swing lows of the 30th and 31st of October.

Looking at our short-term oscillators, we see that the RSI rebounded from near its 50 level, as well as its respective upside support line. The MACD lies fractionally above both its zero and trigger lines but points sideways. Both indicators detect slightly positive momentum, but given that the MACD is pointing sideways, we prefer to wait for a move above 1.5825 before we get more confident with regards to the upside.

On the downside, a clear break below 1.5730 could confirm the break below the upside support line drawn from the low of the 3rd of December and may wake up some bears. Such a move could initially target the lows of the 12th and 13th of December, at around 1.5670, the break of which could set the stage for our next support area, near 1.5580.