EUR/USD for Monday, September 9, 2013

For the last couple of weeks the Euro has fallen strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Despite a couple of rallies back above 1.32 throughout last week, it has continued to drift lower and fall below 1.3150 although it finished last week with a short surge back towards 1.3180. For about a week or so a couple of weeks ago the Euro was placing upward pressure on the 1.34 level however it stood firm. A few weeks ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this has been the story for the last month. Several weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450. Despite its persistent attempts to push through the 1.34 level, it has only been consistently repelled with ample supply.

Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34, with the former level now in the spotlight as the Euro desperately tries to stay within reach of. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 about seven weeks ago, the

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

German Chancellor Angela Merkel has stated that she is not afraid about the final weeks of her re-election campaign, despite the main opposition party gaining strength in polls. “I do not have fear,” Merkel said in an interview with German broadcaster ZDF, when asked about the final days of the campaign. Merkel and her party the Christian Democrats (CDU) have experienced significant differences between pre-election polls and the final result before. In the last election, a poll lead melted away and the party received its worst result in six decades, although it stayed in power. The previous election saw it come in with 35.2 percent of the German vote, seven points lower than opinion polls predicted. “Many people decide very late, and that means that we are fighting for every vote. And I always say that those who believe the election already has been decided, that I will stay German chancellor, might wake up on the Monday after and see that we have red-red-green (a coalition of the Social Democratic Party (SPD), Green Party and the far-left Linke Party),” Merkel said. “I don’t want that and for that I will fight in the last days.”

EUR/USD September 8 at 22:30 GMT 1.3173 H: 1.3180 L: 1.3161

During the early hours of the Asian trading session on Monday, the Euro is just easing away from a short term resistance level at 1.3180 after having finished last week surging higher towards 1.32 again. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again, although it has just eased back to 1.32 recently. Current range: right around 1.3170.

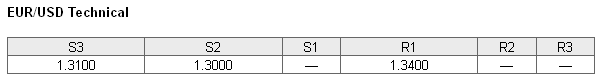

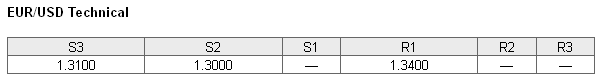

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3400.

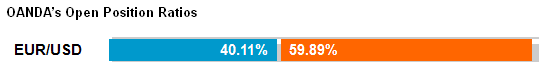

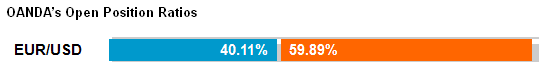

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved back up above 40% even though the Euro has slumped back below 1.32. The trader sentiment remains strongly in favour of short positions.

Economic Releases

For the last couple of weeks the Euro has fallen strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Despite a couple of rallies back above 1.32 throughout last week, it has continued to drift lower and fall below 1.3150 although it finished last week with a short surge back towards 1.3180. For about a week or so a couple of weeks ago the Euro was placing upward pressure on the 1.34 level however it stood firm. A few weeks ago the Euro made a run at the 1.34 level only to be turned away yet again and ease back under – this has been the story for the last month. Several weeks ago it retreated heavily from above 1.34 after having reached a six month high around 1.3450. Despite its persistent attempts to push through the 1.34 level, it has only been consistently repelled with ample supply.

Looking at the bigger picture the Euro has spent most of the last six weeks or so trading within a range between 1.32 and 1.34, with the former level now in the spotlight as the Euro desperately tries to stay within reach of. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there. It has been some time since the Euro has experienced a 24 hour period with as much range as the period earlier in July when it surged higher from from below 1.28 up to above 1.32. Prior to that jump, the Euro had been in a very solid medium term down trend after succumbing to the resistance at 1.29 and moving down below the key long term level of 1.28. This resulted in it trading at a multi-year low near 1.2750. After reaching a four month high above 1.34 about seven weeks ago, the

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

EUR/USD was in the midst of a very solid medium term down trend which has seen it fall sharply. Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

German Chancellor Angela Merkel has stated that she is not afraid about the final weeks of her re-election campaign, despite the main opposition party gaining strength in polls. “I do not have fear,” Merkel said in an interview with German broadcaster ZDF, when asked about the final days of the campaign. Merkel and her party the Christian Democrats (CDU) have experienced significant differences between pre-election polls and the final result before. In the last election, a poll lead melted away and the party received its worst result in six decades, although it stayed in power. The previous election saw it come in with 35.2 percent of the German vote, seven points lower than opinion polls predicted. “Many people decide very late, and that means that we are fighting for every vote. And I always say that those who believe the election already has been decided, that I will stay German chancellor, might wake up on the Monday after and see that we have red-red-green (a coalition of the Social Democratic Party (SPD), Green Party and the far-left Linke Party),” Merkel said. “I don’t want that and for that I will fight in the last days.”

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

EUR/USD September 8 at 22:30 GMT 1.3173 H: 1.3180 L: 1.3161

During the early hours of the Asian trading session on Monday, the Euro is just easing away from a short term resistance level at 1.3180 after having finished last week surging higher towards 1.32 again. Since the middle of June, the Euro has generally fallen sharply from new highs above 1.34, and has been looking to return back to the significant lows around 1.2800, however in the last month or so it has recovered well and moved back to above 1.34 again, although it has just eased back to 1.32 recently. Current range: right around 1.3170.

Further levels in both directions:

• Below: 1.3100 and 1.3000.

• Above: 1.3400.

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio has moved back up above 40% even though the Euro has slumped back below 1.32. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 23:50 (Sun) JP Bank Lending Data (Aug)

- 23:50 (Sun) JP Current Account (Jul)

- 23:50 (Sun) JP GDP (Final) (Q2)

- 01:30 AU ANZ Job Ads (Aug)

- 01:30 AU Housing Finance (Jul)

- 01:30 AU Lending Finance (Jul)

- 05:00 JP Consumer Confidence (Aug)

- 08:30 EU Sentix Indicator (Sep)

- 12:30 CA Building permits (Jul)

- 19:00 US Consumer Credit (Jul)

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or remove ads.

Original postWhich stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI