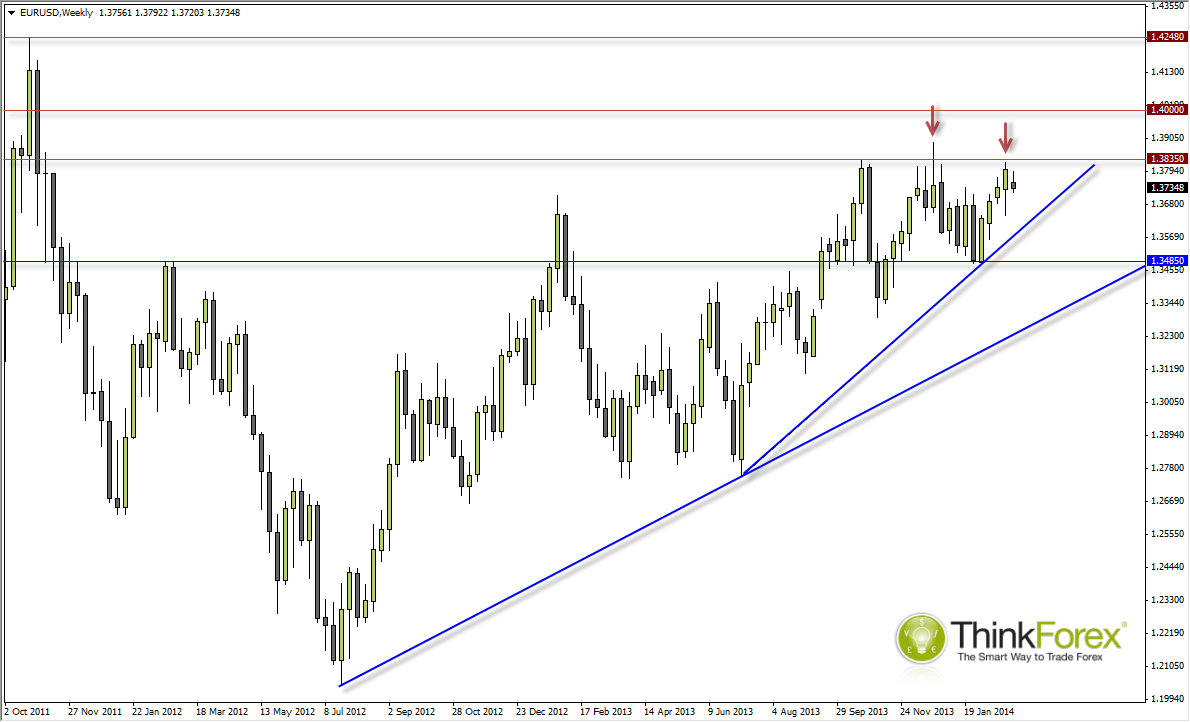

Until this week, the euro had enjoyed 4 successive bullish weeks following 7 weeks of complex correction. However as we approached the previous resistance zone of 1.3825-50 the EUR/USD faltered to close the week with a Hanging Man Reversal candle pattern to suggest near-term weakness.

EUR/USD Weekly Chart" title="EUR/USD Weekly Chart" width="474" height="242">

EUR/USD Weekly Chart" title="EUR/USD Weekly Chart" width="474" height="242">

I have highlighted the Shooting Star Reversal and Hanging Man Reversals which have, so far, respected the 1.3825-50 resistance zone. After 2 trading days this week we have remained in a releatively tight range within last weeks open and close, which is a little surprising given the uncertainty at the start of the week regarding Ukraine and Russia. It is possible we are forming an interim top with last weeks high being a lower high. Obviously, a break above the resistance area will invalidate this idea and target 1.40 on the weekly charts.

The COTS chart show us that, whilst Processional Traders are Net long on euro Futures, it is only marginally so. Additionally, buying interest has lost ground; meaning euro contracts are pushing higher with fewer buyers. As we are using weekly charts we have to remind ourselves these are an approximate guide / roadmap and not a reason to short euro alone, but merely a warning light.

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="474" height="242">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="474" height="242">

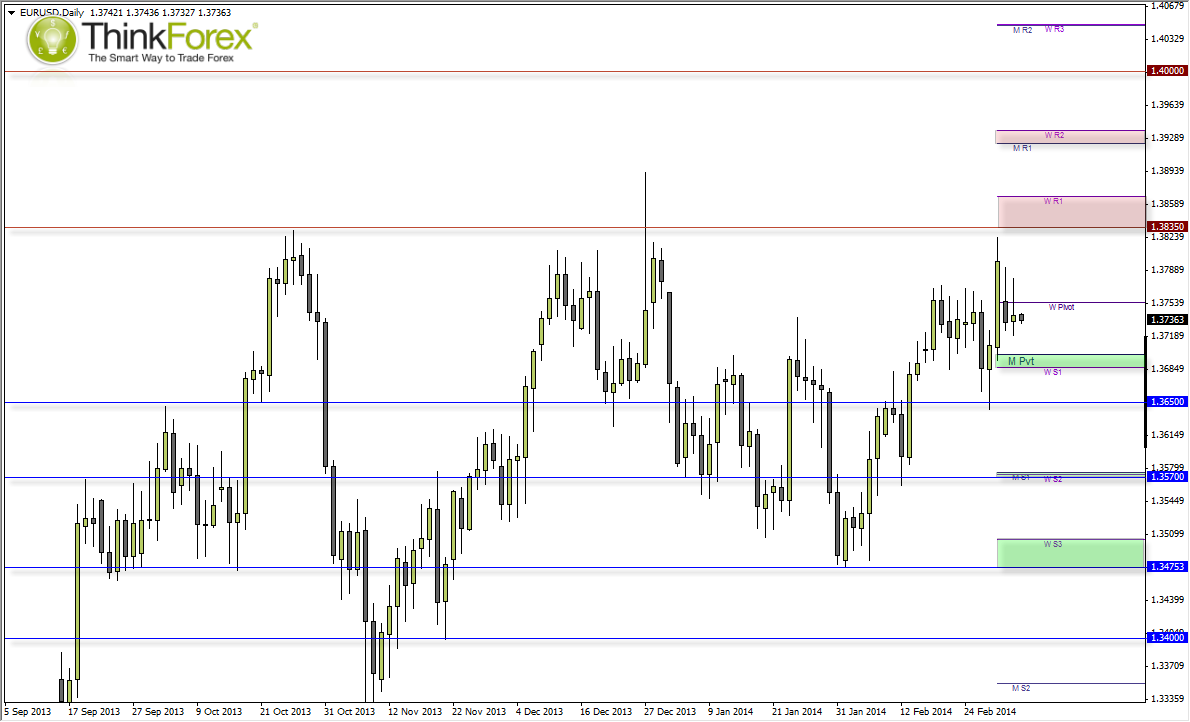

The daily chart provides a great example of why I would prefer to stick with intraday trading on the EUR/USD, there are plenty of levels or S/R close by which have been respected multiple times. Whilst the weekly charts clearer it is trickier to position yourself for any sustainable moves on the daily chart with price action appearing erratic.

We are currently trading between the Monthly and Weekly Pivot points and regardless of which direction we break out we will quickly meet further levels of S/R.

In the event we break above 1.3835 then Monthly/Weekly R2 will become next targets, followed by 1.40.

Should we break below 1.365 then targets become 1.357 and 1.347-50 - however these targets would probably suit an intraday trader more in terms of reward/risk ratios.

Disclaimer: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market. If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade.

A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI